Gove scraps proposed planning reforms after Tory rebellion

Housing Secretary Michael Gove has had a busy week. On Monday he set out a swathe of proposed amendments to the Levelling Up and Regeneration Bill, designed to stop developers landbanking.

Gove announced a series of principles he wants developments to adhere to, under the acronym ‘Biden’: beauty, infrastructure, democracy, environment and neighbourhoods.

The proposed changes also brought forward street votes and allowed local authorities to block planning permissions from developers who have failed to deliver homes on the same site.

However, backbench Tory rebels put a stop to the reforms, and called for the Government to abolish housing targets.

Led by former Environment Secretary Theresa Villiers, and with the support of nearly 50 Conservative backers, a planned vote on the proposed amendments was scrapped.

Villiers and her supporters filed 21 amendments to the Levelling Up bill, including allowing councils to ban greenfield development and institute a third party right of appeal in the planning system.

Meanwhile, Gove has vowed to block affordable housing providers who breach consumer standards from receiving development funding, following the death of two-year old Awaab Ishak.

Gove has also pushed ahead with the £3bn building safety levy, drawing anger from the Home Builders Federation (HBF), who claimed that the Government was an “increasingly anti-development and anti-business policy regime”.

Commenting on the launch of the Department for Levelling Up, Housing and Communities’ consultation on the controversial levy, which runs until 07 February, the HBF said: “in the midst of a recession, it is disappointing for Government to create more barriers to investment with a move that will further threaten supply, in particular of affordable homes.”

Building new homes may not be politically attractive, but the country faces an acute housing affordability crisis, and the construction of new homes supports millions of British jobs.

home builders federation

HSE report reveals two million working days lost a year

Latest figures from the Health and Safety Executive have revealed that the construction industry is losing more than two million working days each year due to work-related health problems.

The figure is an estimated annual average based on data from the Labour Force Survey from 2018/19 to 2021/22.

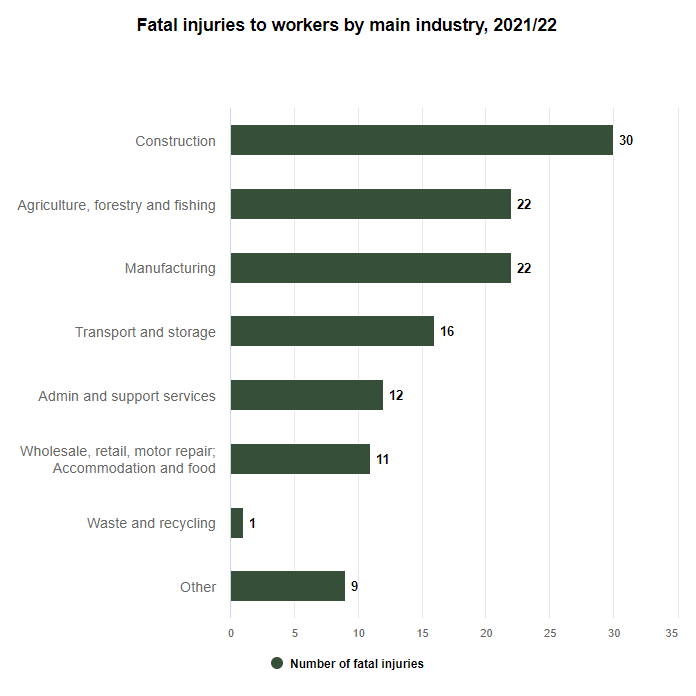

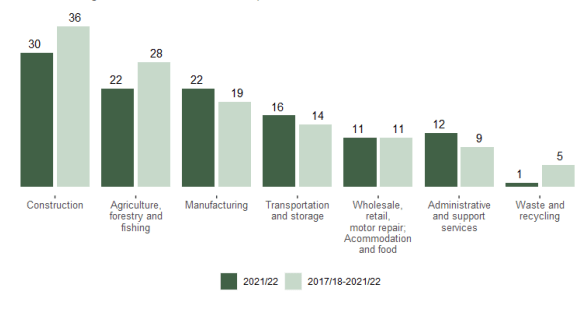

In the most recent year (2021/22), there were 30 fatal injuries to workers in construction – slightly lower than the average of 36 recorded over recent years.

Net housing supply rises 10%, but housing associations miss targets

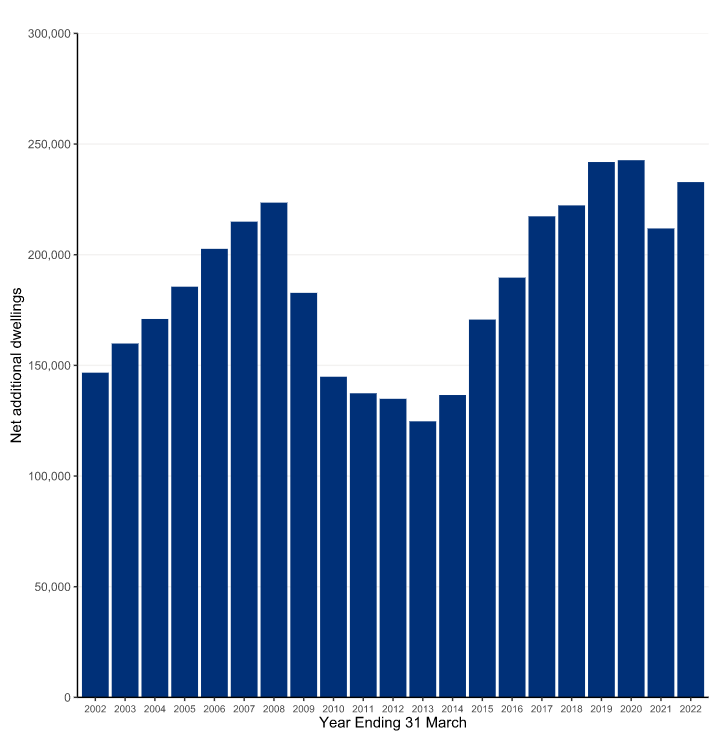

Latest statistics from the Department for Levelling Up, Housing and Communities (DLUHC) have revealed that annual net housing supply in England rose by 10% in the year to March 2022, when compared to the previous year.

Reaching a total of 232,820, of which 210,070 were new build homes, the net housing supply was 4% lower than the 2019/20 pre-pandemic peak.

Within the supply figure of 232,820 were 22,770 units gained through change of use via permitted development, 4,870 conversions between houses and flats, 780 other gains such as caravans and house boats, offset by 5,680 demolitions.

However, several housing associations have published unaudited half-year statements warning that they will likely miss completion targets, citing challenges around sourcing labour and materials.

Sovereign, Optivo and Great Places have all used financial statements to report difficulties, and to express concern over the impact of the current economic turmoil on build rates.

Material lead-in times recover, but further cost inflation likely

The availability of building materials is beginning to return to pre-pandemic levels, according to the latest product availability statement from the Construction Leadership Council (CLC).

However, costs for energy-intensive products such as plasterboard, concrete and bricks are likely to continue rising, with Forterra this week announcing a double-digit increase in the New Year.

In a trading update, the brick manufacturer posted an increase in revenue of 23% in the first ten months of 2022, compared to the previous year, but warned that a fourth price rise in twelve months was likely.

Meanwhile, the volume of building products sold fell by 9% in the third quarter of 2022 when compared to the same period in 2021, following an 11% fall in the second quarter.

Data from the Builders Merchant Building Index found that, whilst volumes were down, sales revenue was up by 4.3% on last year, due to cost inflation.

This consistent theme of price increases and volume declines mirrors much of what is seen across the UK economy, and like other sectors there’s probably an expectation that volumes will continue decreasing.

emile van der ryst, senior client insight manager (trade), growth from knowledge

Healthy stock levels and declining demand are also contributing to a fall in timber imports to the UK, according to Timber Development UK statistics.

Declining for the fourth month in a row to August, import volumes in the first eight months of 2022 stood at 6.8 million cubic metres – the lowest total since 2016.

Softwood import reductions are largely responsible, with volumes 25% lower than in 2021 and 16% lower than pre-pandemic volumes in August 2019.