Home Builders Federation warns that figures will “plunge further”

The latest Housing Pipeline Report from the Home Builders Federation (HBF) and Glenigan has found that the number of planning approvals fell to a record low in Q4 of 2022.

Citing “the Government’s anti-development policies” as the key driving factor, the report also revealed that the number of projects in 2022 dropped below 12,500; well below the 21,000 permissioned in 2017.

In addition, a total of 55 local authorities have withdrawn housing plans following the government’s “capitulation to NIMBYs” in the proposed revisions to the National Planning Policy Framework.

This short-term thinking might be clever politics but its social and economic consequences will be felt for decades.

Stewart Baseley, Executive Chairman, HBF

The impact will be immediate and acute with even fewer young people being able to access decent, affordable and energy efficient housing, hundreds of thousands of jobs will go and local economies up and down the country will lose billions.

The report also calculates the economic implications of a drop in supply, based on 122,000 homes not being built over the next three years:

- 378,000 fewer jobs being supported

- Over £20bn less economic activity

- Over £3bn less investment in affordable housing

Meanwhile a YouGov poll carried out for the i newspaper has found that nearly three-quarters of Conservative voters want the UK to build more social housing.

Of 2,112 adults surveyed across Britain, a total of 74% of respondents agreed that more social housing was needed, with 15% saying that they disagreed, and 11% stating that they did not know.

Prime Minister Rishi Sunak has defended the dropping of local housing targets, describing them as “unconservative” following concerns from “thousands” of Conservative members, councillors and activists.

In an interview with the Conservative Home website, Sunak stated that his party would “continue to be incredibly supportive” of home ownership, but stated that his councillors did not want “a nationally imposed, top-down set of targets telling them what to do.”

We do want to build homes, the right number of homes in the right way. These are the reforms we’ve made, together with unlocking brownfield land for housing.

rishi sunak

Resilient housing market sees prices rising slightly in March

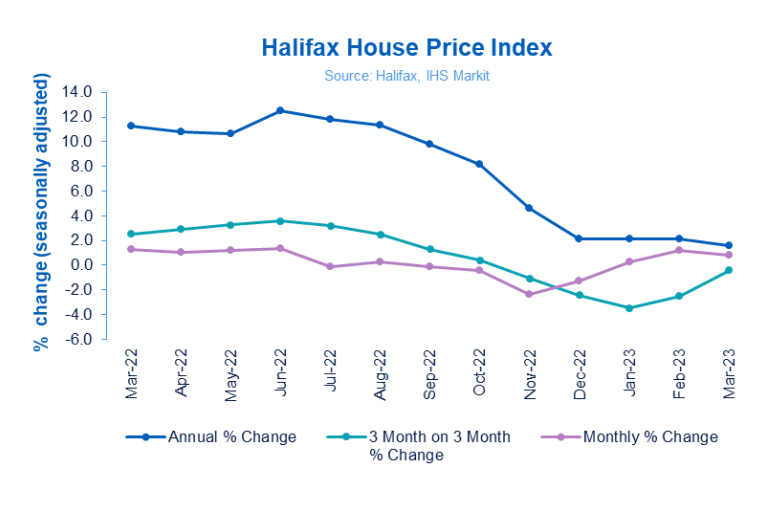

Halifax has published its house price index for March, revealing that house prices increased by 0.8% in the month.

Reaching an average value of £287,880 (Feb: £285,660), the annual rate of house price growth slowed to 1.6% from 2.1% last month – the weakest rate of annual growth since October 2019.

The average house price increased in all UK nations and regions in March, but – with the exception of Greater London and the North East – all areas experienced a slowdown in the rate of annual house price inflation.

Kim Kinnaird, Director of Halifax Mortgages, suggested that these figures demonstrate “relative stability” and gave a cautious view of the future, expecting “a continued slowdown through this year.”

Predicting exactly where house prices go next is more difficult.

Kim Kinnaird, Director, Halifax Mortgages

While the increased cost of living continues to put significant pressure on personal finances, the likely drop in energy prices – and inflation more generally – in the coming months should offer a little more headroom in household budgets.

Survey reveals subdued industry with optimistic long-term outlook

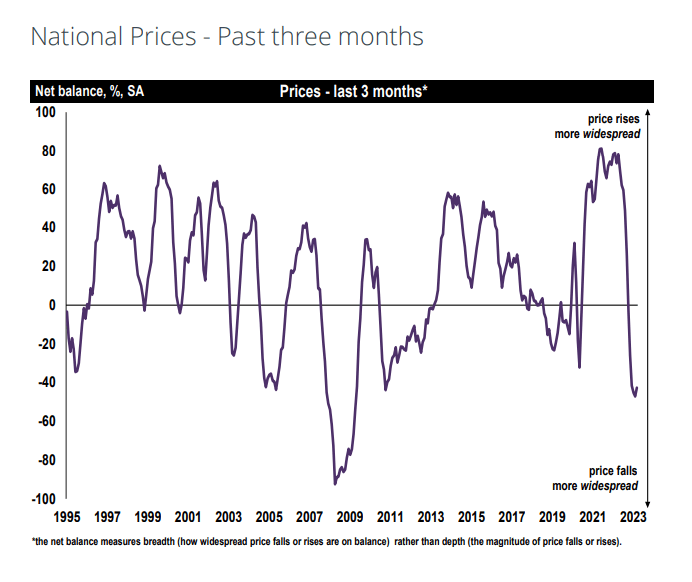

The latest UK Residential Market Survey by the Royal Institution of Chartered Surveyors (RICS) has revealed a “generally weak” market – but twelve-month views on sales volumes have improved.

A higher proportion of surveyors reported a fall in demand in March than a rise, with a net score of -29% (Feb: -30%).

Near-term price expectations remain downbeat, with a score of -49% expecting decreases. However, sales expectations over the next 12 months are at 1% – the first positive score since March 2022.

Meanwhile, official figures from the Office for National Statistics has estimated a 2.4% increase in construction volume output in February 2023, following a -1.7% fall in January 2023.

The key drivers were in repair and maintenance, and new work, predominantly due to an improvement of weather in February.

However, private new housing was the main negative contributor, with a -4.4% fall in output in the month.

Kingspan respond to Gove letter as developers edge closer to signing deal

Kingspan has met the pre-Easter deadline set by Housing Secretary Michael Gove in a letter last month to discuss how the firm would contribute towards the cost of cladding repairs.

The company’s Managing Director, Aiveen Kearney, has responded to Gove, saying that it would pay its share of remediation costs “in circumstances where we have responsibility for the inappropriate use of K15 in buildings.”

She added: “The historical actions of a small number of individuals in our organisation, to which you refer, have been comprehensively addressed within the business and further governance and compliance measures have since been implemented consistent with the recommendations from the Hackitt Review.”

Meanwhile, two of the remaining four housebuilders yet to sign up to the cladding remediation contract are reported to be in talks with the Department for Levelling Up, Housing and Communities (DLUHC).

Avant Homes and Dandara are both edging closer to signing the Developer Remediation contract, as reported by Housing Today.

The remaining two companies – Abbey Developments and Rydon Homes – are yet to sign.