Biggest monthly fall in house prices recorded since June 2020

House price growth has continued to slow in November, according to Nationwide’s latest house price index.

Falling from 7.2% in October to 4.4% in November, the average property value is now £263,788 (Sept: £268,282).

House prices fell by -1.4% in the month – the largest monthly drop recorded since June 2020.

The mortgage lender also warned that market challenges would continue for the forseeable future.

The market looks set to remain subdued in the coming quarters. Inflation is set to remain high for some time, and Bank Rate is likely to rise further as the Bank of England seeks to ensure demand in the economy slows to relieve domestic price pressures.

robert gardner, chief economist, nationwide

Meanwhile, Zoopla have reported the lowest quarterly growth since February 2020 in their latest outlook on the UK housing market, at 0.7%.

The property website also revealed that annual house price growth has slowed to 7.8%, and expects to see house prices falling by -5% in 2023.

Zoopla also stated that one in four sellers have reduced their property’s asking price since 01 September, with 11% reducing their price by more than 5%.

The gloomy outlook continues: the number of mortgage approvals for house purchase has fallen by -10.6% in October, Bank of England statistics have revealed.

At 59,000 – down from 66,000 in September – the number of approvals was also 15% less than this time last year, and 11% lower than the 2014-2019 average.

Planning applications down as Homes England completions fall

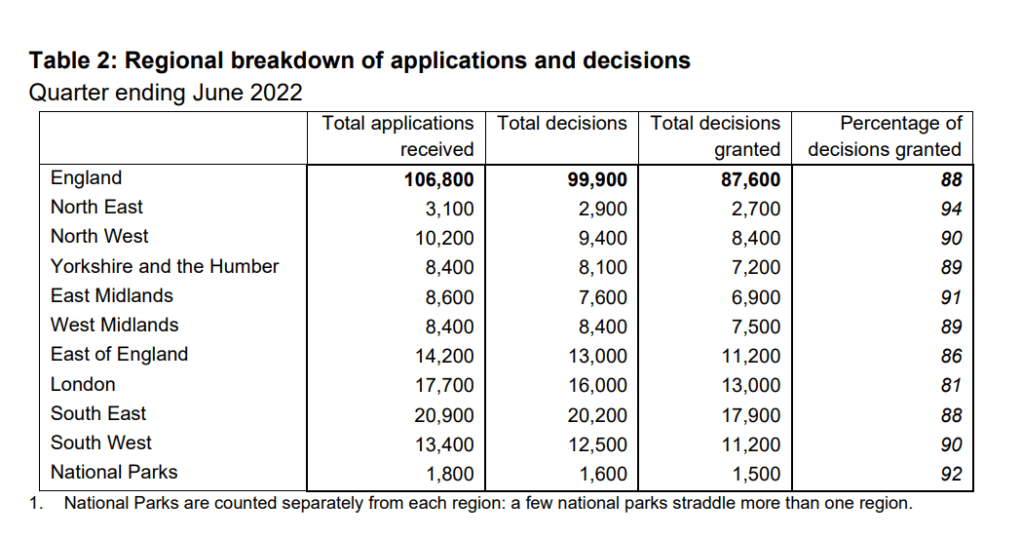

The number of planning applications submitted in the three months from April to June 2022 have fallen by 17% from the corresponding quarter in 2021, figures from the Department for Levelling Up, Housing and Communities (DLUHC) have shown.

Local authorities in England received 106,800 applications, and granted 8,700 residential applications – a reduction of 9% from 2021.

Meanwhile, the Chief Executive of Homes England is blaming “macro-economic pressures” for hitting unit delivery.

Peter Denton has cited “material, labour shortages and rising cost inflation” as the reasons behind a year-on-year fall in starts and completions under Homes England affordable housing programmes.

Figures released show that 14,812 homes were started from April to September, 8% down on 16,115 recorded in the same period last year.

Completions also fell to 12,118 (-15%) over the same period. Homes England pin the fall on the transition to the Affordable Homes Programme.

Two-fifths of students would not choose a career in construction, says survey

A survey of nearly 4,000 students commissioned by engineering firm WSP and carried out by Savanta ComRes has revealed that 37% of respondents would avoid a career in construction.

The research aimed to gauge youngsters’ attitudes to green skills and job opportunities across the economy, with 3,917 students aged between 16 and 23 years old taking part.

Reporting the findings in an event at the House of Commons, there was broad agreement across the panel – which also included representatives from RenewableUK and EngineeringUK – that the industry needs to do more to promote green careers.

Whilst 87% of respondents said they were very or somewhat concerned about climate change, only half felt that their generation could have a high impact on tackling the issue, and just two in five said they understood what the term ‘green jobs’ means.