Housing starts fall in third quarter

Official figures from the Office for National Statistics (ONS) have revealed a fall of 19% in housing starts during the third quarter of the year.

Government figures show that seasonally adjusted quarterly housing starts from July to September fell to 42,430 – down from 52,540 in the previous quarter.

The fall represents the first quarterly drop since the fourth quarter of 2021, and is a stark contrast to the spike seen in the previous quarter, driven by developers accelerating build to avoid Part L regulations.

Completions also fell quarter on quarter by 4%, down to 42,950.

Rightmove reports 5.6% annual growth as 2022 ends

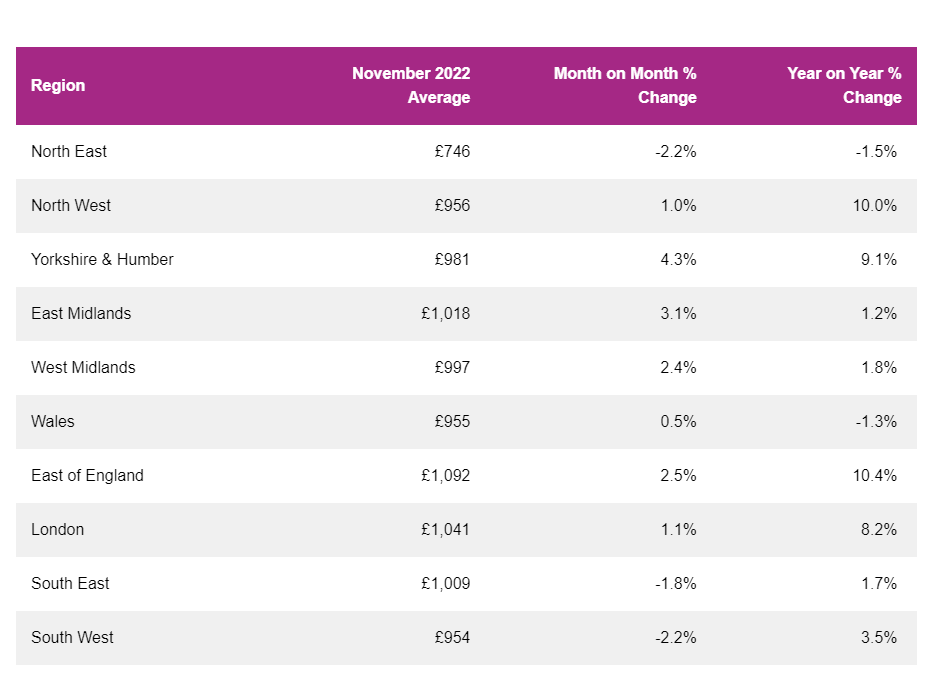

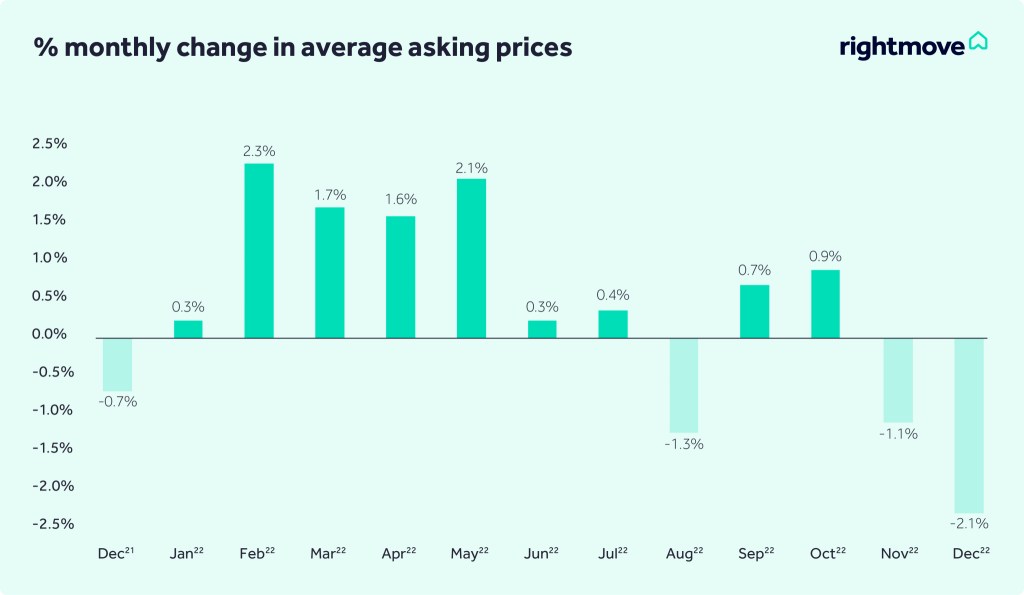

Rightmove have published their house price index for December, reporting a 2.1% fall in the month.

The monthly fall – which Rightmove describe as “a bigger dip than usual at this time of year” means that 2022 ends with property values at 5.6% higher than this time last year. In 2021, annual growth was 6.3%.

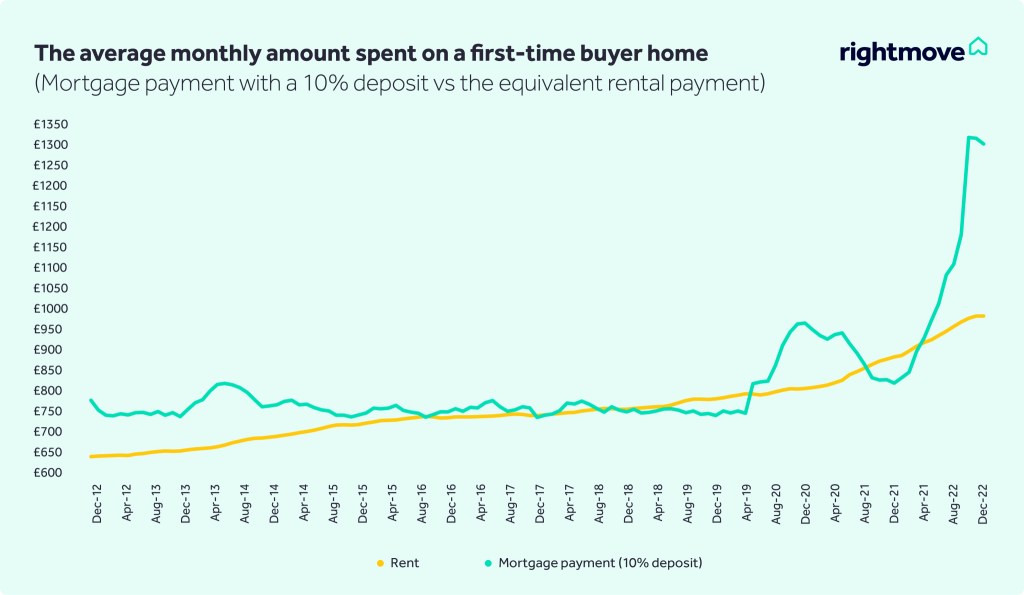

The property website also forecasts a 2% fall in UK house prices next year, with some locations, property types and sectors faring much better than others.

Our data suggests that there are many ready-to-go movers out there waiting for what they feel to be the right time to enter the market in 2023.

tim bannister, director of property science, rightmove

We’d usually see a jump in home-mover activity in January, but it takes a while at the start of the year for any significant price changes to feed through, so we’ll be waiting for a potential bounce back in prices in February.

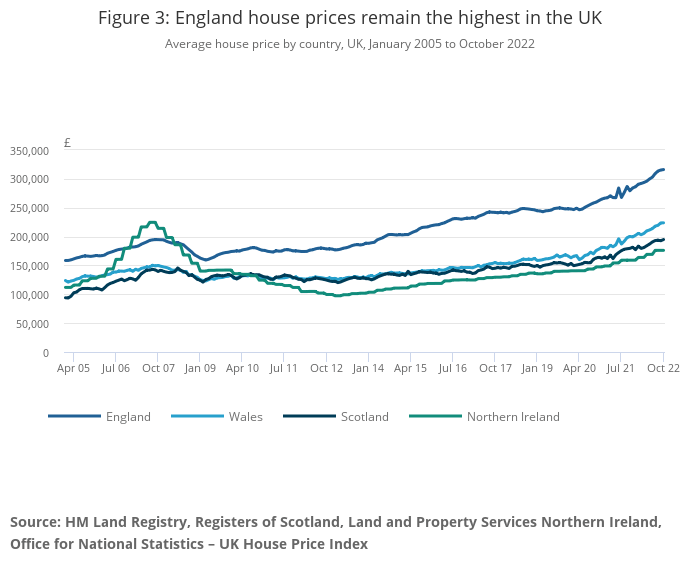

Meanwhile, data from the Office for National Statistics has revealed that average UK house prices increased by 12.6% over the year to October 2022, up from 9.9% in September 2022.

The average UK house price reached £296,000 in October; £33,000 higher than this time last year.

England saw the highest annual house price growth at 13.2%, followed by Wales (11.8%), Northern Ireland (10.7%) and Scotland (8.5%).

House price falls look set to continue, with research from Propertymark revealing that 72% of branches made a majority of their sales in November below the level the client was seeking.

This compares to a low of 15% in March, and a pre-pandemic average of 78%.

The property sector body also revealed a fall in competition, with a high of 11 new buyers to each new property instructed in a member branch falling to seven last month.

The sales market is firmly back in the hands of buyers who have been on the back foot for 18 months. More property is available, but the competition those looking has cooled substantially.

nathan emerson, ceo, propertymark

Cluttons forecast 8.0% fall in house prices next year

The UK housing market seems to be cooling after almost two years of rampant growth, with increased costs of living and mortgage rates look set to correct the industry in the next 12 months.

Property specialists Cluttons have joined the growing number of firms predicting the state of the industry over the next year, predicting that house prices will fall by 8.0% by December 2023.

Labour costs rise despite industry slowdown

Average labour rates have continued to rise in November, despite signs of a slowdown in building activity.

Latest data from payroll firm Hudson Contracts has revealed that the average earnings for self-employed tradespeople grew 1.3% in November to £992 per week – 5.1% higher than the same period last year.