Wales leads the way on house price growth

Official figures from the Office for National Statistics (ONS) have revealed that the average house price in Wales has increased by 17.6% over the year to July, reaching £220,000.

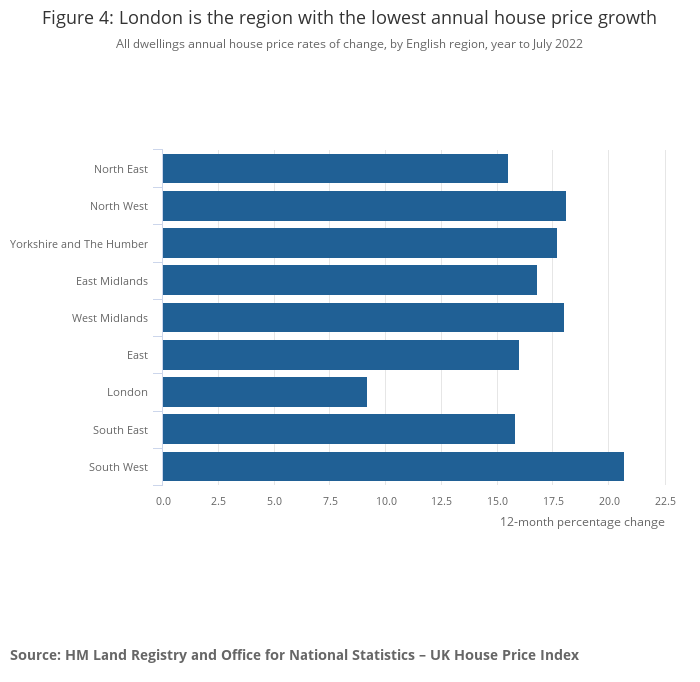

Whilst lower than the average house price in England – which stands at £312,000 – the annual growth for Wales topped the list of all UK countries, with England at 16.4%, Scotland at 9.9% and Northern Ireland at 9.6%.

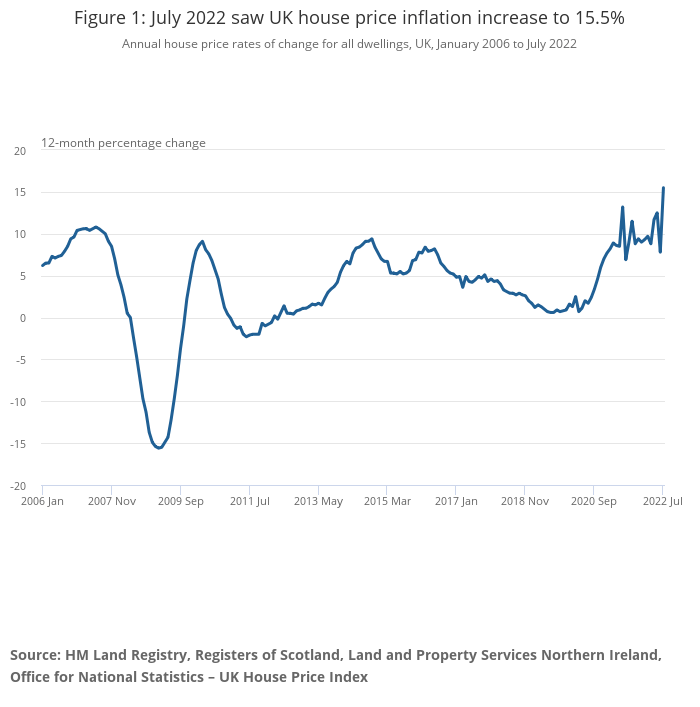

The average house price in July increased by 15.5% over the year; a jump from 7.8% in June, mainly because of the falls in prices seen this time last year as a result of changes in the stamp duty holiday.

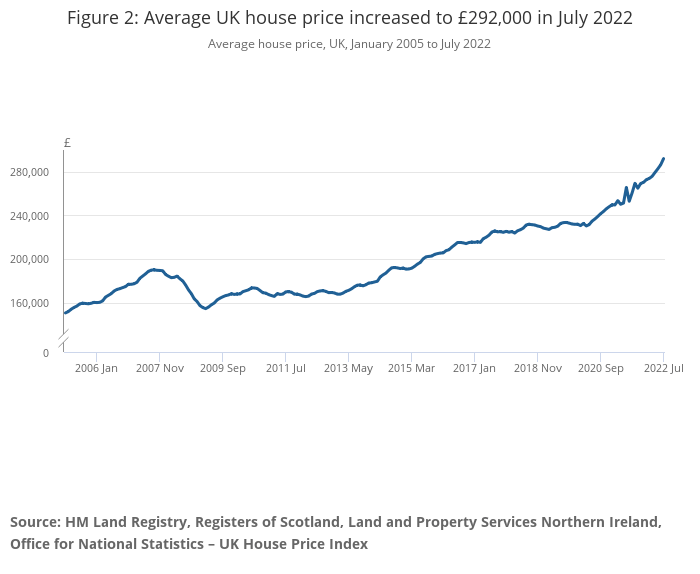

The overall average house price was £292,000 in July 2022, says ONS, an increase of £39,000 from this time last year.

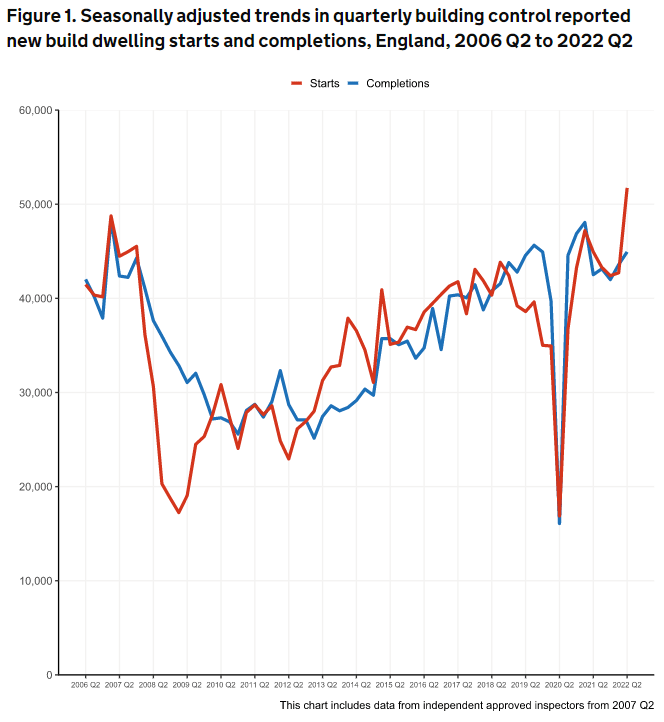

Meanwhile, Government data has revealed that the number of homes registered as starting on site in the three months to June rose by 21% to reach its highest level on record.

According to the figures, 51,730 homes were started in the second quarter of the year, up by 15% on the same quarter in 2021.

However, it is suggested that the figures for this quarter are skewed, as developers rush to begin work on plots to avoid Part L regulations.

Construction output falls, but industry set to limit recession impact

The Office for National Statistics (ONS) has blamed extreme heat for a second successive fall in construction output.

After falling 1.4% in June, output fell again by 0.8% in July, driven by a decrease in repair and maintenance.

However, new work saw a slight increase of 0.3% in the month.

Meanwhile, cost consultant Arcadis has warned that the current market cycle has reached its peak, as energy price increases impact the industry.

However, the firm predicts that the impending slowdown will not be a “blow-out”, like the crash in 2008.

Instead, the industry is likely to experience a prolonged but shallow downturn.

With a high degree of uncertainty around energy costs and availability, there is still a risk the crisis could escalate further and the slowdown could develop into a hard landing.

ARCADIS UK AUTUMN MARKET VIEW

However, sentiment amongst home movers remains robust, according to the latest OnTheMarket (OTM) Property Sentiment Index.

Reporting on August data, the survey found that 73% of buyers were confident that they would purchase a property within the next three months, with 79% of sellers expecting to sell within the same time frame.

Despite all the evidence of a rebalancing of the market, confidence would appear to remain among serious property seekers.

JASON TEBB, CHIEF EXECUTIVE OFFICER, ONTHEMARKET

The resilience of the UK property-seeking public and how they feel about the market is remarkable, yet provides a key indicator in terms of how UK consumers perceive the long-term value of ‘bricks and mortar’.

Green belt land grows to highest amount since 2014

Official Government figures have shown that the amount of land protected from development by green belt classification has grown to the highest amount in almost a decade.

The report, published by the Department for Levelling Up, Housing and Communities (DLUHC), has revealed that 1,638,150 hectares of land were protected at the end of March 2022.

Accounting for 12.6% of the entire land area of England, the green belt rose by 24,150 hectares in a year.

In comparison, around 11% of England’s land area is classed as ‘built up’.

National planning policy resists development on green belt land, apart from in exceptional circumstances.

Redrow posts record turnover, as Galliard profit slumps

Housebuilder Redrow has reported annual figures showing record turnover, beating its pre-Covid highs of 2019.

In the 52 weeks to 3rd July 2022, the developer completed 5,715 new homes and generated revenue of £2.14bn; 10% higher than 2021, and £300m ahead of the £2.11bn revenue reported in 2019.

Pre-tax profit in 2022 was £314m down on 2021, predominantly due to provisions made for fire safety remediation work.

Gleeson also reported a 2% increase in pre-tax profit this week, having put aside £12.9m for the fire safety developer pledge.

In results for the year to 30 June, the developer posted pre-tax profits of £42.6m, up slightly from £41.7m last year.

However, London-based housebuilder Galliard saw pre-tax profit slump by 93% in the year to March 2022.

According to Companies House accounts, the developer reported pre-tax profits of just £4.6m, down from £66.4m in 2021.

Exceptional charges were blamed for the fall, including an £8.3m termination payment to Chief Executive Don O’Sullivan.