House prices increase in month but remain flat annually

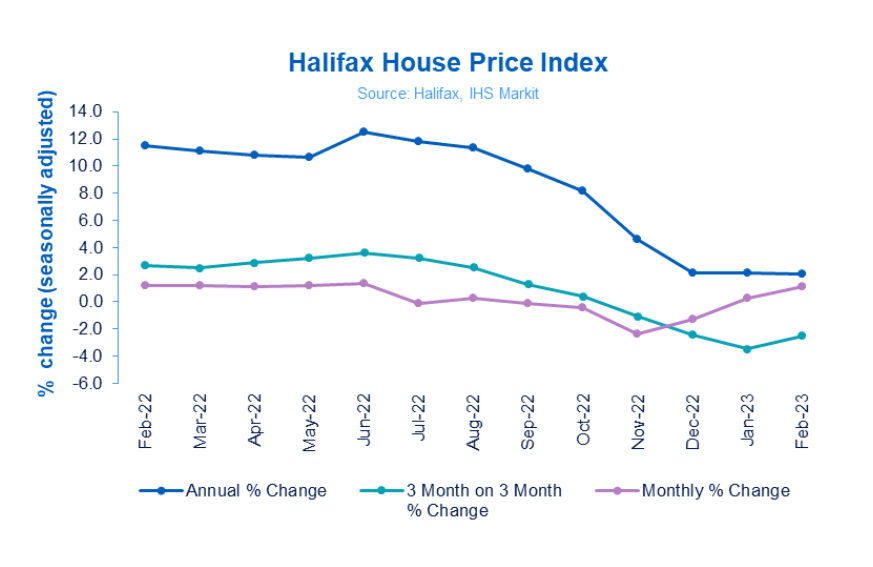

Halifax have published their house price index for February, reporting a 1.1% increase in property values in the month.

The typical UK property now costs £285,476 (Jan: £282,360), with the annual rate of house price growth remaining at 2.1% for the third consecutive month.

The rate of annual growth slowed in all nations and regions in February, with the North East experiencing the most significant fall at 1.1%, versus 3.6% in January.

Recent reductions in mortgage rates, improving

kim kinnaird, director, halifax mortgages

consumer confidence, and a continuing resilience in the labour market are arguably helping to stabilise prices

following the falls seen in November and December.

Still, with the cost of a home down on a quarterly basis,

the underlying activity continues to indicate a general downward trend.

However, respondents to the latest Royal Institution of Chartered Surveyors (RICS) UK Residential Market Survey have painted a gloomier picture, with more than two-thirds of the most expensive properties selling for below their asking price.

The report reveals a house price balance of -48, from -46 in January, measuring the difference between the percentage of surveyors seeing rises and falls in house prices.

However, the outlook is more optimistic, with a net balance of -8% (Jan: -20%).

Ibstock and Forterra post rising profits following ‘dynamic pricing’

Brick manufacturers are enjoying soaring revenues and bumper profits, after increasing the cost of their products to compensate for energy price rises.

Pre-tax profits at Ibstock increased by 65% last year, rising to £105m from a turnover of £513m.

Margins rose to 27.2% (2021: 25.2%) despite sales volumes remaining flat, with ‘dynamic pricing’ – putting its own prices up to offset supply chain and inflation challenges – driving the increase.

Joe Hudson, CEO of Ibstock, recognised a “subdued” start to 2023, but remained positive that this would improve during the year.

Activity in the early weeks of 2023 has continued to reflect the more subdued demand environment experienced towards the end of last year, although we anticipate this to improve as the year progresses.

Joe Hudson, Chief Executive Officer, Ibstock

With the strong strategic platform we now have in place, I am confident both in our ability to respond effectively to conditions this year, and to achieve significant growth over the medium-term.

Meanwhile, fellow manufacturer Forterra increased revenues by 23% to £456m against largely unchanged volume sales.

Pre-tax profit at the firm also increased by 28% to £72.9m. Forterra report total brick consumption in 2022 of 2.5bn bricks, of which 570m were imported.

CEO Stephen Harrison also commented on the outlook for 2023.

The short-term outlook for the UK housing market remains uncertain. We saw signs of softening demand towards the

stephen harrison, chief executive officer, forterra

end of 2022, and this continued into 2023, partly driven by customer inventory reduction.

Whilst we expect demand for our products to fall in 2023 relative to 2022, we are encouraged by falling mortgage rates and recent reports of improving reservation rates.

Rate of decline in housebuilding activity eases in February

The latest CIPS / S&P Global Purchasing Managers Index has revealed an overall increase in construction output during February, rising to 54.6 from 46.4 in January, and above the neutral 50.0 threshold for the first time in three months.

However, residential building work has fallen for the third consecutive month, due to elevated interest rates leading to a slowdown in building activity.

The recorded figure for housebuilding of 47.4 in February represents a softening in decline when compared to the 44.8 set in January.

Meanwhile, figures from the Office for National Statistics (ONS) reveal a fall in construction volume output in January.

The latest construction industry bulletin has January recording the lowest monthly value since February 2022, at £14,841m.

The decline was attributed to heavy rain in the first two weeks of the month, as well as to ongoing economic constraints. Private new housing decreased by 3.0% in the month.

In other news…

Barratt have announced that they are opening a new timber frame factory in the East Midlands, as it prepares to meet 2025 Future Homes Standards.

The £45m facility will be constructed in Derby, and support the developer in reaching its target of building at least 30% of its homes using modern methods of construction by 2030.

Berkeley have reported a 25% fall in sales since the end of September when compared to the first five months of its financial year from May 2022.

The developer added that it was taking a “cautious approach” to releasing new phases of schemes, with the focus on cost control and maintaining operating margins.

Developer Bellway has been ordered to pay £100k to environmental charities after importing contaminated soil on one of its sites.

The developer will pay £50k to Northumberland Wildlife Trust, £30k to Wear Rivers Trust and £20k to Tyne Rivers Trust.