Taylor Wimpey and Persimmon results reveal impact of economic uncertainty

Two of the UK’s largest housebuilders reported falling sales rates and increased cancellation levels this week, as economic uncertainty began to impact the housing market.

In a trading update, Persimmon revealed that it was on track to meet full year volume expectations but noted sales rates per outlet slowing from 0.78 in 2021 to 0.60 in the period covering 1 July 2022 to 7 November 2022.

The developer also revealed an increased focus on cost efficiency and cash management, as the firm enters a “challenging market”.

This relentless focus on customers, cost-efficiency, cash management and disciplined investment will help us navigate this more challenging market while also strengthening our ability to capitalise on future opportunities.

dean finch, group chief executive, persimmon

Meanwhile, Taylor Wimpey also reported a drop in sales rate, achieving 0.74 homes per outlet per week for the year to date, compared to 0.95 in 2021.

In a trading update, the firm also revealed that sales rate in the second half of the year fell to 0.51, against 0.91 during the same period last year, with a cancellation rate of 24% (2021: 14%).

However, Taylor Wimpey also announced that it expects to deliver full year operating profit in line with expectations, due to “resilient pricing in the order book and a focus on cost discipline”.

We operate from a position of financial strength and as we continue to navigate the current macro-economic challenges, our quality landbank in customers’ preferred locations positions us well.

jennie daly, chief executive officer, taylor wimpey

This week also saw Vistry complete its £1.2bn merger with Countryside Partnerships, hailed as a “game-changer” by its Chief Executive, Greg Fitzgerald.

The combined business is set to deliver thousands of homes a year for the open market and affordable housing sectors.

With our resilient business model of sustainable private and affordable delivery, we stand ready to build thousands of new homes, which is obviously great news for home hunters but also for our clients, contractors and local communities, where we will be bringing a much-needed economic boost.

greg fitzgerald, chief executive, vistry group

Lucy Frazer replaces Lee Rowley as Housing Minister

After days of speculation, Lucy Frazer has been confirmed as Housing Minister, replacing Lee Rowley, who is now understood to have the local Government brief, as well as becoming minister for building safety.

Frazer, MP for South East Cambridgeshire, has previously been a minister of state at the Department for Transport. She becomes the fifth MP to hold the Housing Minister brief in 2022, following Chris Pincher, Stuart Andrew, Marcus Jones and Lee Rowley.

Construction grows in September, but house prices continue to fall

Official data from the Office for National Statistics has revealed that construction output rose slightly in September, despite an overall fall in UK gross domestic product.

The industry’s output rose by 0.4% – the third consecutive month of growth for the sector, but slightly lower than the 0.6% recorded for August, and driven mainly by infrastructure and public housing repair and maintenance.

However, the latest house price index from Halifax has shown that the average property value fell by -0.4% in October to £292,598 (Sept: £293,664).

The mortgage lender also revealed that the rate of house price growth slowed in all but one region in England during October, with the North East bucking the trend.

Halifax also reported that the monthly fall was the sharpest seen since February 2021, and that annual growth slowed to 8.3% in October, down from 9.8% in September.

Whilst a post-pandemic slowdown was expected, there’s no doubt the housing market received a significant shock as a result of the mini-budget which saw a sudden acceleration in mortgage rate increases.

kim kinnaird, director, halifax mortgages

While it is likely that those rates have peaked for now…it appears that recent events have encouraged those with existing mortgages to look at their options, and some would-be homebuyers to take a pause.

This report is echoed by the latest UK Residential Market Survey from the Royal Institute of Chartered Surveyors (RICS), which warns of “further deterioration in market conditions” during October.

New buyer enquiries fell for a sixth successive report, with respondents reporting negative feedback on buyer demand across all parts of the UK.

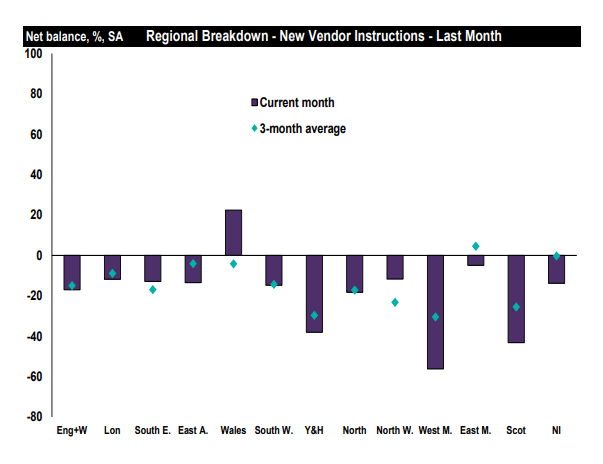

At the same time, the number of new listings coming onto the market has also declined, with a net balance of -17% of respondents citing a diminishing trend.

Meanwhile, the Construction Products Association (CPA) has poured more gloom on an already bleak outlook for the industry, forecasting construction output to fall by -3.9% in 2023, with private housing output set to drop by -9.0%.

Citing the impact of the mini-budget and the resulting “financial market chaos”, the CPA’s Autumn Forecast predicts that developers are likely to reduce housebuilding targets for the coming year.