Wales leads house price growth as official figures released

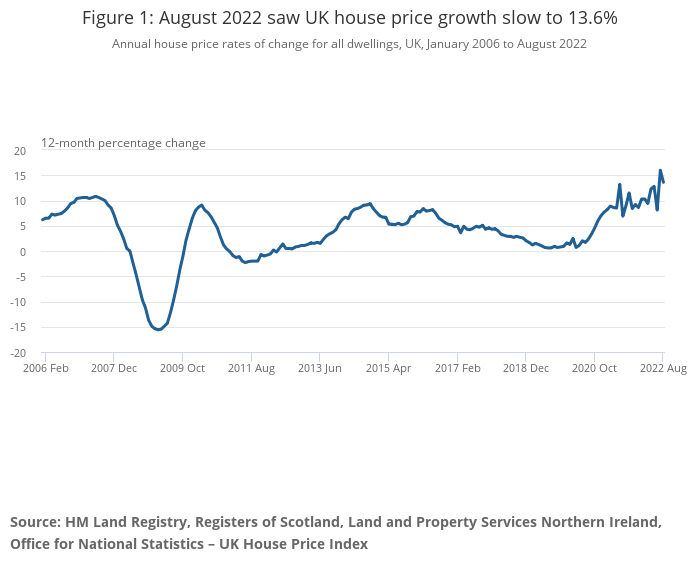

The Office for National Statistics (ONS) has published its house price index for August, revealing that the average UK property value has increased by 13.6% over the year, reaching £295,903.

This represents a fall when compared to July’s annual increase of 16.0% – but these figures were skewed due to a sharp rise in house prices in August 2021 following changes in the stamp duty holiday.

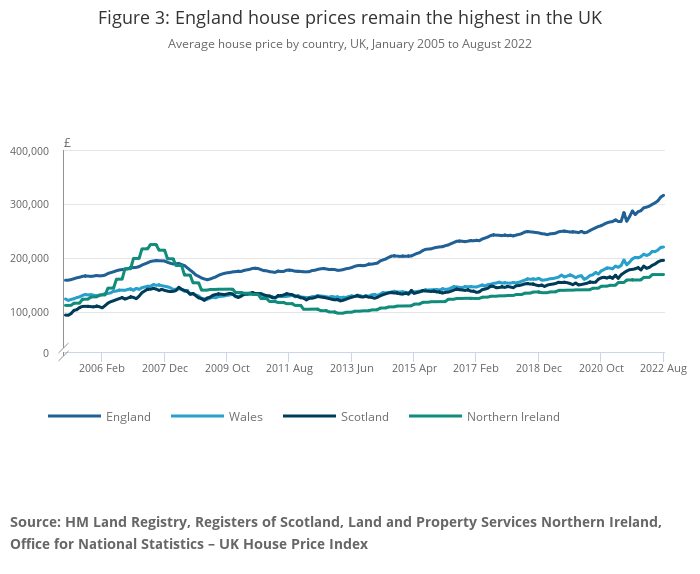

Average house prices increased over the year to £220,000 in Wales (14.6%), £316,000 (14.3%) in England, £195,000 (9.7%) in Scotland and £169,000 (9.6%) in Northern Ireland.

The South West boasted the highest rise in property prices over the year at 17.0%, with London trailing at the bottom of the list, reaching 8.3%.

Meanwhile, Rightmove’s House Price Index for October 2022 has revealed annual house price growth of 7.8%, with the average property increasing by £3,398 (0.9%) in the month to reach a new record value of £271,158.

This represents a fall from the 8.7% annual growth reported by the firm in September.

The property website also stated that, whilst there is little sign of downwards price pressure on existing properties for sale, buyer demand has reduced by 15% in the last two weeks when compared with the same two-week period in 2021.

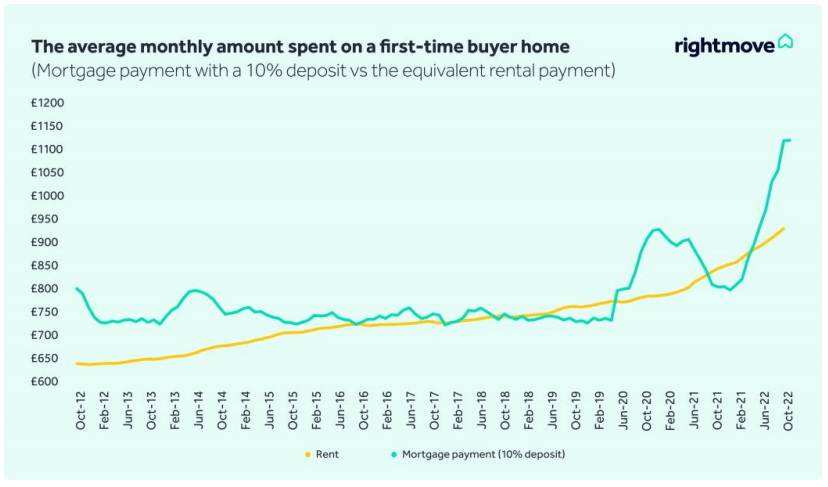

The average monthly mortgage payment, based on a 10% deposit, remains static in the month, at circa £1,100.

And, with further economic events still to be fully reflected in the housing market, Rightmove are not yet prepared to predict what the forthcoming year will bring.

What’s going to happen to house prices is understandably on the minds of many home-movers right now, especially following the market uncertainty after the Government’s mini-budget.

tim bannister, director of property science, rightmove

There has been no immediate effect on prices, but the trend of a slight softening in the pace of growth continues.

Part L rush produces strong sales of foundation blocks

The Construction Leadership Council (CLC) have published their latest Construction Product Availability Statement, revealing that block manufacturers are reporting strong sales of foundation blocks as developers rush to commence work on plots ahead of the Part L deadline of June 2023.

Describing all regions as “reporting the best product availability in two years, both in the range of products available and delivery / lead times”, the CLC also reported that brick availability has significantly improved.

Softening demand has also led overall product price inflation to fall from 25% to around 17%, albeit concern remains over inflation tied to energy costs.

Timber Development UK has also reported that timber prices are falling amidst steady stocks.

Whilst overall import volumes are down – 6.1 million cubic metres were imported in the first seven months of 2022, compared to 7.2 million cubic metres in the same period last year – supply patterns are returning to more pre-pandemic levels.

It is unsurprising that overall import levels are below 2021 volumes. Last year witnessed record demand in the private housing and RM&I market, which will not be emulated this year.

nick boulton, head of technical and trade, timber development uk

Despite the negative macroeconomic picture, the timber industry remains strong.

Meanwhile, an Autodesk survey of 207 industry professionals has shown that roughly four in five construction businesses were actively recruiting to meet their growing contracts book, but over a third were struggling to offer competitive salaries.

Upward pressure on wages created by a tight labour market and the cost-of-living crisis has contributed to these difficulties, with 42% of respondents also reporting a shortage of labour due to Brexit.

Electricians, bricklayers and plumbers are the roles in highest demand, with skills in augmented reality and virtual reality set to become highly sought in the next decade.

Economic headwinds due to affect housing association development, RSH warns

The Regulator of Social Housing (RSH) has warned that the current difficult economic climate is “likely to impact” housing association development programmes.

Reporting in the latest Sector Risk Profile, the RSH have said that housing providers needed to make difficult decisions about investment in order to “maintain financial resilience” and continue to provide services to tenants.

However, new analysis by Savills and the British Property Federation (BPF) has revealed that completed Build-to-Rent (BTR) homes in the UK could increase from 76,800 to more than 380,000 in the next ten years.

In the first long-term projection for the sector on the ten-year anniversary of the Montague Review, the report found that the BTR sector could be worth £170bn by 2032.

The current market conditions underline that we must continue to diversify housing supply in order to drive economic growth, and the Government must continue to look at how planning reform, more support for local authorities and the release of land for development can enable the sector to continue its upward trajectory.

ian fletcher, director of policy, british property federation

Bellway cites economic uncertainty as revised forecast issued

Bellway has expected its output for next year to be similar to 2022, citing the “uncertain economic backdrop” as the reason for rowing back on previously-announced growth ambitions.

Reporting on its full year results for the year ending 31 July 2022, the developer reported a strong order book but a “moderation” in its sales rate, with overall weekly reservations dropping by 12.4% per week against the previous period last year.

However, Bellway announced record housing output and revenue to the end of July 2022, with revenue growing 13.3% to £3.5bn.

Meanwhile, Allison Homes – formerly known as Larkfleet – have appointed former Miller and Persimmon Executive Darren Jones as its new Chief Operating Officer.

The £126m turnover housebuilder has recently secured re-financing to support an expansion to deliver 2,000 homes a year.

Finally, Barratt have committed to announcing the hiring of a new woman non-executive to its board within the next two weeks, following a shareholder protest at its AGM.

The UK’s largest housebuilder was forced to make the statement after more than a fifth of shareholders voted against the re-election of Chairman John Allan, in a protest against the lack of female representation on the board following Nina Bibby’s retirement.