Housing Secretary gives developers six weeks to sign cladding contract

Housing Secretary Michael Gove has issued an ultimatum to housebuilders this week, giving them six weeks to sign cladding remediation contracts – or face a development ban.

The Department for Levelling Up, Housing and Communities issued contracts to developers which commits them to paying to repair unsafe buildings, warning that those who fail to sign will face “significant consequences”.

Under the contract, developers will commit an estimated £2bn for repairs to buildings they developed or refurbished over the past 30 years.

Today marks another significant step towards righting the wrongs of the past and protecting innocent leaseholders, who are trapped in their homes and facing unfair and crippling costs.

michael gove, secretary of state for levelling up, housing and communities

There will be nowhere to hide for those who fail to step up to their responsibilities – I will not hesitate to act and they will face significant consequences.

Barratt and Persimmon were the first housebuilders to say they will sign the contract, with Vistry following suit soon after.

But large developers Berkeley, Taylor Wimpey and Bellway are yet to commit to the pledge.

Meanwhile, the Government has said it will tackle nutrient pollution as part of its new Environmental Improvement Plan (EIP).

The EIP, which sets out a five-year programme to improve the environmental quality of the UK’s air, land and water, also includes a commitment to increase the supply of mitigation credits for nutrient neutrality to unlock planning permission for thousands of homes.

House prices dip in January, but demand expected to rise

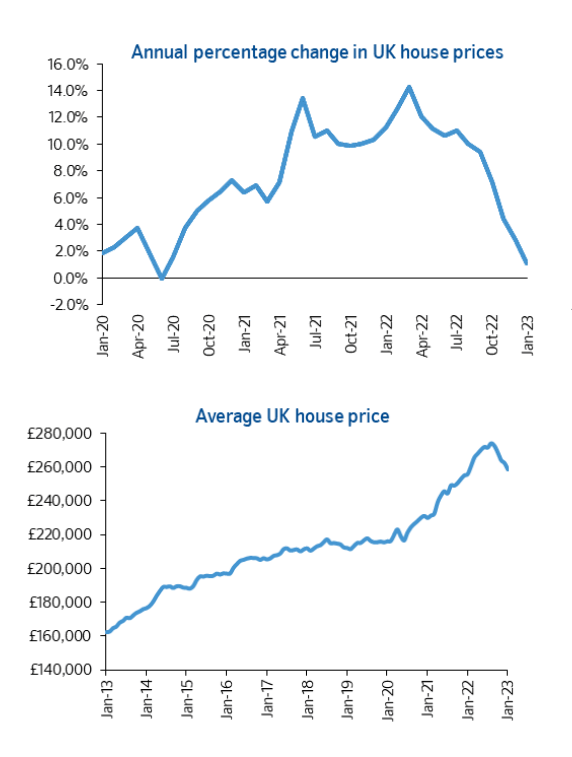

Nationwide published their house price index for January this week, revealing a slight fall of -0.6% in property value over the month.

Slowing to 1.1% over the year – down from 2.8% in December – the average property price is now calculated at £258,297 (Dec: £262,068).

Robert Gardner, Nationwide’s Chief Economist, acknowledged the fall and laid out the current poor affordability situation.

It will be hard for the market to regain much momentum in the near term as economic headwinds are set to remain strong, with real earnings likely to fall further and the labour market widely projected to weaken as the economy shrinks.

robert gardner, chief economist, nationwide

Saving for a deposit is proving a struggle for many, given the rising cost of living, especially those in the private rented sector where rents have been rising at their strongest pace on record.

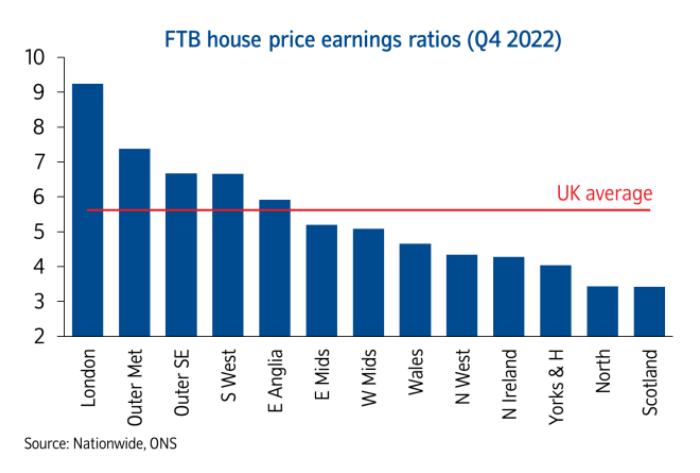

Scotland and the North region have the lowest house price to earnings ratios at 3.4, whereas in London the ratio is 9.2.

Zoopla’s house price index reported an annual rise in property values of 6.5% to December – the lowest rate of annual growth since May 2021.

And, whilst it is still too early to tell what will happen in 2023, the property website expects demand to pick up towards the end of the year as households wait and see what happens to mortgage rates.

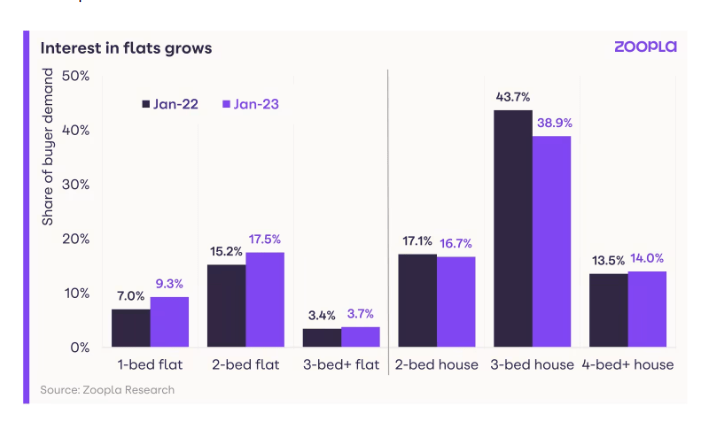

Interestingly, in a reverse of the trend seen during the pandemic, Zoopla have reported a shift in demand towards flats and away from houses, with 27% of new buyers looking for 1 and 2-bed flats, up from 22% a year ago.

In contrast, demand for 3-bed houses has fallen 5% to 39%, although they are still the most in-demand homes in the UK.

Construction output forecast to fall, but apprenticeships increase

The Construction Products Association (CPA) has forecast that industry output is expected to fall by -4.7% this year – a downward revision from the -3.9% forecast last Autumn.

Citing the impacts of a wider UK economic recession, rising interest rates and inflation, private new build housing is forecast to be one of the worst affected sectors.

Predicting a sharp decline in demand in Q1 of 2023, followed by a recovery in the Spring, the CPA state that private housing output in 2023 is forecast to fall by -11.0% as housebuilders focus on completing existing developments, rather than starting new sites.

It is worth keeping in mind the broader context that this is not 2008 and the decline is nowhere near the fall in output that occurred in the last recession.

noble francis, economics director, cpa

Looking back 15 years ago, construction output fell by 15.3% over two years during the global financial crisis.

Meanwhile, Turner & Townsend have predicted that tender prices will keep rising, despite the wider threat of economic recession.

In their UK Market Intelligence Report for Q4 2022, the construction cost consultant forecasts tender price inflation to reach 3.5% in 2023, falling to 2.5% in 2024.

Construction payroll company Hudson Contract have reported a 1% increase in self-employed labour rates in December, pushing average weekly pay over the £1,000 mark.

Whilst tender opportunities are slowing, the lack of labour supply has kept rates high, with subcontractors in equipment and operator hire enjoying the highest earnings last month.

Meanwhile, construction and engineering apprenticeships have experienced an increase in uptake for the first time in six years.

Research by power tool firm Protrade based on Government data has revealed that approximately 26,100 new apprenticeships started in the industry between August 2021 and July 2022; the first annual increase since 2016/17.

Ethnic minority representation grew to its highest point ever at 6.47%, whilst the proportion of women starting apprenticeships fell slightly to 7.35%.

The overall rise in uptake of construction apprenticeships is the first time the number has increased since the introduction of the Apprenticeship Levy.