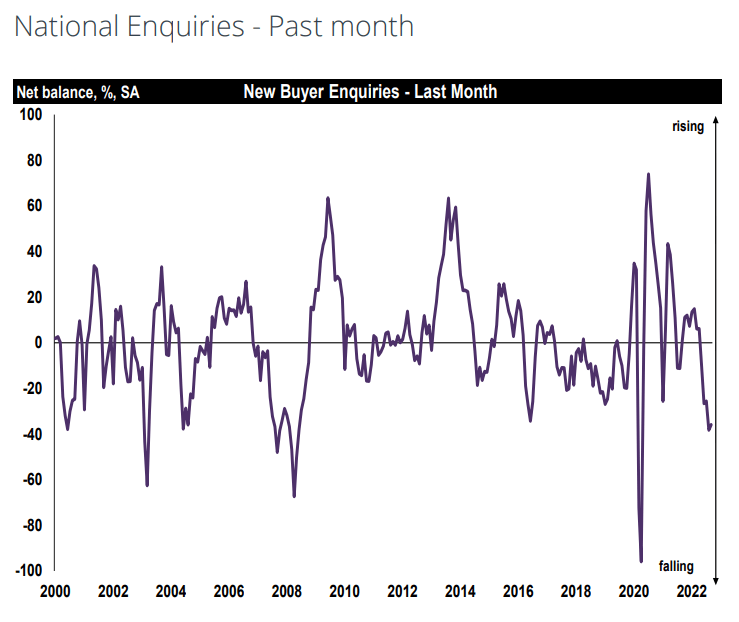

New buyer demand falls for fifth month in a row

The latest UK Residential Market Survey from the Royal Institution of Chartered Surveyors (RICS) has found that new buyer enquiries have fallen for the fifth month in a row.

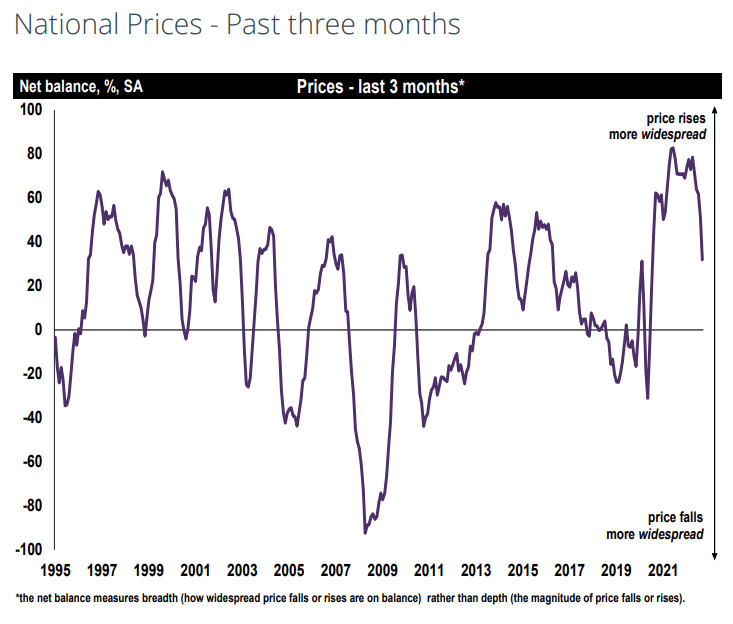

Forecasting that expected mortgage rate rises will outweigh any benefit from the recently-announced cut in Stamp Duty, the survey also revealed that a limited supply of housing is supporting a modest rise in house prices – although the pace of growth is fading quickly.

The survey also found that new instructions are also continuing to fall, with the average estate agent holding just 34 residential properties on their books.

Going forward, twelve-month price expectations have now turned negative, with respondents citing the expected further substantial rises in mortgage rates as a factor putting pressure on the market over the year ahead.

RICS RESIDENTIAL MARKET SURvey, september 2022

Meanwhile, rising interest rates could continue until at least early 2024 according to Oxford Economics, who have revealed that the average residential property is currently overvalued by 37%.

Forecasting that the fall in affordability will cause a sharp drop in new buyer demand and a fall in house prices by 10%-15% over the next two years, the consultancy stated that “this is the most worrying outlook for the housing market since 2007-2008, with markets poised between the prospect of modest declines and much steeper ones”.

This news comes at the same time as research house Capital Economics predicts a drop in housing starts of nearly 40% in 2023, amid steep house price falls as mortgage rates rise.

Forecasting that UK housing starts were now likely to fall from a predicted 178,000 homes in 2022 to just 110,000 next year, Capital Economics also warned of a 13.6% fall in house prices across 2023.

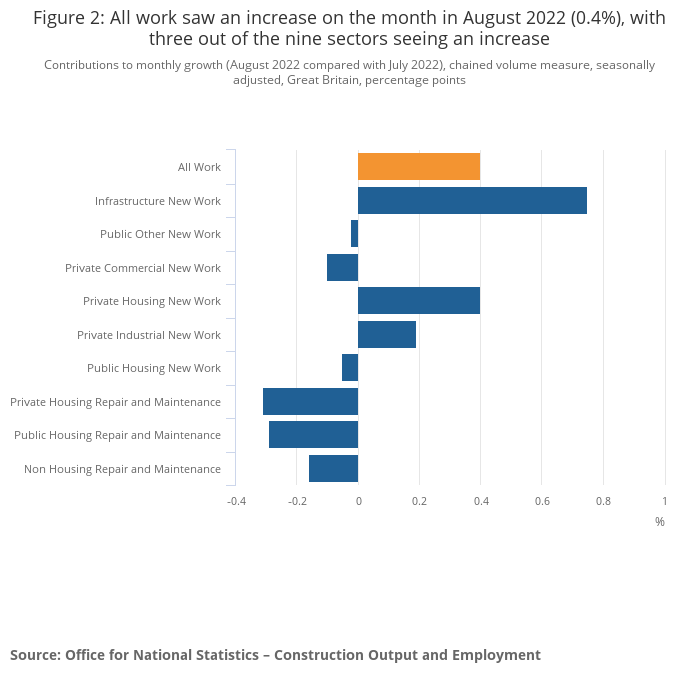

In better news, latest data from the Office for National Statistics (ONS) has found that construction enjoyed a modest 0.4% growth in output during August.

Researchers for the ONS also upwardly revised July’s output to 0.1%, as increased output in August was attributed to a 1.9% increase in new work, with private housing rising by 1.7%.

Barratt reservations dip, as Vistry deal set for November

Barratt has seen private reservations fall below last year’s levels as cost of living, economic uncertainty and interest rates begin impact customers.

Issuing a trading update for the period from 01 July to 09 October, the UK’s largest developer said that net private reservations per average week per active outlet were at 0.55, down from 0.85 in FY22.

Barratt also revealed that their average selling price as at 09 October 2022 was £377.2k, up by 9.6% on last year.

Meanwhile, Barratt Chief Executive David Thomas has been appointed chair of the Future Homes Hub.

The cross-industry collaboration was set up in November 2021 by the housebuilding industry with support from Government departments, and aims to accelerate the transition to net zero.

This week also saw Vistry announce that their merger with Countryside Partnerships was expected to complete on 11 November.

Following the housebuilder’s announcement in September of its intention to purchase Countryside for £1.25bn, Vistry stated that their new shares will start trading on the London Stock Exchange by 14 November.

Meanwhile, former Countryside boss Iain McPherson has been appointed as Chief Operating Officer for Sage Homes.

McPherson left Countryside in January 2022 after just two years in the role, following first quarter performance which was “below expectations”.

HBF report reveals energy savings from new build homes

A report published by the Home Builders Federation (HBF) has found that buyers of new build properties will save an average of £2,000 in energy bills per year.

The study – which also revealed that one in four buyers now put efficiency as a key consideration when purchasing a house – also found that new build properties also reduce carbon emissions by more than two tonnes per property each year.

The energy crisis is highlighting starkly the efficiency benefits and cost savings provided by new build homes. Energy efficiency is a growing priority for house hunters and the financial savings clearly demonstrate why.

Stewart baseley, executive chairman, home builders federation

In the face of the cost-of-living crisis we now need lenders to take these savings into account so that consumers can benefit further through cheaper mortgages.