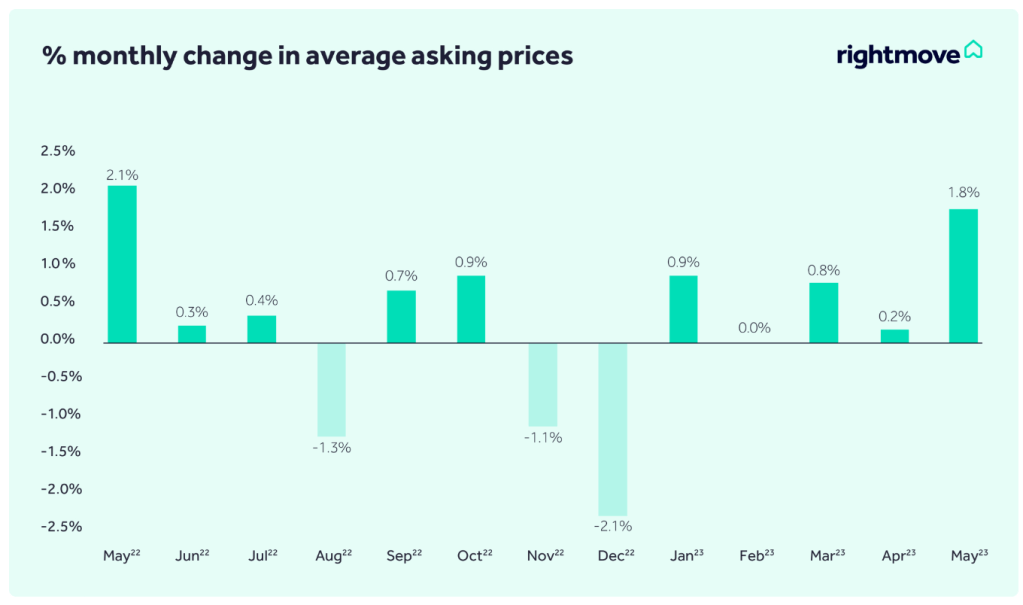

Property values rise by 1.8% in May

House prices have jumped by 1.8% in May to reach a new record of £372,894, according to the latest house price index from property website Rightmove.

The largest monthly increase of the year so far is higher than the historical average May rise of 1.0%, as sellers respond with “increasing pricing confidence to a market that is defying start-of-the-year expectations.”

Discounts from final asking price to agreed sale price have also steadied at an average of 3.1%, in line with normal market levels.

Tim Bannister, Rightmove’s Director of Property Science, described the results as “a sign of increasing confidence from sellers.”

One reason for this increased confidence may be that the gloomy start-of-the-year predictions for the market are looking increasingly unlikely.

Tim Bannister, Director of Property Science, RIghtmove

What is much more likely is that the market will continue to transition to a more normal activity level this year following the exceptional activity of the pandemic years.

Steadying mortgage rates and a generally more positive outlook for the economy are also contributing to more seller confidence, though there are likely to be more twists and turns to come.

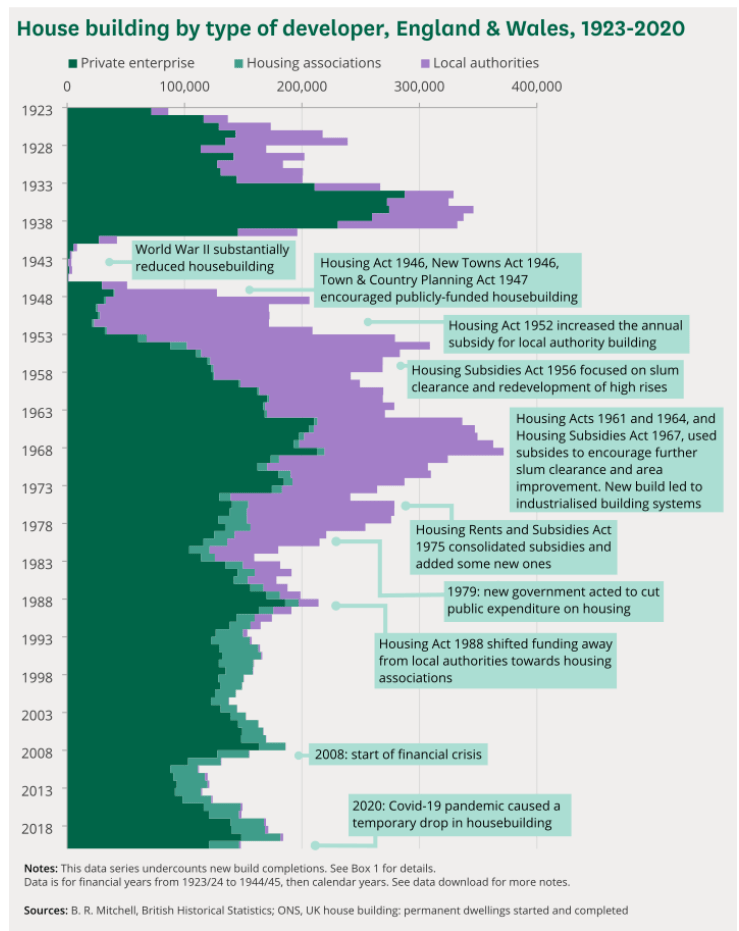

Government paper sets out potential solutions to housing supply in England

A new research briefing has been published in the House of Commons Library, which sets out barriers to housing supply in England and proposes a range of solutions.

Tackling the under-supply of housing in England references Conservative pledges to build 300,000 homes a year and lists key solutions to delivering this target, such as:

- Ensuring land suitable for development is brought forward as a reasonable price;

- Properly resourcing local authority planning departments and addressing the planning system;

- Encouraging and supporting more small and medium sized building firms into a market dominated by a small number of large companies.

Merchant sales volumes reduce in Q1, but some prices remain high

The latest Builders Merchant Building Index (BMBI) report has revealed that first quarter sales were down 2.5% on last year by value, and 16.4% by volume.

Citing a combination of poor weather and a slowdown in the housing market, the report – produced by MRA Research – revealed that sales of decorating, plumbing and electrical products were up by over 10%, but landscaping and timber materials fell by 15-18%.

Before the turn of the year, the industry was bracing itself for a tough 12 months and 2023 hasn’t failed to deliver.

Mike Rigby, CEO, MRA Research

The latest BMBI figures show a drop in year-on-year value sales, with a steep decline in volumes offset by an equally sharp increase in prices.

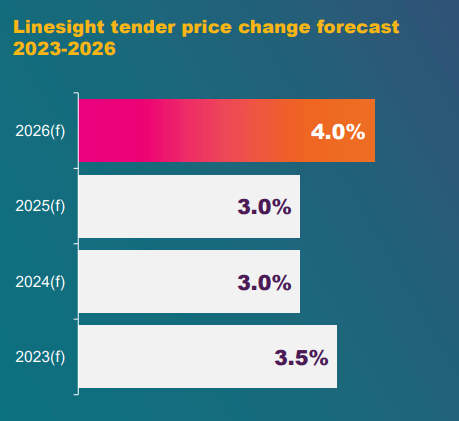

Meanwhile, the latest commodity report by Linesight has found that cement and brick prices remain high, as steel and lumber costs begin to ease.

Steel rebar prices in January 2023 were around 25% lower than in June 2022, and are set to fall further over the forthcoming quarters as demand weakens.

However, cement and concrete prices are forecast to rise further, supported by elevated energy costs; but the report notes that “producers will struggle to pass on higher costs to buyers”, as demand begins to fall back.

The construction consultant has forecast tender prices to increase by 3.5% this year, before slowing to 3.0% in 2024 and 2025.

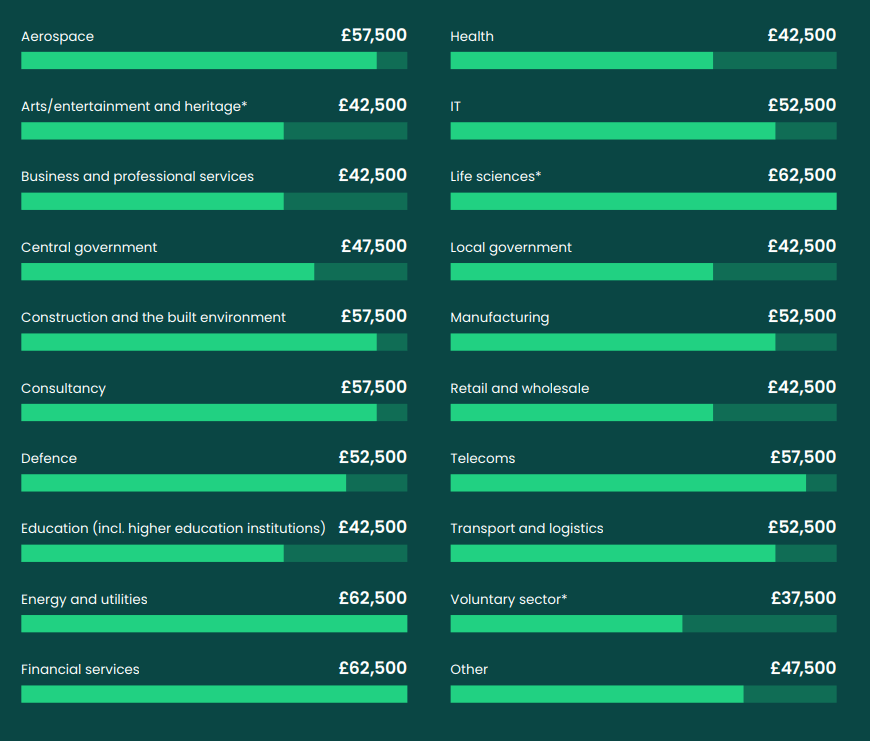

Construction project professionals see 10% salary increase since 2021

The average basic salary for construction project professionals has risen by a tenth in the last two years, according to the 2023 Association for Project Management Salary and Market Trends Survey.

The report, which finds that project professionals in the construction industry currently receive an average salary of £57,500, sees the sector ranking joint second, behind financial services and energy and utilities, both at £62,500.

According to the survey, 68% of construction project professionals saw their average salary increase in 2022, with 59% of respondents earning above £50,000.

The construction sector has enjoyed a positive 10% average salary growth among project professionals and has retained its position as one of the most well-paid sectors for the profession, this year’s Salary and Market Trends Survey shows.

Professor Adam Boddison OBE, Chief executive, APM

This does not come as a surprise, given the incredible resilience and innovation the sector has consistently shown to navigate successfully out of the pandemic and overcome uncertainties to play a vital role in the post-Covid economic recovery.