DLUHC rows back on housing targets as Gove goes on the offensive

After a few weeks of back and forth – and a rebellion from backbench Conservative MPs – the Department for Levelling Up, Housing and Communities (DLUHC) finally confirmed this week that the previous Government target of 300,000 new homes a year was set to be a “starting point”, rather than a mandatory requirement.

In a number of amendments to the Levelling Up and Regeneration Bill which will see housing numbers become more locally determined, DLUHC claimed that the targets “remain an important part of the planning system and the Government will consult on how these can better take account of local density”.

The news sparked annoyance within the industry, with Neil Jefferson, Managing Director of the Home Builders Federation, stating that the Government’s “vague public commitments” to its targets were “worthless without action”.

If ministers fail to stand up to the anti-business and anti-development section of the Conservative party it is inevitable that housing supply will fall dramatically, costing hundreds of thousands of jobs, slashing GDP and preventing even more people from accessing decent housing.

neil jefferson, managing director, home builders federation

Meanwhile, Gove has urged the Competition & Markets Authority (CMA) to conduct a study into the housebuilding sector.

In a letter to interim Chief Executive Sarah Cardell, Gove writes: “The last housebuilding study took place 14 years ago and since then, there have been significant changes in both the market and the challenges facing the country as a whole…reflecting on the above, and in the context of increasing economic pressures, it feels timely that the CMA should be considering a market study”.

In her response, Cardell wrote that the CMA “have been developing proposals for work in this area, including a possible market study for the board’s consideration in January”.

Gove has also reversed compromises in the £2bn building cladding pledge proposed by his predecessors, which amended legal text within a document previously described by the Home Builders Federation as “impossible to sign”.

Meanwhile, the Government looks set to fall short of its target to build 180,000 new homes through the 2021-2026 Affordable Homes Programme, according to a report from MPs.

A statement from the Public Accounts Committee has revealed that the number of new homes will be around 157,000; 32,000 short of the target.

In good news, though, Housing Minister Lucy Frazer has confirmed a one-month extension to the practical completion deadline for Help to Buy.

Instead of 31 December 2022, developers can now reach practical completion by 31 January 2023 – as long as they notify Homes England in writing by 20 December.

Halifax reports largest monthly house price drop since 2008

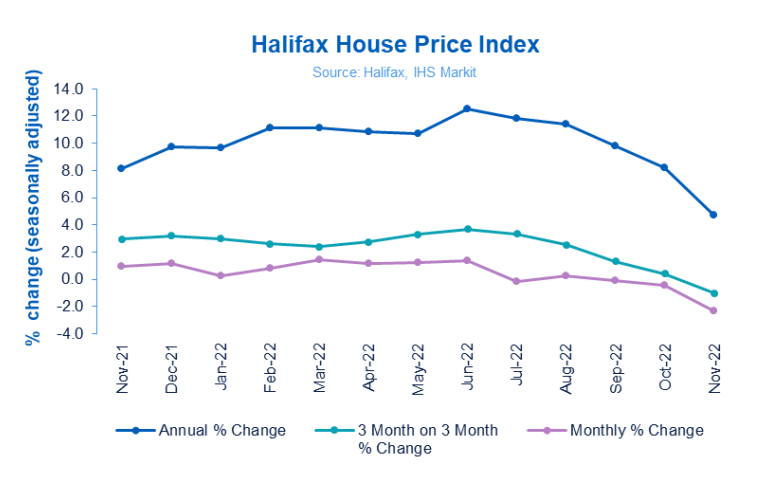

The UK housing market continues to slow, with Halifax revealing this week that the average house price fell by -2.3% in November, versus -0.4% in October.

In the largest monthly drop since October 2008, the average property value fell from £292,406 last month to £285,579 in November.

The annual rate of growth dropped to 4.7% from 8.2% in October.

Kim Kinnaird, Director for Halifax Mortgages, is keen to remind the industry of the recent boom in house prices, with property values up more than £12,000 compared to this time last year, and well above pre-pandemic levels.

The market may now be going through a process of normalisation.

kim kinnaird, director, halifax mortgages

While some important factors like the limited supply of properties for sale will remain, the trajectory of mortgage rates, the robustness of household finances in the face of the rising cost of living, and how the economy – and more specifically the labour market – performs will be key in determining house price changes in 2023.

Industry optimism falls as labour struggles continue

The latest Purchasing Managers’ Index from S&P Global and CIPS has revealed that optimism in the UK construction sector has fallen to the same level as during the 2008 crash.

Falling to 50.4 in November – the lowest level for two-and-a-half years – from 53.2 in October, the results demonstrate concern over higher costs and the economic outlook.

Meanwhile, more than one in three construction businesses experienced a shortage of workers in late November, according to the Office for National Statistics.

According to the ‘business insights and impact on the UK economy’ dataset, just over 36% of firms are struggling to find staff.

And, in further evidence of an ongoing skills shortage across the industry, a report from the Association of Professional Staffing Companies (APSCo) has revealed that construction sector vacancies in the UK shrank by 6% in the first 10 months of 2022.

However, the number of applicants per vacancy was down by 44% over the same period, suggesting a shortage of available skills and a reluctance to move jobs during a time of economic uncertainty.

It’s crucial that the Government enacts policies that will bring stability for workers, including announcing the long-awaited Employment Bill and revising policies to better recognise and support the unique needs of the highly skilled contractor labour market.

ann swain, chief executive, apsco

Ilke Homes raises £100m to fund growth

Volumetric housebuilder Ilke Homes has successfully raised £100m from new and existing shareholders – the largest-ever raised by a UK modular housebuilder.

Following ambitions to increase output capacity to 4,000 homes a year and open a new factory, the firm sees Fortress Investment Group joining TDR Capital and Sun Capital as an owner of the business.