Persimmon and Taylor Wimpey publish gloomy statements

Two of the UK’s largest developers have reported pessimistic forecasts for the year ahead, amidst ongoing market uncertainty.

Firstly, Persimmon announced that their legal completions could drop to between 8,000 and 9,000 homes as tough conditions drive down sales rates.

Reporting a 2.1% rise in completions to the end of December 2022 when compared to 2021, the volume developer posted private sales rates of 0.52 per outlet per week during the first eight weeks of 2023, compared to 0.96 during the same period in 2022.

Revenue in 2022 rose to £3.82bn (2021: £3.61bn) with pre-tax profit falling 24% to £731m as the firm increased its provision for building safety works.

Dean Finch, Group Chief Executive, laid out the company’s response to market headwinds.

We have carefully managed our pricing, recognising the improved value and energy efficiency of our product in these difficult times and sales prices have proved resilient.

dean finch, group chief executive, persimmon

We responded quickly to stimulate sales, enhance cost controls and preserve cash, promptly slowing new land investment in the fourth quarter of last year.

Meanwhile, Taylor Wimpey also warned that housing completions would likely fall this year as it amended build programmes to reflect poor sales rates.

Reporting an improvement in pre-tax profit of 22% to reach £828m in 2022, the developer forecast that it would achieve between 9,000 and 10,500 completions in 2023, reflecting an anticipated sales rate of 0.5 to 0.7 per outlet per week.

Taylor Wimpey also announced the establishment of a new timber frame facility in Peterborough, as well as the closure of their regional office in Oxfordshire.

In a year marked by two distinct halves, we acted quickly and decisively to address rapidly changing market conditions in the second half of the year and continued to focus on operational excellence and efficiency.

jennie daly, chief executive, taylor wimpey

While the weaker economic backdrop continues to impact the near-term outlook, customer interest in our homes remains good and, whilst it is still early in the year, trading has shown some signs of improvement compared to Q4 2022.

And the outlook for the UK’s housebuilding industry looks set to worsen, with the Home Builders Federation (HBF) this week warning that government policies and higher mortgage rates could result in the number of new homes completed in each year slumping to its lowest level since the Second World War.

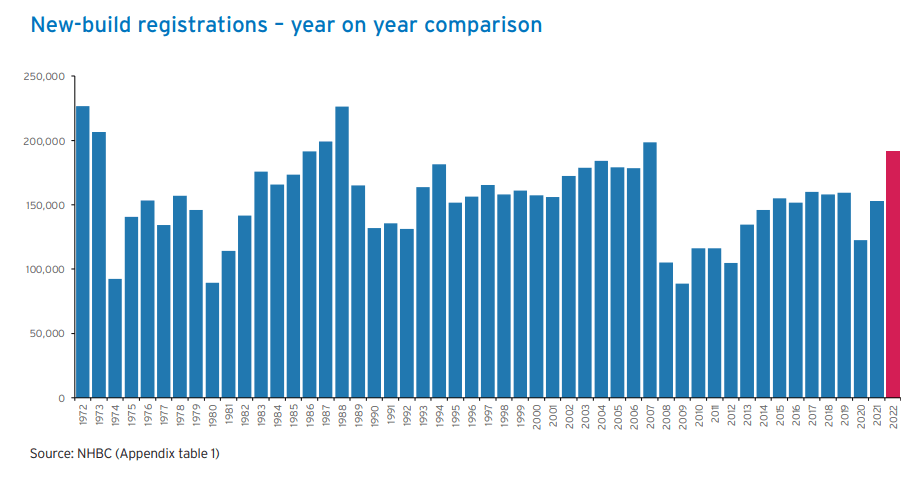

A new report by the trade body, Planning for Economic Failure, warns that reforms of the planning system could see supply fall from 233,000 homes last year to below 120,000 homes per annum in the coming years.

The HBF highlighted the social and economic implications of this drop, including more than £20m less economic activity being generated and £3bn less investment in affordable housing.

The Government’s capitulation to the NIMBY lobby and its mishandling of water and drainage legislation could see fewer homes built than ever before.

stewart baseley, executive chairman, home builders federation

The social and economic implications are stark and threaten to widen the ever growing intergenerational divide while costing hundreds of thousands of jobs.

Meanwhile, the Financial Times warned that the UK housing market faces a “make-or-break” spring, as it heads into peak property selling season against the backdrop of increasing living costs and higher mortgage rates.

However, there is some good news: the National House Building Council (NHBC) has reported that annual registrations in 2022 reached the highest levels since 2007, reaching 191,801.

The final quarter of the year saw a 21% fall in new home registrations when compared to the previous quarter, as the impact of September’s mini-budget took hold.

The decline in housebuilding during in the last few weeks of 2022 has also been highlighted by information firm Glenigan, who report that residential construction project starts in the three months to February 2023 was down by 27% on the previous three months, and 43% on the prior year.

Glenigan’s Economic Director, Allan Wilen, said: “Consumers and investors are spending thriftily with many holding back until a degree of certainty returns.

“This is having a knock-on effect for the construction sector, prompting many contractors to follow suit and ride out the storm before committing shovel to soil.”

House prices decline in February when compared to boom of 2022

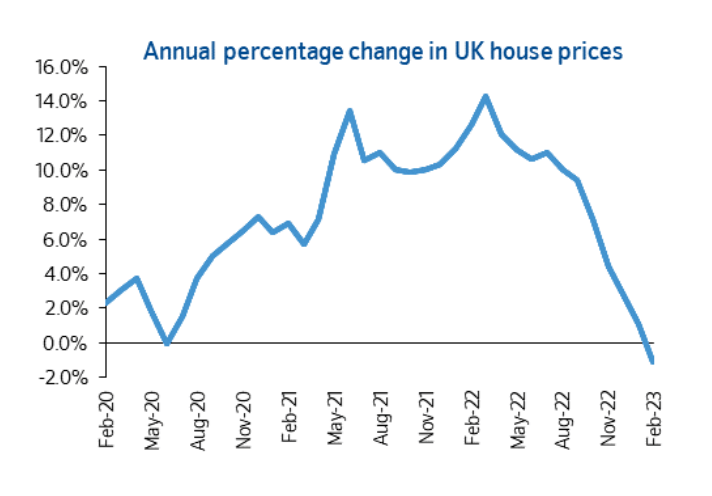

The latest house price index from Nationwide has revealed a decline in annual house prices in February for the first time since June 2020.

Falling by -0.5% in the month and -1.1% across the year, the mortgage lender values the average property at £257,406 (Jan: £258,297).

Robert Gardner, Nationwide’s Chief Economist, warned that the coming weeks remain a challenge.

It will be hard for the market to regain much momentum in the near term since economic headwinds look set to remain relatively strong, with the labour market widely expected to weaken as the economy shrinks in the quarters ahead, while mortgage rates remain well above the lows prevailing in 2021.

robert gardner, chief economist, nationwide

However Zoopla – whilst also reporting a fall in annual house price inflation – has provided a more optimistic view of the current market struggles.

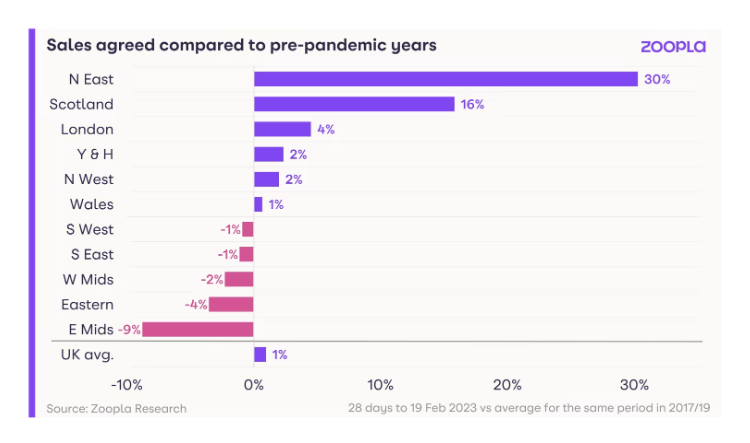

Noting annual house prices slowing to 5.3%, and reporting that sellers are currently accepting an average discount of 4.5% to their asking price, the property website urges readers to compare to pre-pandemic levels and overlook the boom of the last two years.

Agreed sales across the UK have improved by 1% in the 28 days to 19 February 2023 when compared to the same period in 2017/19.

Zoopla also forecast “reasonable levels of turnover” in 2023, but are expecting “modest” annual price reductions of up to 2 or 3% by the summer.

In other news…

The Competition and Markets Authority has confirmed that they are to launch a market study into the housebuilding industry, following calls last year by Housing Secretary Michael Gove.

The study comes following concerns that builders are not delivering the homes people need at sufficient scale or speed.

Comments are invited by 20 March on the issues raised by the study’s Statement of Scope, with the report set to be published in February 2024.

The Home Builders Federation (HBF) has calculated that home buyers can expect to spend over £70k in upgrading an average property to meet new build standards.

In a report entitled Get on with Living, the HBF base their figures on a three-bed semi-detached house, reaching a total bill of £73,272.

Meanwhile, research by Midland developer Spitfire Homes has found that only 19% of customers would be willing to pay more to have an air source heat pump in their new home.

The survey of more than 2,000 respondents found that heat pumps were the lowest priority choice, falling behind solar panels, smart heating systems, underfloor heating and car charging points.

Earlier this year, Redrow announced that it would be installing air source heat pumps in all detached homes from January.