Annual rate of house price inflation stabilises

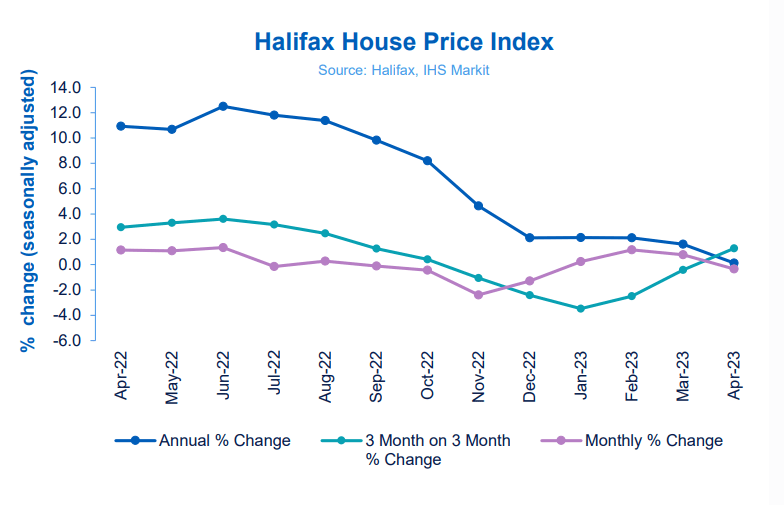

Halifax have published their house price index for April, revealing that the average property value decreased by -0.3% in the month, following a modest 0.8% rise in March.

Valuing a typical UK property at £286,896, the mortgage lender also reported that annual house price growth slowed to 0.1% in April from 1.6% the previous month.

The report also reveals that existing property prices have fallen by -0.6% over the year, with new-build house prices rising by 3.5% in twelve months.

A “resilient” first-time buyer market is experiencing a 0.7% increase in property prices over the last year, with sharply rising rents meaning it is becoming increasingly cost effective to purchase a home – despite challenges in raising a deposit and higher interest rates.

A north-south divide in house price growth is also emerging, with the four regions of southern England (South West, Greater London, Eastern England and the South East) experiencing falling average house prices over the last year.

Elsewhere, all other regions and nations across the UK saw the annual rate of property price inflation remain positive, with the West Midlands posting the strongest annual growth, at 3.1%.

Alongside a market-wide uptick in mortgage approvals, these latest figures may indicate a more steady environment. However, cost of living concerns remain real for many households, which will likely continue weigh on sentiment and activity.

Kim Kinnaird, Director, Halifax Mortgages

Combined with the impact of higher interest rates gradually feeding through to those re-mortgaging their current fixed-rate deals, we should expect some further downward pressure on house prices over course of this year.

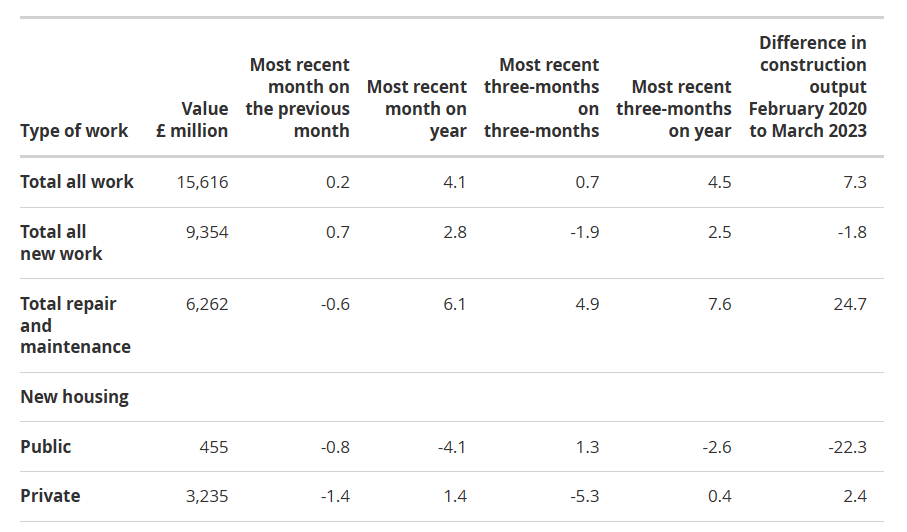

Housing output falls in first quarter

The slump in UK housing at the start of the year continues to evidence itself through various reports, with official figures published this week revealing a fall of -5.3% in housing output in the first quarter of the year.

Latest data from the Office for National Statistics reveals that £9.74bn of private housebuilding work was carried out from January to March – a sharp drop on Q4 2022, but 0.4% ahead of the same period last year.

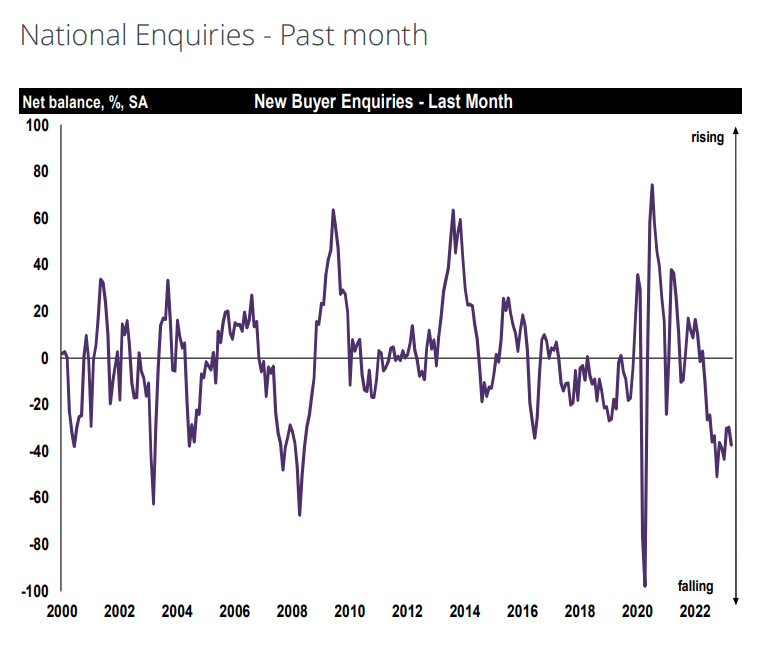

Meanwhile, the latest UK Residential Market Survey from RICS has reported a “weak” sales market momentum, with higher borrowing costs still presenting a challenge to the industry.

Reporting a headline net balance of -37% in April (Mar: -30%), the survey did reveal an improvement on many indicators from the slump experienced at the end of 2022.