More homes “desperately” needed, says Housing Secretary

Michael Gove, Secretary of State for Levelling Up, Housing and Communities, has declared the UK’s housing model as “broken” in the foreword to a collection of essays.

The comments appeared in Home Advantage, published by the Conservative think tank Bright Blue and housing charity Shelter.

Gove stated “that change is necessary is undeniable”, and reiterated that “we are determined to build the new homes our country so urgently needs.”

If one clear measure of success is having a home to call your own, we desperately need more homes to bring ownership within reach of many more people.

Michael Gove MP

That the current housing model – from supply to standards and the mortgage market – is broken, we can all agree.

Lisa Nandy, Labour MP for Wigan and Shadow Housing Secretary, said: “It takes some brass neck for ministers that have been in power for 13 years to complain about our ‘broken’ housing model.

“People would be entitled to ask: who broke it?”

Housebuilding activity falls as applications drop to record low

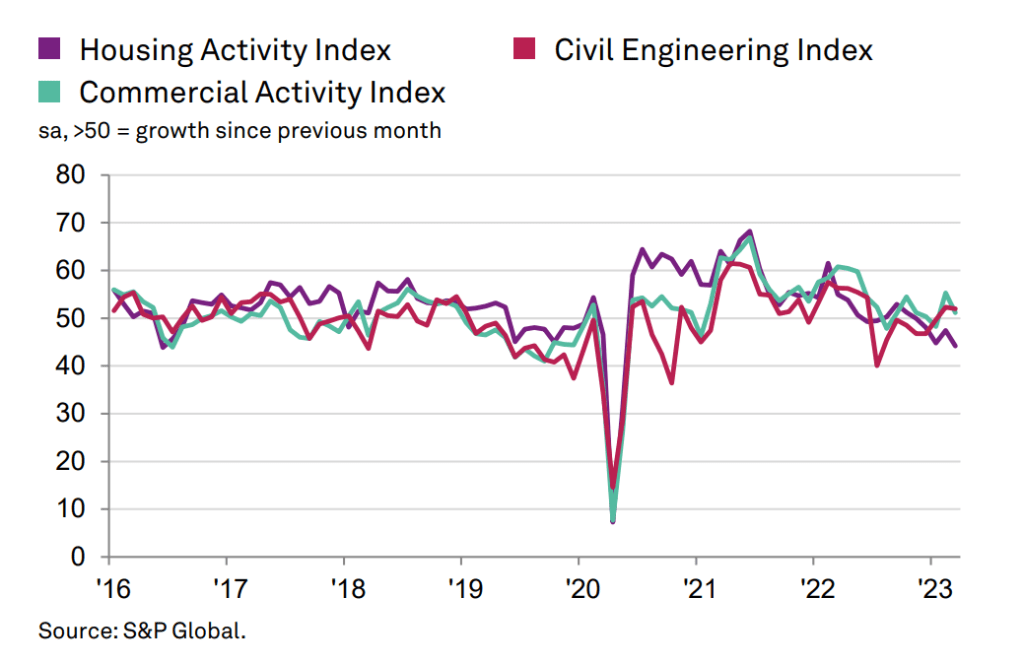

The latest S&P Global / CIPS UK Purchasing Managers’ Index has revealed that activity in the housebuilding sector fell at the fastest rate since the height of lockdown in March.

Whilst overall construction output remained over 50.0, which indicates an increase in output, housebuilding was the weakest performing segment for the fourth month in a row, and the fastest rate of decline since May 2020.

Survey respondents cited fewer tender opportunities due to rising borrowing costs, and therefore future housing projects.

Meanwhile, planning applications in England have fallen to their lowest level in at least 16 years, according to figures published by the Department for Levelling Up, Housing and Communities (DLUHC).

The data shows that local authorities received 409,459 planning applications in 2022, down nearly 14% on the previous year and their lowest level since before 2006.

The number of planning applications being submitted has been falling steadily since early 2021.

Data provider Glenigan has also published gloomy news this week, reporting that the overall value of small housing starts in the quarter to March were 39% lower than the previous quarter, and 51% lower than the same period last year.

Poor construction performance in the three months to March is disappointing but unsurprising, with a continued slowdown in project-starts reflecting the UK’s stagnant economic situation.

Allan Willen, Economic Director, Glenigan

Despite the Chancellor’s confirmation that we are not entering a recession in last month’s Budget, the UK economic outlook remains weak. Investor and consumer confidence is at a low ebb which has, inevitably, stalled private sector activity.

The fall in small housing projects, valued at £100m or less, comes as cost inflation remains the “number one issue” for construction companies, according to the Construction Leadership Council (CLC).

In their latest Construction Product Availability Statement, the CLC remarked that, “while prices are not rising as quickly as they have been, they are still substantially higher than 18 months ago and profit margins are being squeezed.”

However, the CLC’s statement did add that “consumer confidence is holding”, and noted that there is good availability for the vast majority of building products, with the exception of plasterboard, which is on allocation for the short-term.

But, whilst issues with brick and block availability seems to have been resolved, the falling price of wholesale gas is unlikely to be reflected in material costs for some time, as manufacturers hedged their gas prices last Autumn.

Zoopla states that the housing market “defies expectations”

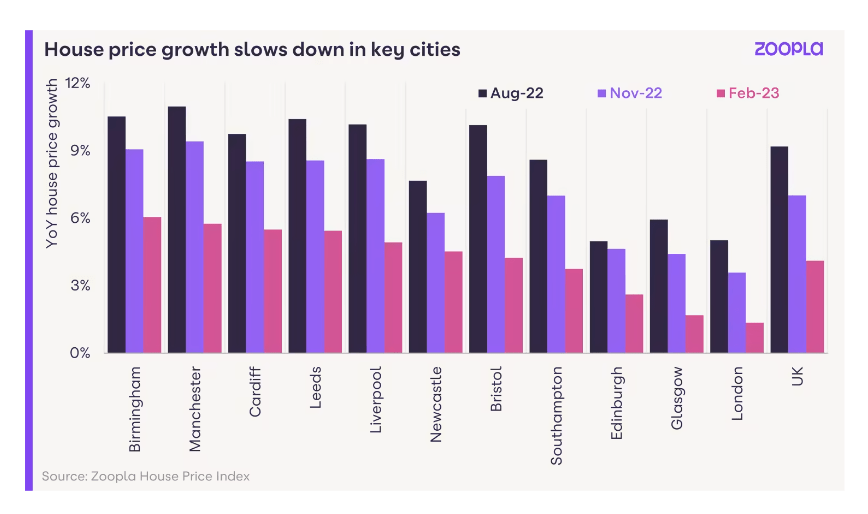

Online estate agent Zoopla has reported stronger than expected sales in its house price index for March, and expects 500,000 homes to be sold in the first half of 2023.

The firm has also reported a slowdown in annual house price growth to 4.1% from 9% in March 2022, with property values -1% lower than in October 2022.

Reporting that “the housing market is in much better shape than many predicted at the end of 2022”, Zoopla also recognised that the market is going through a “soft re-pricing process” but that buyers and sellers are agreeing deals which are supporting sales activity.

Government establishes older people’s housing taskforce

The government has unveiled a taskforce to help improve housing options for older people.

Headed by Professor Julienne Meyer, a leading expert in care for older people, the team will work across housing, health and care sectors to drive an increase in the volume and range of housing options, and make recommendations.

Making sure older people can access the right homes that meet their needs later in life is a government priority.

Rachel Maclean, Housing Minister

And by unlocking more housing for older people, we can also have a hugely beneficial impact on their health and wellbeing.

Meanwhile, Galliard Homes and Emerson Group are the latest firms to sign up to the government’s cladding remediation contract.

Four developers are yet to sign the contract: Abbey Developments, Avant, Dandara and Rydon Homes.

The government could also mandate new minimum water efficiency standards for new homes, in an effort to deliver “clean and plentiful water”.

The Department for Environment, Food and Rural Affairs (DEFRA) has launched its Plan for Water, which could limit water usage in England’s new homes to 105 litres per person per day, dropping to 100 litres in areas of “serious water stress”.

Current Building Regulations state a water usage limit of 125 litres per person per day.

And finally…

It can be easy to become downhearted, with so much negativity surrounding the housing industry.

Talk of economic downturns, falling sales rates and reduced housing starts can prevent those who work in the industry from remembering the benefits and rewards of a career in construction.

Housing View creator Ben Wakeling has written a piece for Housebuilder magazine, setting out the reasons why construction is often one of the most fulfilling career choices there is.