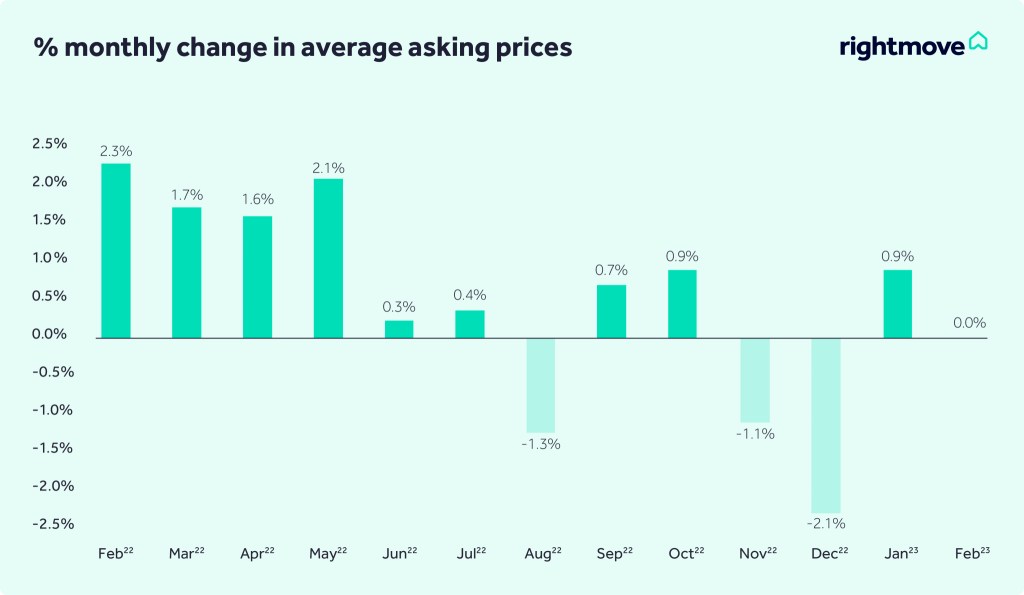

Flat month for asking prices, but buyer demand is up

Rightmove has published its house price index for February, revealing next to no change in property values, which increased by just £14 in the month.

However, the property website also found that the number of people contacting agents has increased by 11% when compared to the pre-pandemic 2019 market.

And, in further positive signs, the average rate for a 15% deposit five-year fixed mortgage is now 4.82%, compared to 5.90% in October 2022.

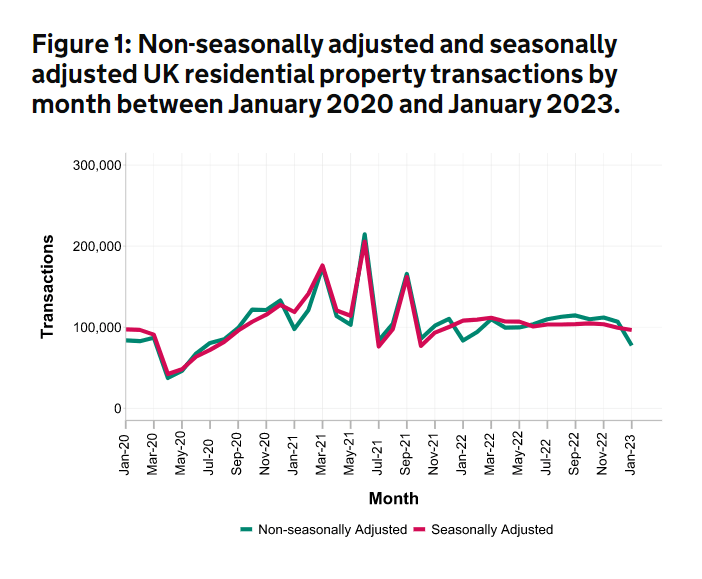

Meanwhile, the after-effects of 2022’s last-quarter market slowdown have been reflected in HMRC’s latest residential transaction statistics, which revealed that UK house sales in January fell to their lowest level for a decade, excluding the pandemic.

Figures produced by HMRC found that 77,390 sales were completed in the month; the lowest level seen since 2013 and a 27% fall when compared to December 2022.

Seasonally adjusted, this figure improves to 3%.

Lloyds Bank have revised their forecast for house price performance in 2023, predicting a worst case -7% fall in property values; a slight improvement from their -7.9% forecast in October.

However, Lloyds Chief Executive Charlie Nunn said that most of its customers would still have “very positive equity”, and that the best case scenario would see a relatively small -2.8% fall in house prices this year.

Government responds to consultation on biodiversity net gain

Sites between one and nine homes in an area of less than one hectare will be exempt from biodiversity net gain requirements until April 2024, as the Government responds to its consultation on the proposals.

Under the Government’s plans within the Environment Act, development sites must achieve biodiversity net gain of at least 10% from November 2023, but this has been extended by five months for small sites.

Construction material demand slows, as stocks improve

The availability of construction materials continues to improve, with most brick types now on just an eight-week lead-in.

With demand slowing in recent months, the latest Construction Product Availability Statement from the Construction Leadership Council (CLC) also reports an improvement in the availability of gas boilers, which has increased by over 20%.

The report also claims that price inflation has largely stabilised, with some suppliers deferring price increases in the wake of slowing demand and easing energy costs.

However, the impact on manufacturers often takes a few months to feed through to product prices, and the CLC warn that price volatility experienced last year will likely continue into the Spring.

The easing demand as a result of the disastrous mini-budget was also felt by builders’ merchants, who have reported a reduction in sales and volumes in the last quarter of 2022.

The latest index from the Builders Merchants Federation (BMF) has revealed a 13.9% fall in takings in Q4 2022 when compared to the previous three months.

Volume sales also fell by 18.3% over the same period.

With forecasts for 2023 predicting further slowdown in the first half of the year, general product availability should have an opportunity to recover before the market begins to recover in the second half.

John newcomb, ceo, builders merchants federation

New report reveals new-build homes save more than £3k per year on energy bills

Research by the Home Builders Federation (HBF) has revealed that homeowners living in new-build properties could save more than £3,100 per year on energy bills.

In Watt a Save, the HBF analysed Government Energy Performance Certificate (EPC) data to find that 85% of new-build homes had an A or B rating.

Fewer than 4% of existing homes reach these levels of energy efficiency; and the HBF is calling on mortgage lenders to introduce ‘green mortgages’ to recognise the benefits of a new-build property.

Energy efficient new homes are saving owners thousands of pounds a year in running costs. In the face of mounting pressures on households across the country, the energy performance of a home is an increasing motivator for consumers considering a new home purchase.

neil jefferson, managing director, home builders federation

Now we need lenders to take greater consideration of these numbers to support more people to get onto or move up the property ladder.