New home completions and registrations increase

The National House Building Council (NHBC) have reported that the number of new home registrations has increased 46% year-on-year, with 66,855 new homes registered in the three months to 30 June; up from 46,217 in the same period a year ago.

However, whilst often seen as an indicator of housebuilding activity levels, the NHBC said that the rise was – in part – due to housebuilders bringing forward schemes to avoid the introduction of new energy efficient Part L Building Regulation changes.

The NHBC also reported that new home completions were up by 16% in the same period to 40,289, returning to pre-pandemic levels.

At this stage we are not seeing evidence that the cost-of-living crisis or risks of recession are affecting consumer demand, whilst registration levels reinforce continued confidence within the sector.

STEVE WOOD, CHIEF EXECUTIVE, NHBC

However, the Department for Levelling Up, Housing and Communities (DLUHC) has warned that rising inflation and interest rates are a “major risk” to the success of the Government’s flagship £11.5bn affordable housing programme.

In a progress report, DLUHC stated that “The pressures could have a serious impact on the financial viability of individual schemes, and also on the overall financial health of providers.

“This could limit the appetite for grant funding and significantly affect the success of the programme.”

The news comes as L&Q reported a boost of 29% in housing completions in the first quarter of the year.

The housing association has completed 1,295 homes in the first quarter of the year, up from 1,003 in the same period in 2020/21.

Construction output growth stalls in June

Official figures from the Office for National Statistics (ONS) have revealed that monthly construction output fell 1.4% in June, bringing to a halt seven months of steady growth.

The fall in volume of monthly construction output came predominantly from falls in private new housing, which fell 6.1%.

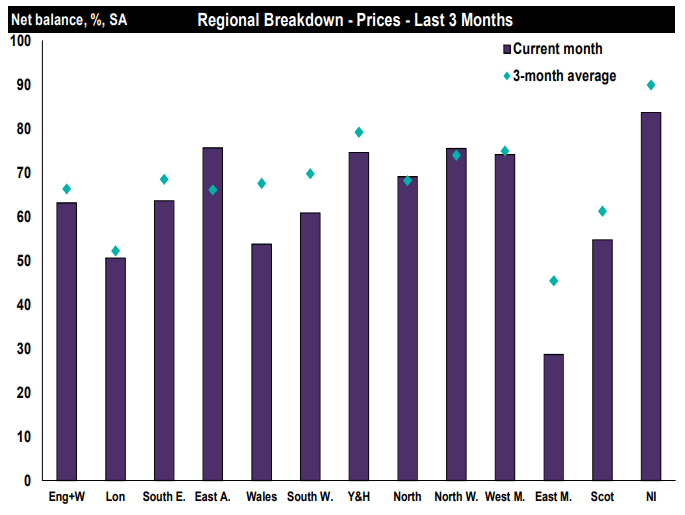

Meanwhile, the latest Royal Institution of Chartered Surveyors (RICS) report found that activity levels in the UK housing market were continuing to slow, with property sales expectations for the coming 12 months falling to -36% in July.

The RICS UK Residential Market Survey for July 2022 also revealed that new buyer enquiries continue to decline, albeit a lack of supply continues to underpin house prices.

Bellway reports revenue and completions above pre-pandemic levels

Housebuilder Bellway has reported “record” results during its financial year, revealing that housing revenue rose 13% to more than £3.5bn against FY2021.

In a trading statement for the year ending 31 July 2022, the developer also reported 11,198 completions, exceeding the company’s pre-pandemic result of 10,892 homes in 2019 by 10.5%.