Official figures show slowdown in annual house price rises

Data from the Office for National Statistics (ONS) has revealed – as expected – a fall in annual house price growth in December.

The average UK house price reached £294,000 at the end of 2022 – down from £296,000 in November – representing a 9.8% increase over the previous 12 months (Nov: 10.6%).

Wales and England both saw the largest annual increase of all UK nations, at 10.3%. Next came Northern Ireland (10.2%), followed by Scotland at 5.7%.

Scotland’s annual house price inflation has been slowing since April 2022, when it reached 13.9%.

The East Midlands topped the charts with regards to regional annual house price change, reaching 12.3%, followed by the North West at 12.2%.

London continues to experience the slowest rate of annual growth, at 6.7% in the 12 months to December, albeit house prices in the capital remain the most expensive of all regions, with an average property price of £543,000.

Key industry indicators reflect subdued start to 2023

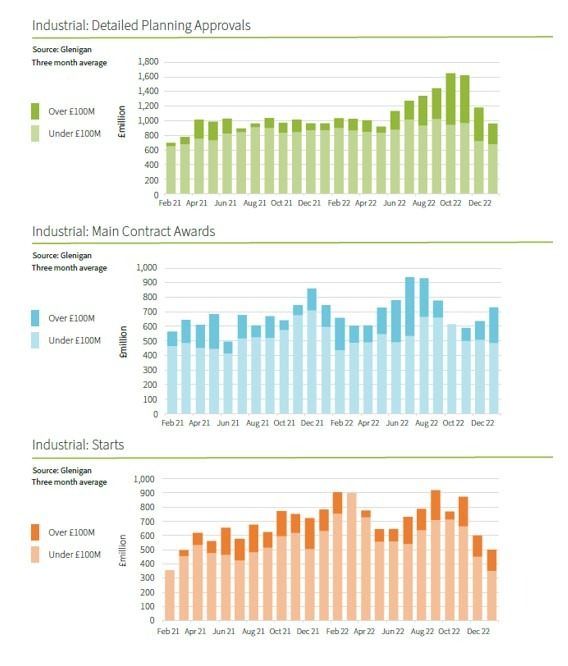

Construction data analyst Glenigan has reported a fall in construction starts and detailed planning approvals in the three months to January.

Reporting in February’s issue of the Construction Review, the firm found that project starts had slumped by 47% over the period when compared to the previous three months, and down by a third over the year.

Detailed planning approvals were also 17% down on the previous three months, albeit largely unchanged when compared to the previous year.

Residential starts were also down by 26% in the three months from November to January, when compared to the previous three months, and 38% lower than a year before.

Starts on site are softening and, as global and national disruption continues, we’ll likely see contractors adopting a cautious and retrenched approach, pushing back start dates until the economic landscape looks less hostile.

allan wilen, economic director, glenigan

Meanwhile, analysis of real versus nominal price indices by Barbour ABI has revealed that rising costs added £23bn to construction output last year, surpassing £200bn for the first time and representing a 15% increase from 2021 output values.

A review of the data also found that this value would have been closer to £181bn if prices had remained at pre-pandemic levels.

The construction information firm is now forecasting that prices will soften in the second half of 2023, although some energy-intensive materials, such as insulation, could experience further price rises.

Construction product inflation and shortages are expected to ease over the second half of 2023, but will not return to the stability in the 2010s.

tom hall, chief economist, barbour abi

Contractors are working on razor-thin margins. All in all, 2023 is likely to be another bumpy year.

Gleeson Homes restructures as market headwinds continue

Low-cost housebuilder Gleeson Homes has announced that it is reorganising its operating structure to help prepare for market recovery.

Reporting on its half year to 31 December 2022, the developer said that it expected demand for new homes to “slowly recover” throughout the year, but that it was reviewing its operating structure “to ensure that it is strongly positioned to continue its growth trajectory in a sustainable manner”.

The housebuilder is now expecting to deliver between 1,650 and 1,850 homes for its full year.