Nationwide reports sharp fall in annual house price growth

Nationwide has published its house price index for October, revealing that the annual property value grew by 7.2% over the year – down from 9.5% in September.

Falling by 0.9% in the month, the average house price reached £268,282 in October (£272,259 in September).

The market looks set the slow in the coming quarters. Inflation will remain high for some time yet and Bank Rate is likely to rise further as the Bank of England seeks to ensure demand in the economy slows to relieve domestic price pressures.

robert gardner, chief economist, nationwide

The outlook is extremely uncertain, and much will depend on how the broader economy performs, but a relatively soft landing is still possible.

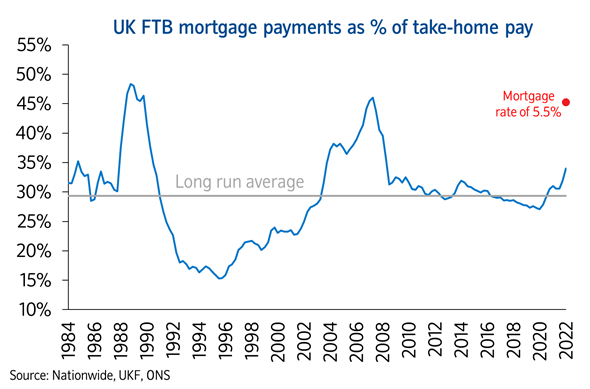

Nationwide also revealed that the recent increase in mortgage rates means that a first-time buyer earning the average wage and looking to buy a typical home with a 20% deposit would see their monthly mortgage payment rise from 34% of take-home pay to 45%, based on an average mortgage rate of 5%.

Zoopla have also announced that buyer demand has dropped by a third since the mini-budget in September.

The property website also predicted that a shortage of housing supply means prices will remain buoyant for the rest of the year, and “we don’t anticipate any impact on house prices to be felt until 2023”.

Housing market correction predicted amidst gloomy outlook

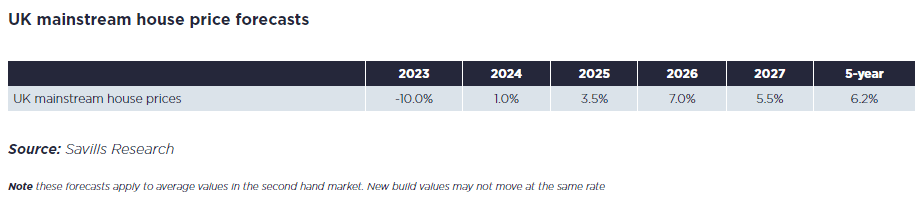

Savills has issued a five-year house price forecast, predicting that the average UK property value is expected to fall by 10% in 2023 as interest rates peak.

However, the research firm has reported that by the end of 2027 house prices are predicted to be 6.2% higher than they are currently.

Savills note that a fall in house prices would result in more buyers entering the market, allowing a “return to modest house price growth from 2024 onwards”.

Meanwhile, the Royal Institution of Chartered Surveyors (RICS) have published their UK Construction and Infrastructure Survey for Q3 2022, revealing a gloomy market outlook.

Only 17% of respondents reported an increase in construction workload activity, compared to 30% in Q2 2022.

Labour and materials shortages were blamed for the falls, alongside concerns about the wider economic climate.

This is echoed by Gleeds, whose Autumn 2022 UK Market Report states that only three in ten survey respondents said that material prices are beginning to settle, and 76% of contractors reported challenges with finding suitable labour.

The report also revealed that 27% of contractors are forecasting a reduction in tender opportunities in Q4 2022; although only one in ten contractors experienced a reduction in tender opportunities in Q3 2022.

Of our survey respondents, over 80% said they had seen greater collaboration to overcome the challenges on projects.

douglas mccormick, group executive director, gleeds

This spirit will need to continue to deliver projects and much-needed outcomes.

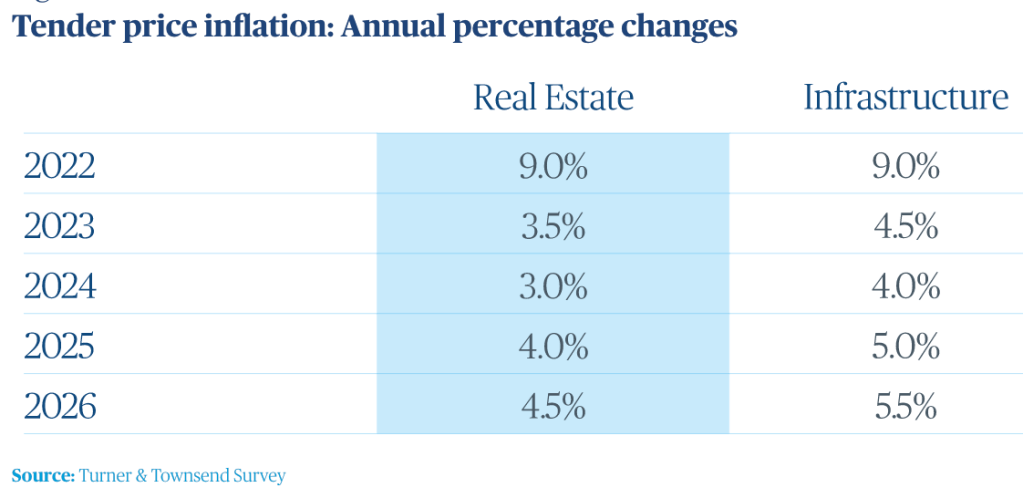

However, Turner and Townsend (T&T) have predicted that tender price inflation going into 2023 will be “more moderate” than 2022, assisted by weakening demand and contractors pushing back on increased production costs being passed through the supply chain.

T&T also forecast that the coming months could see some clients defer or scale back projects, scrutinise cost savings, and reassess their net-zero ambitions.

Expecting tender price inflation to reach 9.0% this year, T&T have forecast a drop to 3.5% in 2023.

Housebuilding growth slowed in October but remained in positive territory, according to the latest survey of purchasing managers.

The CIPS / S&P Global UK Construction Purchasing Managers’ Index registered a reading of 53.2 in October, up from 52.3 in September. Anything over 50 signals market expansion.

However, total new orders decreased for the first time in 28 months in October, signalling a fall in optimism amidst rising borrowing costs and economic uncertainty.

Gove commits to housebuilding target, but sounds warning over fire safety contracts

Housing Secretary Michael Gove has stated that the Government is still committed to their manifesto pledge of building 300,000 new homes every year by the mid-2020s.

Former Prime Minister Liz Truss had cast doubt on the promise, saying she wanted to scrap “Stalinist” housing targets; but Gove, back in the cabinet, has reaffirmed the pledge.

However, he warned that meeting the target would be “difficult”.

The cost of materials has increased because of the problems with global supply chains, and also a very tight labour market means that the capacity to build those homes at the rate we want is constrained.

michael gove, secretary of state for levelling up, housing and communities

The number of net additional dwellings has fallen short of the Government’s 300,000 target, peaking in 2020 as developers enjoyed a booming market.

The Department for Levelling Up, Housing and Communities (DLUHC) has also said that it is finalising revised fire safety pledge contracts, and expects housebuilders to sign them “very soon”.

A total of 48 developers signed the Building Safety Pledge earlier this year, but refused to sign initial contracts amidst concerns the wording would leave them open for additional costs beyond ‘life-critical’ defects.

These contracts have now been reworked, with a DLUHC spokesperson stating that “we will not accept any backsliding on [developer] commitments”.