Annual house price growth slows, as mortgage borrowing decreases slightly

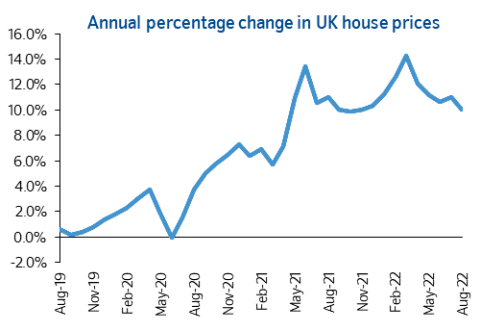

Nationwide published their house price index for August this week, revealing that annual UK property value growth slowed to 10% in the month, from 11% in July.

Reporting the average house price at £273,751 – a monthly increase of 0.8% – the mortgage lender revealed that the average house price has increased by almost £50,000 in two years.

We expect the market to slow further as pressure on household budgets intensifies in the coming quarters, with inflation set to remain in double digits into next year.

ROBERT GARDNER, CHIEF ECONOMIST, NATIONWIDE

Meanwhile, latest Bank of England statistics have revealed a fall in net mortgage borrowing from £5.3bn in June to £5.1bn in July – but still above the pre-pandemic average of £4.3bn in the year to February 2020.

However, the data also showed that residential property purchase numbers – a good indicator of future borrowing – rose from 63,200 in June to 63,800 in July.

With the highest level of stock available in July compared with any time during the previous 12 months, we’re seeing the inevitable rebalancing of supply and demand in the market.

JASON TEBB, CHIEF EXECUTIVE OFFICER, ONTHEMARKET.COM

Remarkable confidence prevails despite considerable headwinds, as committed property seekers remain determined to move before mortgage rates rise further still.

However, Hamptons has warned that a potential rise in interest rates could cause average UK house prices to flatline in 2023, with recovery seen in 2024.

Reporting in their Housing Market Forecast Autumn 2022: Winds of Change, the estate agency predicts that prime central London will see the strongest price growth over the next four years, at 15.5%, with the East of England (12.0%) and South East (11.5%) following closely.

Financial pressures are raining down on households as inflation bites and mortgage rates rise. And it’s unlikely we’ve seen the worst of it yet, with rates expected to peak at the beginning of 2023.

ANEISHA BEVERIDGE, HEAD OF RESEARCH, HAMPTONS

If mortgage rates surpass the 5% mark, there’s a much stronger likelihood that house prices will fall.

Glenigan reports decline in project starts, as cost increases exceed inflation

Information firm Glenigan has revealed that construction project starts have fallen by 18% in the three months to the end of July when compared to the preceding three months – a drop of 31% in the year.

In their August Construction Review, the firm also revealed that detailed planning permissions were down by 18% on a year ago, attributing the gloomy outlook to the continuing supply chain issues brought about by the conflict in Ukraine.

Meanwhile, research commissioned by the National Housing Federation has revealed that the cost of building new homes is accelerating significantly faster than the rate of inflation.

Undertaken by the Centre for Economics and Business Research, the research found that building costs have risen by 12.3% in the year to June 2022, with inflation reaching 9.4% in the same period.

This report demonstrates the huge financial pressures housing associations are currently facing with the cost of repairs, materials and building new homes already rising well above inflation by 14% and 12.3% respectively.

KATE HENDERSON, CHIEF EXECUTIVE, NATIONAL HOUSING FEDERATION

Housing associations must ensure they can continue to maintain their homes and provide vital services to residents in the years ahead.

Rising energy costs have also prompted the Mineral Products Association (MPA) to seek Government support, calling on Chancellor Nadhim Zahawi to take urgent action to limit the impact on its members.

The MPA have set out four steps to alleviate the burden on UK mineral products companies, including reinstating the red diesel rebate and extending the freeze on Aggregates Levy indexation beyond April 2023.

Study reveals housing targets would blow carbon budget

A new study has revealed that England would use up the entirety of its carbon budget on housing alone if the Government continues to target building 300,000 homes a year.

A carbon budget is the cumulative amount of emissions a country can emit over a specific period, with England holding a 1.5C budget, restricting total emissions to 2.5 gigatonnes of CO2 between 2022 and 2050.

Instead, the paper – published in Ecological Economics – argues that radically retrofitting existing houses, reducing the number of second homes, and making people live in smaller buildings would be more sustainable ways to address the housing crisis.

Meanwhile, Housing Secretary Greg Clark has brought into force new laws which could see developers blocked from obtaining planning permission or building control approval if they do not meet government demands to fix historic cladding defects.

Under the Building Safety Act, eligible housebuilders will have to meet criteria – such as remedying building safety defects in existing buildings – to ensure they remain members of the scheme.

Those not deemed as “responsible actors” could find themselves prevented from starting on new sites.

The announcement comes as a report has revealed that a Government programme in 2015, designed to see public land sold to provide 161,000 new homes, has achieved just 38% of its aim.

Summarising the findings of the 2015-2020 Public Land for Housing Programme, the report discovered that by March 2020 just 616 sites with capacity for 61,302 homes had been released – almost 100,000 plots short of the target.

It was clear by 2017 that much of the land originally committed to the programme was not going to materialise, the study admits, citing repurposing of the land for other needs, or delayed due to “changing operational requirements”.