House prices bounce back in January

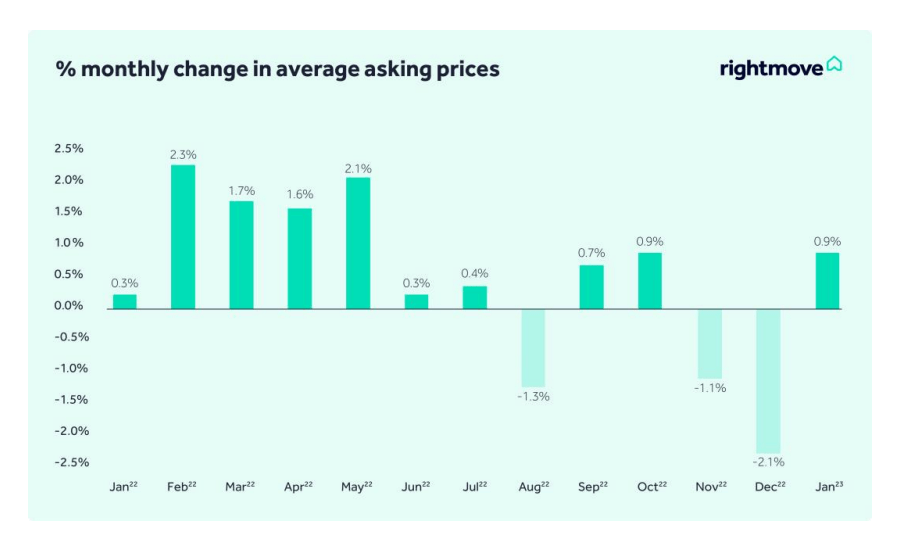

Rightmove reported a larger than usual New Year bounce in house prices this week, after two months of falls.

Reporting a rise of 0.9% in January, the property website voiced a cautiously optimistic outlook for the year, with the number of prospective buyers contacting agents up 4% compared to the same period in 2019, and up by 55% compared with the two weeks before Christmas.

The average house price now stands at £362,438; an increase of £3,301 in the month.

In addition, a softening of mortgage rates has eased the pressure of monthly payments for first-time buyers.

We expect that the full effect of affordability constraints and last year’s mortgage rate rises will hold back some segments of the market in the first half of the year, but our leading market indicators may start to identify some green shoots of growth that will go on to strengthen in the second half of 2023.

tim bannister, director of property science, rightmove

This positive news comes after a challenging December, with RICS UK Residential Survey results revealing a net balance of -42% of survey participants reporting a decline in house prices during the month – down from -26% in November.

The Royal Institution of Chartered Surveyors also forecast a continued decline in house prices over the forthcoming quarter.

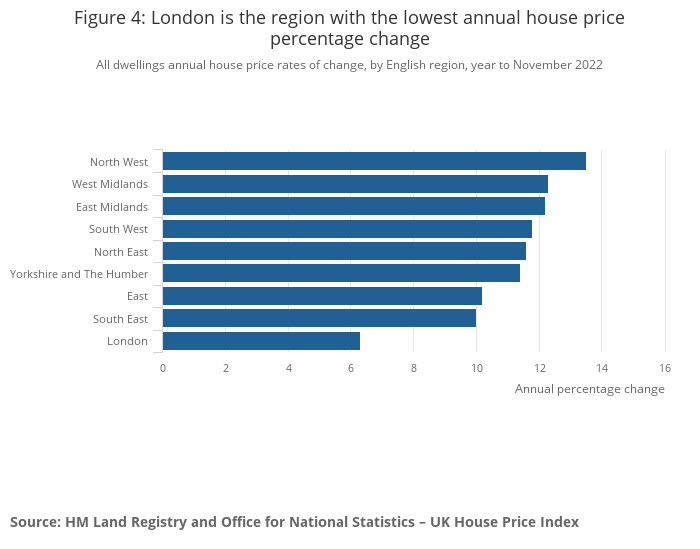

Meanwhile, official data from the Office for National Statistics has reported a slowdown in annual house price growth in November, down to 10.3% from 12.4% in October.

England saw the highest annual increase in property values, reaching 10.9%, followed by Wales and Northern Ireland (both 10.7%), and Scotland (5.5%).

The North West experienced the largest annual regional growth, at 13.5%. London posted the lowest increase, at 6.3%.

Construction to employ 225,000 extra workers by 2027

Latest figures from the Construction Industry Training Board (CITB) have revealed that 225,000 extra workers will be needed by 2027 to meet demand.

Bringing the total number of people working in the industry to 2.67m, the sector will need to recruit 44,980 people a year to meet this target.

Whilst down from last year’s projection of 53,200 per year, the forecast still raises questions as to how the industry will attract this level of interest, given the current labour crisis.

We know the next 18 months won’t be easy, however, I remain inspired by the construction industry’s resilience shown in the pandemic and throughout 2022.

tim balcon, chief executive, citb

To bolster industry resilience CITB will strive to attract and train a diverse range of recruits for industry, equipping them with modern skills for rewarding construction careers.

DLUHC announces £60m brownfield fund, as councils halt local plans

The Department for Levelling Up, Housing and Communities (DLUHC) have announced that councils across England will be able to bid for a share of £60m, set aside to develop brownfield sites across the country.

The funding is targeted to deliver 5,800 new homes by March 2027, and create around 18,000 new jobs in the housing and construction sector.

We want to turn neglected areas into thriving new communities, as part of our mission to level up the country.

lucy frazer, minister for housing

To do this we must prioritise brownfield land to deliver new homes for people, in the right places.

The £60 million fund we are opening today provides another fantastic opportunity for councils to drive regeneration in their towns and cities – and help more young families onto the housing ladder.

Meanwhile, fallout from the recent scrapping of annual housing targets continues, with North Somerset Council and Gedling Borough Council scaling back local plans.

This comes after other local authorities – such as Stockport and Mole Valley – delayed work on their local plans following Gove’s planning reforms.

Developer trading updates reveal mixed reaction to market conditions

Vistry, Crest Nicholson and Cala have all published trading statements in the last few days, following downbeat reports from Taylor Wimpey, Barratt and Persimmon last week.

Vistry revealed that full-year profits are in line with expectations, but – as reported by many other developers – private sales fell significantly in the lead-up to Christmas.

In a trading update for the year to 31 December 2022, the group – which acquired Countryside Partnerships in November – saw a drop in average weekly private sales per site from 0.84 in the first half of the year to 0.46 in the final quarter.

Crest Nicholson revealed that it was pausing regional expansion plans, in response to falling demand.

Crest recently opened a new Yorkshire office, and had plans to open a new division in East Anglia; but these have been shelved until further notice.

The developer reported strong results for the year ending 31 October 2022, with adjusted profit before tax up 29% to £138m.

However, Cala Group has announced that it is planning to work on 29 new sites this year, compared to 20 in 2022.

Reporting a strong set of results to the end of 2022, with turnover up to £1.36bn (2021: £1.24bn), the developer also revealed the highest pre-tax profit ever recorded by the firm, at £169m.