Hunt’s statement garners mixed response from housing sector

Chancellor Jeremy Hunt delivered his much-anticipated Autumn Statement this week, resulting in a varied response from the housebuilding industry.

Hunt announced an end to stamp duty cuts in 2025, and reversed the Investment Zones announced by his predecessor Kwasi Kwarteng.

The Chancellor stated that the Office for Budget Responsibility (OBR) expected housing activity to slow over the next two years, falling by 9% between now and autumn 2024.

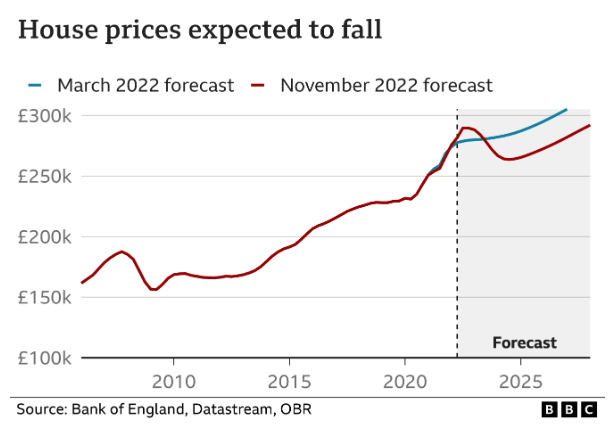

In their November 2022 Economic and Fiscal Outlook, the OBR reported an expected increase in property value of 10.7% in 2022, followed by two years of falls, with house prices down by 1.2% in 2023 and 5.7% in 2024.

The OBR then predicts house prices will rise by 1.2% in 2025, 3% in 2026 and 3.5% in 2027.

The stamp duty changes, which took effect in September, increased the threshold from £125,000 to £250,000, which were described by Kwarteng as “permanent”.

But Hunt reversed this plan, announcing that stamp duty cuts would remain until the end of March 2025.

After that, I will sunset the measure, creating an incentive to support the housing market and all the jobs associated with it by boosting transactions during the period the economy most needs it.

jeremy hunt, chancellor of the exchequer, autumn statement 2022

Hunt also revealed that the previously-announced Investment Zones would be scrapped, and instead the Government would “refocus” this initiative on “a limited number of high potential clusters, working with local stakeholders, to be announced in the coming months”.

Elsewhere in the Statement, Hunt confirmed that the Government would limit social housing rent increases to 7% next year, not 5% as previously suggested.

Hunt said that this measure would “support people most exposed to high inflation”. Under previous rules, rents could have increased by up to 11.8%.

The Autumn Statement produced a mixed reaction from the housing industry. Richard Cohen, Chief Executive Officer of St Arthur Homes, said that the move to retain stamp duty cuts to 2025 “shows how important a thriving housing market is to the wider UK economy”.

However, Paul Woodward, Finance Director for affordable housing specialist AJC Group, labelled the change as “disappointing, as we have already seen signs that this recently introduced measure is helping hard-working people to get a foothold on the ladder.”

Andy Morris, Managing Director of Hayfield, welcomed the scaling back of Investment Zones, but called for “a clear, transparent and sensible planning application system across the board that avoids valuable time and money being wasted on all sides”.

Meanwhile, the Home Builders Federation called on Government to engage with the home building industry to deliver against its ambition of 300,000 new homes a year.

Despite the clear threats to supply levels, and the associated impact on the social and economic benefits of building new homes, there is little in today’s statement to assist housing delivery.

stewart baseley, executive chairman, home builders federation

We would urge the Government to engage with the industry and look to develop policies that will support demand for new homes and address the acute constraints we face.

Gove pledges to prevent “poor aesthetic quality” developments

Housing Secretary Michael Gove has declared that the Government would use “all the powers we have” to prevent schemes which are not “aesthetically high quality” from obtaining planning permission.

Speaking at a Centre for Policy Studies conference, Gove stated that planning reform was not “dead”, and pledged to ensure unappealing developments “don’t go ahead”, citing the poor appeal of new homes one of five reasons why communities opposed new development.

Gove also announced that the Department for Levelling Up, Housing and Communities would unveil a set of policies “to ensure that we improve the quality, in particular the aesthetic quality, of new developments”.

For those who are seeing the new homes being built, the fact that housebuilders use a restricted pattern book with poor quality materials and the aesthetic quality of what is produced is both disappointing and not in keeping with the high aesthetic standards of what may already exist – that is a reason why communities say ‘no’.

michael gove, housing secretary

The other reasons Gove cited for communities opposing development were a lack of supporting infrastructure, a concern that the landowner would receive all the cash benefit of an increase in land value and not local areas, a lack of democracy in the planning process, and environmental concerns.

Official figures reveal slowdown in house price growth

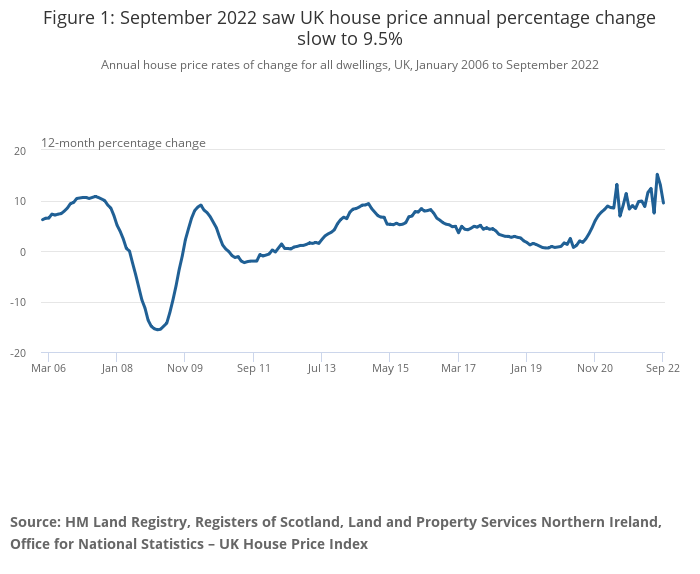

The Office for National Statistics (ONS) has published their house price index for September, revealing that the average UK property value increased by 9.5% over the year, down from 13.1% in August.

The ONS blamed the fall on a spike in house prices in September 2021 due to the end of Stamp Duty Land Tax changes, stating that the average value remained unchanged between August and September 2022, at £295,000.

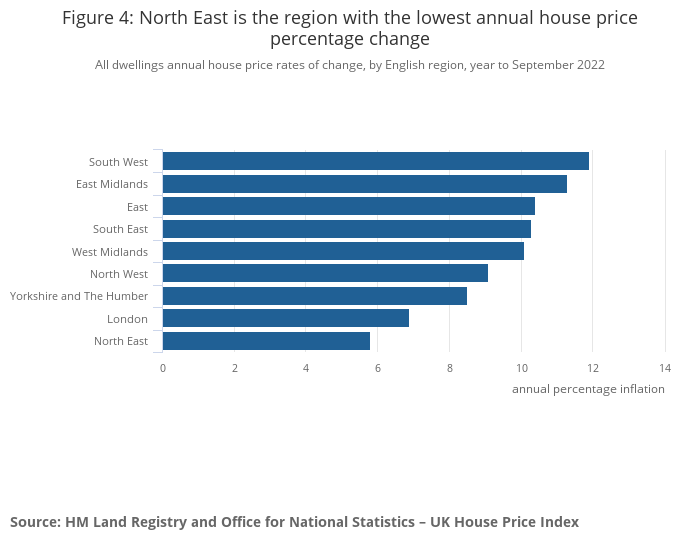

Wales continued to lead the way in annual house price growth at 12.9%, followed by Northern Ireland (10.7%), England (9.6%) and Scotland (7.3%).

London was replaced by the North East as the lowest-performing region, with prices increasing by just 5.8% over the year.

The South West boasted the highest increase, at 11.9%.

Rightmove have also reported a house price fall of -1.1% in the month of November, but stated that this was in line with the norm recorded during the pre-pandemic years of 2015-2019 as sellers price more competitively to try and find a buyer before Christmas.

However, in their house price index for November, the property website also revealed that more existing sellers, with properties already on the market, are reducing their prices to achieve a quicker sale.

Buyer demand is up by 4% on the normal market of 2019, but down by 20% on October last year, Rightmove said.

The plethora of predictions about what might happen to prices next year comes at a time when much is still uncertain, but what is certain is that the exceptional price growth of the last two years is unsustainable against the economic headwinds and growing affordability constraints.

tim bannister, director of property science, rightmove

Meanwhile, latest NHBC data has revealed that new home registrations grew 33% in the third quarter of 2022 year-on-year, but warned of a “slowdown ahead”.

During Q3 a total of 44,729 new homes were registered – the highest number of Q3 registrations since 2007. Of these, 26% were private sale, with those for the affordable and Build to Rent sectors increasing by 55%.

However, the NHBC pointed to expectations of sales slowing “in the coming period” because of increased mortgage rates and falling consumer confidence.

More housebuilders report falling sales rates

Developers continue to report a slowdown in sales and a rise in cancellations, following Persimmon and Taylor Wimpey posting cautious outlooks last week.

In a trading update, Redrow declared a “changing economic outlook”, with reservations dropping since the start of its new financial year in July.

The value of net private reservations fell 19% against the previous year to £515m, as reservations per outlet per week dropped to 0.49 from 0.68 during the equivalent period last year.

Meanwhile, Crest Nicholson have postponed plans to open a new operating division next year due to the “challenging macro-economic outlook”.

The developer was due to open a third division, but have deferred plans “until further notice”.

We believe it is the right decision to defer the planned opening of a third new division and adjust the pace of growth in our existing ones until a more stable environment returns.

peter truscott, chief executive, crest nicholson

The UK is clearly facing a challenging macro-economic outlook, however we remain confident in the long-term fundamentals of the UK housing market.