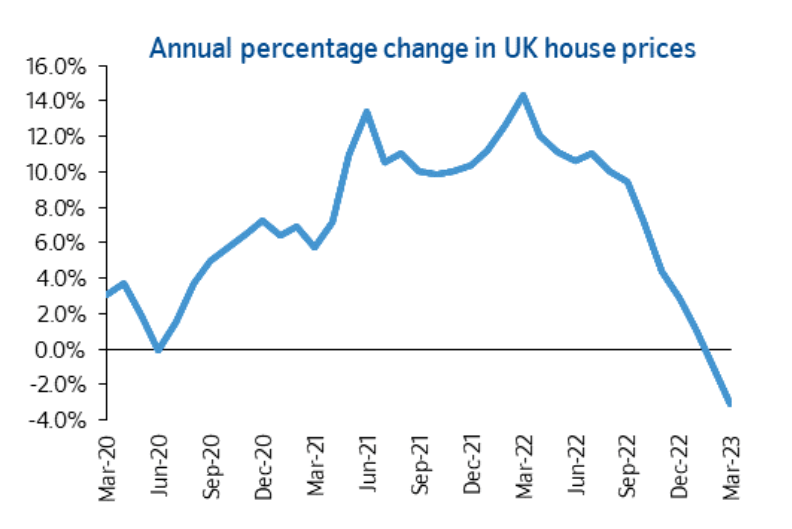

Nationwide report shows year-on-year prices down by -3.1%

Mortgage lender Nationwide has published its house price index for March, revealing the largest slowdown in annual house prices since July 2009.

March also experienced a seventh consecutive monthly price fall, experiencing a decrease of -0.8%, with the average property now valued at £257,122.

Robert Gardner, Chief Economist at Nationwide, described market activity since the mini-Budget as “subdued”, and suggested that further short-term results will reveal similar figures.

It will be hard for the market to regain much momentum in the near term since consumer confidence remains weak and household budgets remain under pressure from high inflation.

Robert Gardner, Chief Economist, Nationwide

Housing affordability also remains stretched, where mortgage rates remain well above the lows prevailing at this point last year.

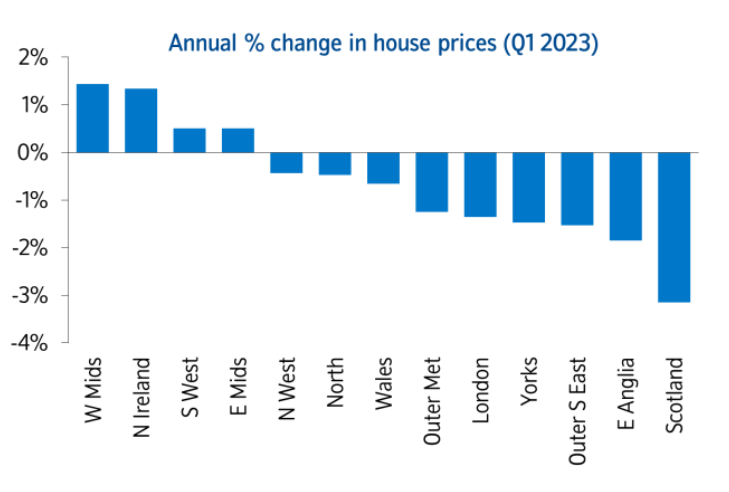

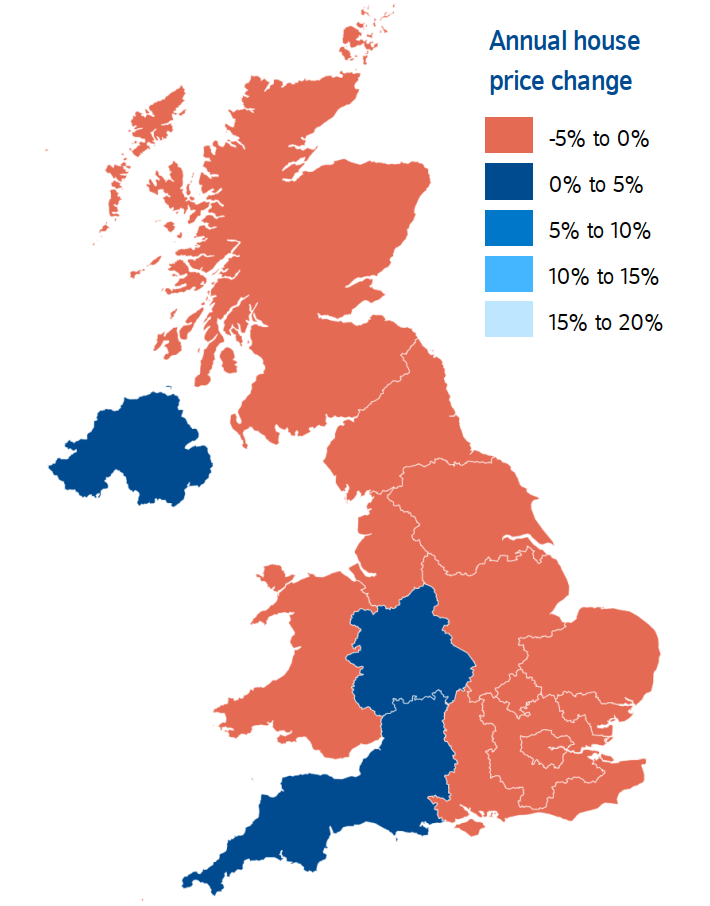

The report from Nationwide also found that nine of the thirteen UK regions recorded annual house price declines in Q1 2023.

The figures follow index reports from both Rightmove and Halifax, who reported month-on-month price rises.

Gove confirms sanctions on developers

Housing Secretary Michael Gove has confirmed plans to impose planning and building control restrictions on housebuilders who have not signed contracts to rectify fire safety defects on their properties.

The government is establishing a Responsible Actors Scheme in Spring 2023, and those who do not join and comply with the demands of the scheme under the Building Safety Act 2022 will find themselves “prohibited from carrying out major development and gaining building control sign-off”.

Meanwhile, Gove has written to cladding firm Kingspan, inviting the Chairman for talks about paying for remediation works where their products were installed.

The letter states: “I was appalled by the evidence heard by the [Grenfell Tower] enquiry about the reckless and deceptive behaviours within your company,” and suggests that remediation could be funded by Kingspan’s “record trading profit” of £382.8m.

Gove later sent another letter, this time to US products firm Arconic, who supplied aluminium composite material cladding panel for the Grenfell refurbishment.

Stating that the firm had “not taken any responsibility – moral or financial – for their role in the Grenfell tragedy”, Gove invited the Chief Executive of Arconic for talks, and asked for a response by 12 April.

Cost inflation eases as some material costs fall

The BCIS Private Housing Construction Price Index – which measures the prices housebuilders pay for constructing units – looks to have peaked in Q2 2022, reaching 15.3% over the preceding twelve months.

Whilst all respondents to the latest survey cited increased costs, many said that they expected housebuilding costs to rise by an average of 1.4% over the next quarter.

Nearly half of housebuilders who responded reported that they were postponing construction or reducing build-out rates, with a third stating that they have reduced selling prices.

However, there are signs that cost inflation is stabilising, with brick manufacturer Michelmersh stating that they are planning to avoid further price rises in 2023.

Joint Chief Executive Frank Hanna has stated that the company would “stabilise our pricing environment” and focus on long-term relationships.

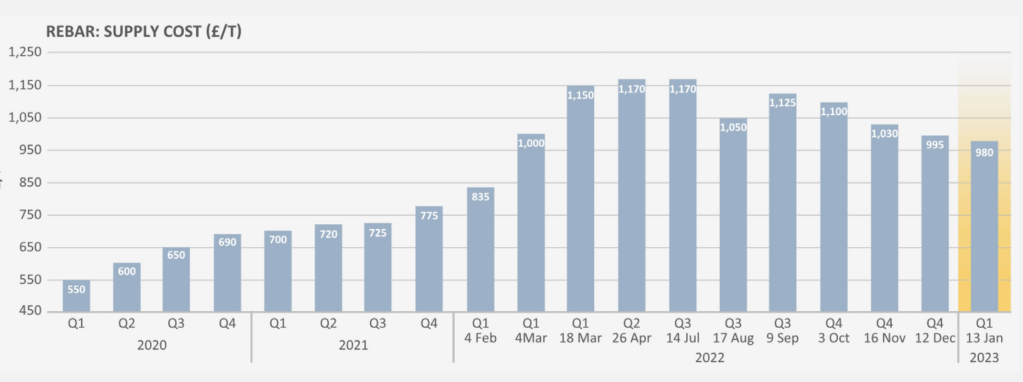

Meanwhile, cost consultant Gardiner & Theobald (G&T) has reported that several key materials have have fallen in price since the summer of 2022, including structural steel and rebar.

The cost of structural steel has fallen to around £1,000 per tonne in January, down from Spring 2022’s peak of £1,450.

Similarly, rebar is down from £1,170 to £980 per tonne over the same period.

However, G&T have warned that concrete and cement prices may continue to rise, with a localised supply chain meaning that suppliers have greater pricing power.

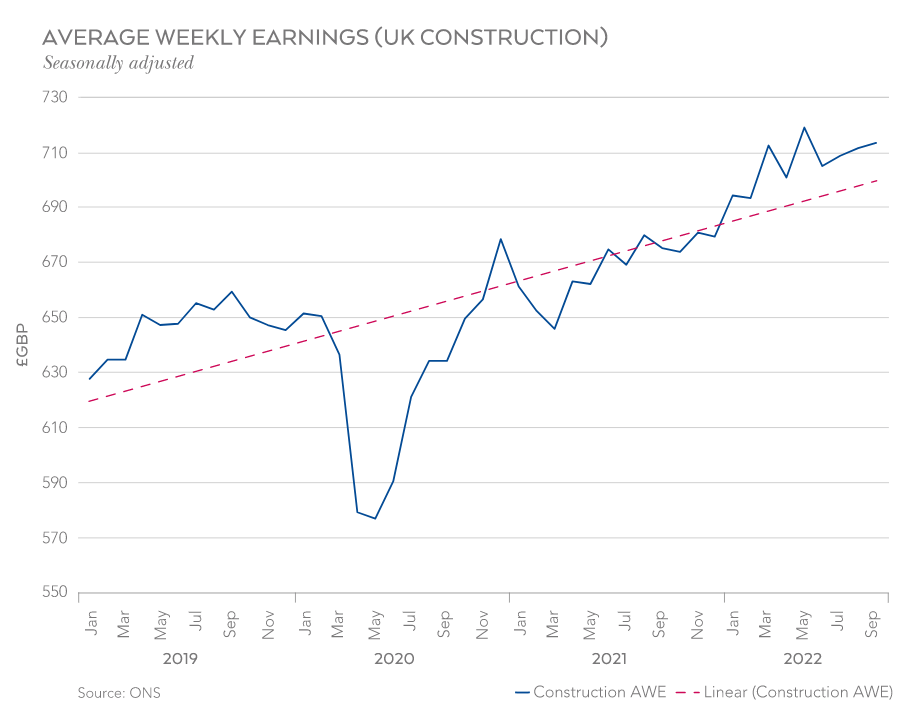

In addition, the report predicted that rising labour rates will drive tender price inflation in 2023, as supply issues with skilled labour and cost-of-living pressures pushed average weekly earnings up by 6.1% year-on-year in October 2022.

Echoing this, a report from consultancy firm Turner & Townsend (T&T) has found that the total number of people working in construction has fallen by 10.5% since Q1 2019.

The report also revealed that the number of 16 to 24-year-olds enrolling on construction trainee schemes is now barely a quarter of its 2007 level.

However, the construction industry was applauded for boosting productivity despite a dwindling labour force, adopting modern methods of construction and other technologies to increase output.

Repositioning construction work as a chance to shape the infrastructure on which modern life runs, while learning highly-prized digital, engineering and robotics skills is now possible.

turner & townsend

That’s why the industry must leverage and consolidate the advances that have delivered better productivity today to attract the workers of tomorrow.

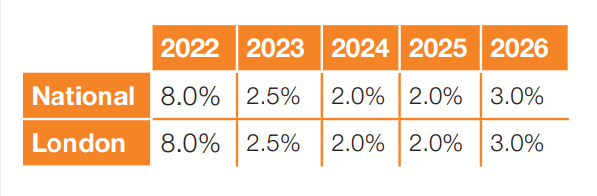

Finally, international consultancy firm Mace has predicted a “steadying of the construction sector”, warning that growth is likely to slow this year, and forecasting a 2.5% tender price inflation rate for the year.

In its Q1 Market View report, the firm further predict that tender price inflation will slip to 2% in 2024 and 2025.

Huge majority of SMEs unhappy with government housing policy

A new report published by the Home Builders Federation (HBF) in partnership with Travis Perkins and Close Brothers has found that 92% of small and medium-sized businesses are unhappy with the government’s approach on housing.

The SME State of Play Report also reveals that 93% of SME developers believe that securing and processing planning permission is a major barrier to growth.

Other challenges include Local Authority staffing shortages, availability of land and rising material costs.

The results of the survey have reinforced what we already knew in terms of the challenges we have faced over the last 12 months.

Kieran Griffin, Managing Director, Travis Perkins

There is not a construction business in the country which hasn’t faced significant challenges in terms of increased costs and supply chain issues.

Bellway expects build margins to fall

Housebuilder Bellway has reported a -0.6% fall in pre-tax profit for the six months to 31 January, and expects to build 11,000 homes in the full financial year to July – a slight reduction on 2022.

Citing a lower level of completions combined with build cost inflation, the developer predicts “a further modest reduction in the underlying operating margin” for the rest of the financial year.

Revenue was up by 1.6% when compared to the same period in 2022, reaching £1,809m. Pre-tax profit reached £305.9m (2022: £307.6m).