Housebuilder share prices plummet following mini-budget

The fall-out from Kwasi Kwarteng’s mini-budget continued this week, reflected in a stark fall in housebuilder share prices.

The drop suggests traders are reacting to the prospect of further interest rate hikes, and the knock-on effect on mortgage affordability.

Share prices continued to fall over the week, as reaction to the mini-budget was swiftly followed by the news that major mortgage lenders were withdrawing products.

Some mortgage lenders – including Virgin Money, the Bank of Ireland and Post Office Money – stopped lending entirely.

Meanwhile, the Department of Levelling Up, Housing and Communities (DLUHC) insisted it would press ahead with legislation within the existing Levelling Up and Regeneration Bill (LURB), despite the announcement of a new Planning and Infrastructure Bill in Kwarteng’s mini-budget.

The LURB contains several planning reforms, such as the creation of a new Infrastructure Levy, with the new Planning and Infrastructure Bill also containing additional legislation to reduce the burden of environmental assessments on planning decisions.

Amidst confusion over whether two separate bills containing similar policies would be brought forward at the same time, a DLUHC spokesperson said: “We remain focused on levelling up and are continuing to progress the bill.”

Labour were quick to pledge home ownership measures in the wake of the Conservative turmoil, with leader Kier Starmer pledging to get 1.5 million more people onto the housing ladder, and setting a target of 70% home ownership.

The dream of owning your own home is slipping away for too many.

KIER STARMER, LABOUR PARTY LEADER

That’s a political choice. Because if you keep inflating demand without increasing supply, house prices will only rise, and homes become less affordable for working people.

My message is this: if you’re grafting every hour to buy your own home, Labour is on your side.

Signs of market slowdown continue, as house price indices published

Nationwide published their house price index this week, reporting that the annual property value fell from 10% in August to 9.5% in September.

The mortgage lender also revealed that 10 of the UK’s 13 regions recorded a softening in annual price growth in the third quarter of the year, with the average property price falling slightly to £272,259 (August: £273,751).

The South West remained the strongest performing region, with annual house price growth at 12.5%, followed closely by the East Midlands, at 12.3%. Wales continued to be the strongest performing nation, with London experiencing weakest annual growth.

There have been further signs of a slowdown in the market over the past month, with the number of mortgages approved for house purchase remaining below pre-pandemic levels and surveyors reporting a decline in new buyer enquiries.

ROBERT GARDNER, CHIEF ECONOMIST, NATIONWIDE

Nevertheless, the slowdown to date has been modest and, combined with a shortage of stock on the market, this has meant that price growth has remained firm.

Zoopla also reported an 8.2% annual house price growth in September, and commented on the transition to a buyers’ market, as higher mortgage rates look set to cut buying power by up to 28%.

The property website also revealed that some parts of the country have seen a decade’s price growth in just two years, with the average home in London rising in value by £100,000 since the pandemic began.

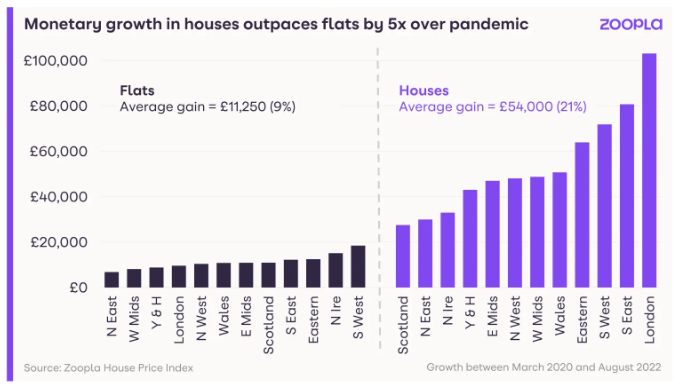

Data also showed that the price of the average house has risen five times faster than the average flat since March 2020.

Rightmove reported a similar annual house price growth to September, with the average property value rising by 8.7% to reach an average asking price of £367,760 – a rise of 0.7% in the month.

The property firm also estimated that two-thirds of homes are now exempt from stamp duty, following cuts announced in the Government’s mini-budget last Friday; although average monthly mortgage payments are currently £1,057 per month, which is 40% of an average gross salary for the first time since November 2012.

Planning permissions fall to lowest level in ten years

Latest data from the Department for Levelling Up, Housing and Communities has revealed that the number of major residential planning approvals granted has fallen to its lowest level for a decade.

Quarterly statistics have shown that just 1,009 major decisions – those for ten homes or more – were approved in the three months from April to June 2022; the lowest figure since the third quarter of 2012.

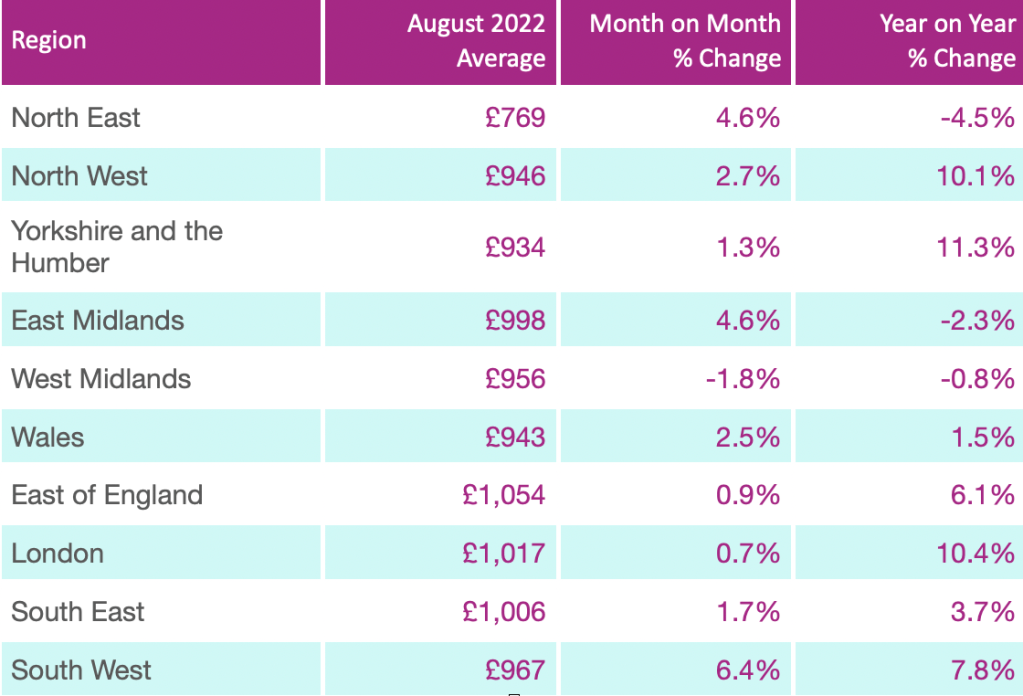

Meanwhile, Hudson Contract have reported that self-employed tradespeople earnings have hit an all-time high, with average weekly pay exceeding £1,000 in London, the South East and East of England.

The payment consultant revealed that earnings in August were 4.6% higher than in the same period in 2021, with plasterers enjoying the largest increase, with rises of over 10% in the month.

The volume of goods sold by builders’ merchants in July was down 12.8% over the year, according to data from the Builders Merchant Building Index.

Total sales were also down 2.6% by value in July compared with June, with volumes down by 5.2%.

However, MRA Research, who produced the report, downplayed the falling figures.

A flat July was probably to be expected by merchants, as the construction sector was hampered by everything from lost working days due to the exceptionally hot weather to the cost of living crisis having a continued impact on consumer spending – particularly in the repair, maintenance and improvement market.

MIKE RIGBY, CHIEF EXECUTIVE, MRA RESEARCH