Barratt, Redrow and Bellway brace for challenging year but remain optimistic

Three of the UK’s largest developers released trading statements this week, giving cautious but optimistic outlooks on market conditions.

Barratts went first, forecasting around 16,500 to 17,000 completions in its full year – 1,000 fewer homes than previously predicted.

And, although sales rates in January improved on December, at 0.49 homes per week, it was still down from 0.9 reported for the same period in 2022.

Turnover and profit also increased by 23.9% to £2.8bn and 15.9% to £502m respectively for the six months to 31 December 2022.

While we have seen some early signs of improvement in current trading during January, we will need to see continued momentum over the coming months before we can be confident that these challenging trading conditions are easing.

david thomas, chief executive, barratts

Volume housebuilder Bellway also reported an improved level of reservations since the New Year, and said it is on course to build around 11,000 homes this year – but only if visitor numbers and reservation rates are sustained through the Spring.

In a trading statement for the six months ending 31 January 2023, the developer reported a revenue of £1.8bn, up from £1.78bn last year.

However, their forward order book has dropped from 6,628 homes in 2022 to a forecast of 5,108 homes this year.

Since the start of the new calendar year, mortgage rates have fallen from their recent peak, and we have been encouraged by a seasonal increase in visitor levels and an improvement in reservations.

jason honeyman, chief executive, bellway

Redrow reported a slight fall in profit and turnover for the first half of the year and commented on “challenging” conditions, but noted some signs that the market is improving.

Reporting its results for the six months to 1 January 2023, the developer reported a turnover of £1.03bn (2022: £1.05bn), with pre-tax profit falling 2.4% from £203m to £198m.

However, the firm said that private reservation rates per site per week in the first few weeks of 2023 were 0.51, up from 0.38 in the first half of its financial year.

And Matthew Pratt, Group Chief Executive, levelled criticism at the Government over a “broken planning system”.

Planning permissions are taking a record amount of time…this means a huge missed opportunity for the country in lost school places, infrastructure, employment and social mobility.

matthew pratt, group chief executive, redrow

We continue to call on the Government to revisit its housing and planning strategy to help the country deliver growth and the homes it so badly needs to address the chronic housing shortage.

Government appoints sixth Housing Minister in a year

A Government reshuffle has resulted in Rachel Maclean being appointed as a new minister at the Department for Levelling Up, Housing and Communities (DLUHC), replacing Lucy Frazer.

Frazer’s promotion to Culture Secretary in Prime Minister Rishi Sunak’s cabinet means she served just 102 days in the role.

Maclean, a former parliamentary private secretary to Sunak, becomes the sixth Housing Minister in a year.

Meanwhile, the Levelling Up, Housing and Communities Committee has launched an inquiry into the Government’s consultation on changes to the National Planning Policy Framework (NPPF).

The group of MPs is set to example the NPPF changes, as well as National Development Management Policies and other planning reform proposals.

The NPPF consultation was published just before Christmas, and plans such as removing the need for local authorities to demonstrate a five-year housing supply have caused controversy within the industry.

In addition, a report from the London School of Economics (LSE) has highlighted several areas of concern with housing policies, with successive governments failing to create a “coherent” strategy for resolving the housing crisis.

The report, entitled Why is housing policy in such a mess?, calls for a more strategic approach, and criticises “inconsistent and incoherent policies”.

There is an enormous housing problem to solve, and successive governments, of all colours, have not got it right. It is complex, as this report shows.

ben everitt mp, chair, housing market and housing delivery all-party group

We are unravelling the different strands and the next stages are to develop policies that work in harmony.

House prices stable in January, but construction activity falling

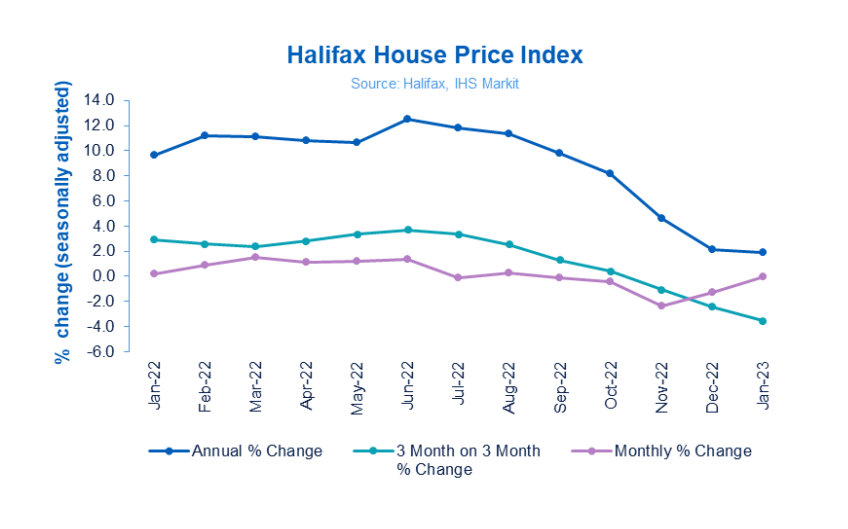

Mortgage lender Halifax have reported no monthly change in property values in January, with the average house price remaining stable at £281,684 (Dec: £281,713).

However, the annual rate of growth slowed in all nations and regions during January, falling to 1.9% in January from 2.1% in the previous month.

Wales saw the largest annual house price fall of all UK nations, dropping to 2.0% in January from 6.0% in December, having previously recorded very strong annual inflation.

For those looking to get on or up the housing ladder, confidence may improve beyond the near-term. Lower house prices and the potential for interest rates to peak below the level being anticipated last year should lead to an improvement in home buying affordability over time.

kim kinnaird, director, halifax mortgages

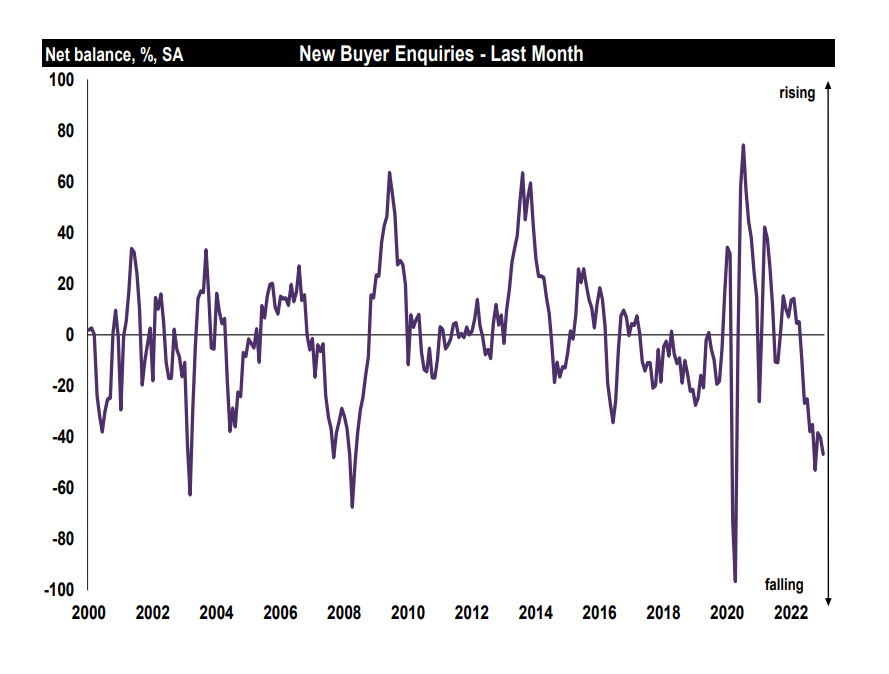

The Royal Institution of Chartered Surveyors (RICS) also revealed a “muted” housing market in its latest survey, recording the ninth successive month of respondents reporting falling demand.

New buyer demand, sales, fresh listings and prices are all on a downward trend, according to RICS’ latest UK Residential Market Survey, with near-term expectations suggesting that this will continue to be the norm whilst markets adjust to higher interest rates.

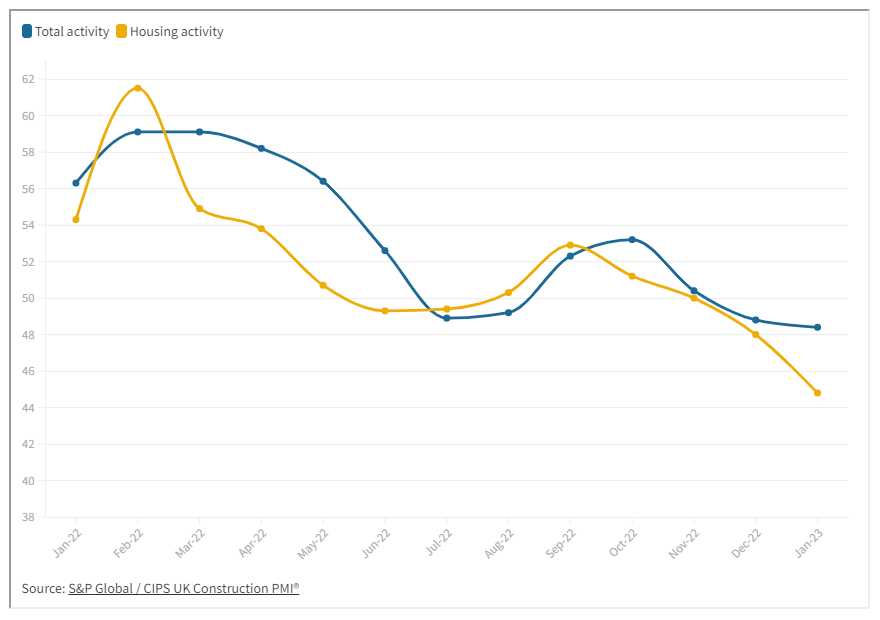

Meanwhile, the latest S&P Global / CIPS UK Construction Purchasing Managers Index (PMI) figures reveal that construction activity has fallen at its fastest rate since the first Covid lockdown.

Reporting an index score of 44.8 in January, down from 48 in December 2022, housebuilding represented the weakest performing sector in construction. Any score below 50 represents a decline in output.

Total construction activity fell from 48.8 to 48.4 in the month. A score of 28.9 was registered in May 2020.

The fall in housing activity was attributed to rising borrowing costs, unfavourable market conditions and greater caution from clients.

The index is supported by latest official figures from the Office for National Statistics, which reveal that monthly construction output in Great Britain saw zero growth in both November and December 2022.

Overall, 2022 was a solid year for the industry, with output increasing by 5.6% when compared with 2021, but private new housing fell by 2.3% in December.

Meanwhile, inflation and labour shortages have contributed to a slowdown in the construction of build-to-rent (BTR) homes in 2022.

Analysis published by the British Property Federation (BPF) shows that the total number of BTR homes in planning, under construction or completed increased by 14% in 2022, in a sector which has increased by an average of 28% per year since 2017.

Despite the economic headwinds, however, the pipeline of BTR units remains strong, with 113,379 units in planning – an increase of 14% on 2021.

In the long-term, we expect the sector to continue to expand as a vital component of overall housing delivery, but the Government must be careful not to stymie its progress.

Ian Fletcher, director of policy, british property federation

Material sales fall as output slows

The Construction Products Association’s latest State of Trade Survey for the last quarter of 2022 has found that heavy materials producers have reported a second quarter of falling sales, as project starts slow.

However, light side product producers have seen continued growth, with 27% of manufacturers reporting a rise in sales in the last quarter of 2022.

The Builders Merchants Federation (BMF) is also forecasting a challenging year, expecting price inflation to continue through the first half of 2023 before gradually slowing.

As a result, the forecast from the BMF predicts negative growth of -1.6% in 2023, when compared to 2022.