Rightmove and ONS report slowdown in house price growth

Property website Rightmove has reported the first monthly house price fall this year, with the average property value falling by -1.3% in August to reach an average asking price of £365,173.

However, the fall has been attributed to the holiday season, with the drop being on par with August results over the past ten years.

The largest monthly sample of residential property prices also found that buyer enquiries are down by 4% from this time last year, but remain 20% higher than in 2019.

Rightmove’s Director of Property Science, Tim Bannister, also reported that some sellers are pricing more competitively, in order to beat the current average time of 136 days to complete a sale.

Sellers who want or need to move quickly at this time of year tend to price competitively in order to find a suitable buyer fast, with some hoping to complete their move in time to enjoy Christmas in a new home.

Nevertheless, we’re still expecting price changes for the rest of the year to continue to follow the usual seasonal pattern, which means we’ll end year at around 7% annual growth, even with the wider economic uncertainty.

TIM BANNISTER, DIRECTOR OF PROPERTY SCIENCE, RIGHTMOVE

The report also revealed that this month marks 20 years since the first Rightmove house price index was published, with average asking prices more than doubling from £155,994 to £365,173 in that time.

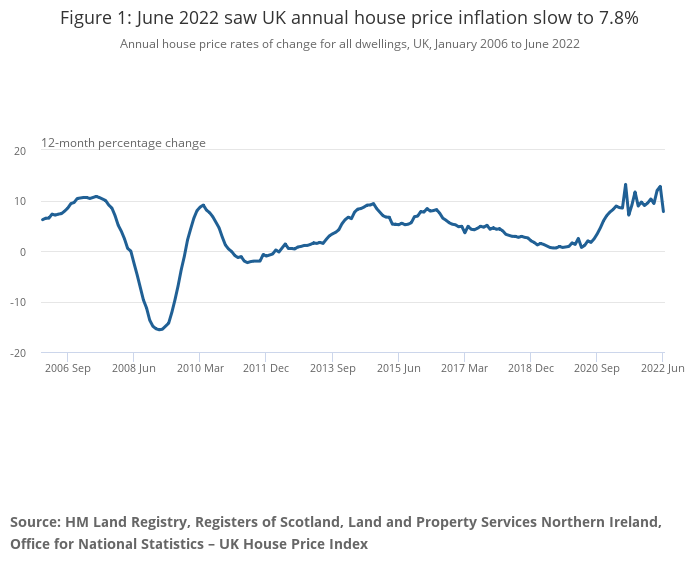

The Office for National Statistics (ONS) also revealed this week that the UK average house price increased by 7.8% over the year to June 2022, down from 12.8% in May 2022.

However, this is likely predominantly due to the Stamp Duty tax break changes ending in June 2021, which pushed up prices last year, resulting in a lower annual growth this year.

The ONS place the average UK house price at £286,000, which is £20,000 higher than this time last year. Scotland saw the largest annual growth at 11.6%, followed by Northern Ireland (9.6%), Wales (8.6%) and England (7.3%).

Meanwhile, Savills has published their English Housing Supply Update, revealing that planning consents in the year to Q2 2022 have fallen below the Government target of 300,000 for the first time since 2016, with permission granted for 292,000 units.

However, the fall will not be immediately felt, with the number of new starts edging higher than completions for the first time since 2018.

The latest OnTheMarket Property Sentiment Index has also been released, showing that housing stock is at the highest level in a year.

The report, reflecting on July 2022 data, also revealed that 75% of active buyers were confident that they would purchase a property within the next three months, and concluded that current economic certainty was not yet reflected in the property market.

Despite the rising cost of living, our data shows that sentiment was largely unchanged in July. Serious buyers remained committed, with 75% confident that they’d successfully purchase a property within the next three months, the same percentage as in June and May.

Meanwhile, 80% of sellers were confidence that they could complete a sale within the same time frame.

JASON TEBB, CHIEF EXECUTIVE OFFICER, ONTHEMARKET

Construction pay rises faster than most sectors, as career interest remains mixed

Total average pay in the construction sector rose 6.3% in April to June, according to the Office for National Statistics, rising faster than most other sectors including manufacturing (4.1%), but less than the wholesaling, retail, hotels and restaurants sector (7.7%).

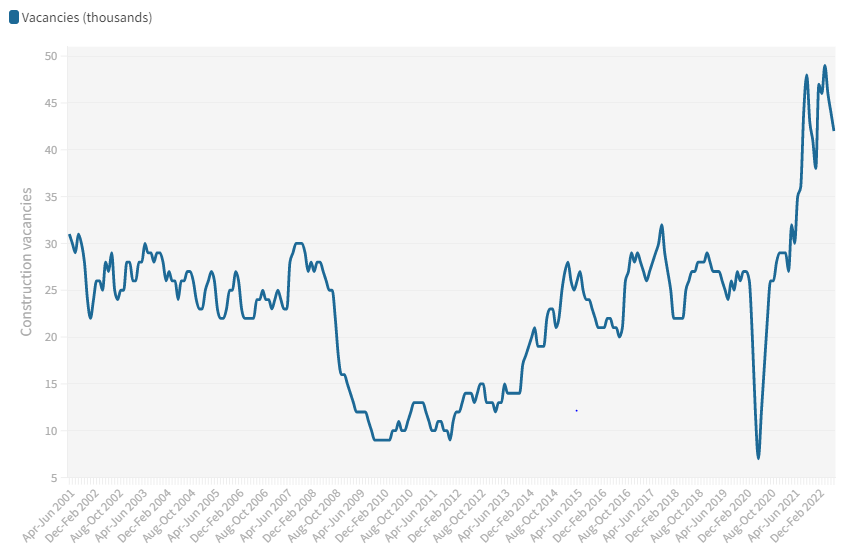

ONS data also revealed that there were 42,000 vacancies in construction in May to July; the lowest three-monthly figure posted since the 38,000 recorded for November to January this year.

However, the vacancy data is still historically high.

Meanwhile, a survey by construction data platform NBS has revealed that 56% of respondents found a career in the construction sector ‘very attractive’ or ‘somewhat attractive’.

However, only 4% of those surveyed – of 2,000 people aged 18 to 29 – listed that they wished to work in a skilled construction trade.

Among those interested in a construction career, the top reasons from a multiple-choice list were:

- An industry going through massive change (35%)

- Love of architecture (32%)

- Want a practical job (32%)

- Want to create a better physical world (31%)

Those not attracted by construction listed the failings as:

- Dirty and manual (52%)

- Dangerous (37%)

- Sexist (33%)

- Dull (22%)

Finance, social media influencer, designer and educator all scored more highly than construction trades in the survey.

Persimmon on track for completion target, as Barratts investigation closed

Persimmon has stated that it is on track to achieve 14,500 to 15,000 legal completions this year, despite completions falling during half year due to delays achieving planning consents.

During the six months to 30th June 2022, the volume housebuilder reported a fall in revenue of 8% to £1.69bn, when compared to half-year in 2021.

Meanwhile, the Competition and Markets Authority (CMA) has closed its case into an alleged mis-selling of leasehold homes by the UK’s biggest housebuilder, Barratt.

The CMA concluded that the evidence available was “insufficient to support a clear legal case for the CMA to secure collective redress for Barratt leaseholders under its consumer law powers.”

Barratt issued a statement saying it was “pleased to note” the announcement, and “committed to putting its customers first and has been awarded a five-star rating by its customers for 13 successive years, more than any other major housebuilder.”