Government department instructs BSI to set the bar for offsite construction

The Department for Levelling Up, Housing and Communities (DLUHC) has commissioned the British Standards Institution (BSI) to establish a UK-wide standard for modern methods of construction.

This standard aims to improve the quality of offsite manufacturing, increasing the choice of homes and access to product warranties.

It will also look to reduce the costs of prefabricated homes for developers and consumers.

We want to help homebuilding step into the future. This means embracing the latest technology to deliver more high-quality, energy-efficient homes for generations to come.

lucy frazer, housing minister

The news comes in the same week that Vistry announced plans for a timber frame manufacturing facility in Bardon.

The offsite factory – previously put up for sale by Countryside – was acquired as part of the Vistry merger, and is capable of producing 3,500 units a year.

Stephen Teagle, Chief Executive of Vistry Partnerships, said: “Our hope is we will be using Bardon for our own delivery, but in addition to that, there is capacity at Bardon to work with SMEs and housing associations on delivery of their own programmes.”

Meanwhile, housebuilder Redrow has committed to fit all new detached homes with air source heat pumps and underfloor heating as standard from this month.

In an industry first, the developer stated that this “places us ahead of competitors when it comes to the Government’s proposals to make all new build properties gas-free from 2025.”

The move to air source heat pumps will ensure our future homes are ‘zero-carbon ready’ for when the grid is decarbonised and supports our goal of achieving science-based net-zero emissions no later than 2050 across our operations, homes and supply chain.

matthew pratt, ceo, redrow

CMA to launch a probe into housebuilding sector

The Competition and Markets Authority (CMA) has announced that it will conduct an investigation into the operation of the housebuilding sector, following a request for an inquiry made last year by Michael Gove.

In an open letter to Gove, the Government’s competition regulator said that the board had agreed to look at the housebuilding industry as its next market study.

The CMA are now finalising the scope of the project, which is expected to be given formal approval in a few weeks.

The probe could generate several outcomes, from recommending Government policy changes to commencing consumer enforcement action, as seen in a recent CMA inquiry into the miss-selling of leasehold properties by several developers.

EPC data reveals housebuilding high in 2022

Government numbers detailing the number of energy performance certificates (EPCs) recorded for new homes has revealed that 261,332 units were registered in 2022 for new builds, conversions or changes of use – an increase of 3.3% on 2021.

This is also the highest number of EPCs since 2019, which saw 264,302 certificates registered, and reflects the housing market boom experienced for the majority of last year.

However, the housing industry experienced a tumultuous few weeks in the final quarter, triggered by a disastrous mini-budget in September.

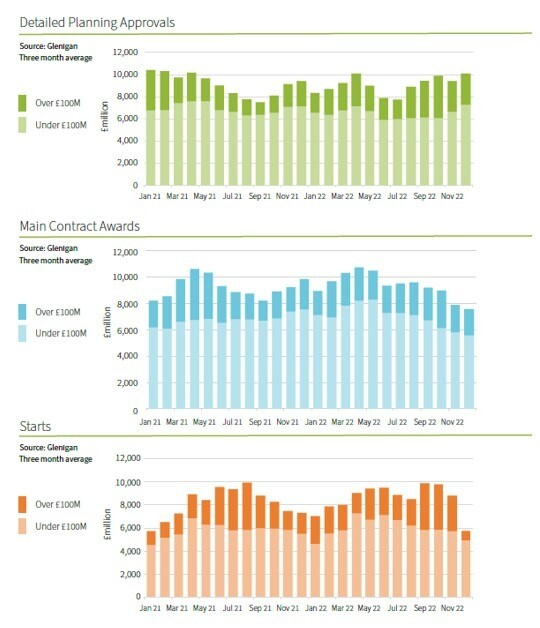

This has been reinforced in Glenigan’s latest Construction Review, which found that construction starts in the fourth quarter of 2022 slumped to their lowest level since the first Covid lockdown.

The analysis has revealed a 48% fall in project starts from October to December 2022 when compared to the third quarter, and 20% down on the same quarter in 2021.

However, the Construction Review also reported a 2% increase in detailed planning approvals in the final quarter of 2022 when compared to the previous three months.

The slump in housebuilding towards the end of 2022 has also been reflected in the latest Builders Merchant Building Index (BMBI), which found that the volume of building products and materials sold in the UK was down 13.6% in November when compared to the same month in 2021.

However, sales were up 1.4% over the year in terms of value, due to cost inflation, and the BMBI report – produced by MRA Research – gave a cautiously optimistic outlook for the coming months.

Interest rates are expected to peak sooner and lower than earlier forecasts; high energy and material costs are now not expected to be so extreme.

mike rigby, ceo, mra research

We may be over peak Truss-shock and the Autumn’s doom and gloom may have been overcooked, but there are still plenty of challenges to overcome.

Meanwhile, the Construction Leadership Council has reported a continued improvement in product availability across almost all UK regions.

Driven by a reduced level of construction activity and poor weather, the supply improvement in most materials has also seen some stabilisation in price inflation – although timber costs are expected to rise in the second quarter of the year.

Energy-intensive products continue to experience price increases, but some suppliers have deferred these in light of ongoing economic uncertainty.

In other news: CSCS cards out, HTB extension, and CPS report

The Construction Leadership Council has confirmed plans for a reform of the current Construction Skills Certificate Scheme (CSCS), which will cease renewing industry accreditation cards from the end of June 2024.

Instead, those looking to renew their CSCS card will have to reapply for new cards in 2024 and acquire an appropriate National Vocational Qualification (NVQ) or other recognised qualification, which will be provided by an independent assessor.

Housing Minister Lucy Frazer has extended the deadline for practical completions for Help to Buy transactions by six weeks, stating that developers now have until 17 March to achieve practical completion of homes sold under the scheme, instead of 31 January.

Finally, the think-tank Centre for Policy Studies (CPS) has published a report which seeks to debunk a series of longstanding myths about the UK housing sector.

The Case for Housebuilding takes aim at a series of claims that the UK does not have a housing supply problem, and that increasing supply would do little to reduce house prices.

The report also claims that there is insufficient brownfield land to meet housing demand, and that building new homes is not as unpopular as often thought.