Property values flat in June, but annual growth remains in negative territory

Nationwide published its house price index for June this week, revealing a 0.1% monthly change in house prices – but annual property value growth was down by -3.5% when compared to the same period a year ago.

Valuing the average UK property at £262,239 (May: £260,736) the mortgage lender also reported annual house price falls in Q2 across all regions, with the exception of Northern Ireland.

East Anglia was the weakest performing region, with prices reducing by -4.7% compared to last year.

Robert Gardner, Chief Economist for Nationwide, described the monthly change as “stable”, and noted that market sentiment has not yet reflected the impact of recent interest rate rises.

Longer term borrowing costs have risen to levels similar to those prevailing in the wake of the mini-Budget last year, but this has yet to have the same negative impact on sentiment.

Robert Gardner, Chief Economist, Nationwide

For example, the number of mortgage applications has not yet declined and indicators of consumer confidence have continued to improve, though they remain below long run averages.

Meanwhile, Zoopla’s house price index for June shows annual growth decreasing to 1.2%; but the property website warned that it still expects house prices to fall by up to -5% this year.

In June 2022, reports Zoopla, annual house price growth was more than 10%; but higher mortgage rates and rising living costs are the key reason for “stunted sales activity” this year.

However, the firm also anticipate that house prices could improve by around 2% if interest rates were to reduce to around 4-5% from their current level of 6%.

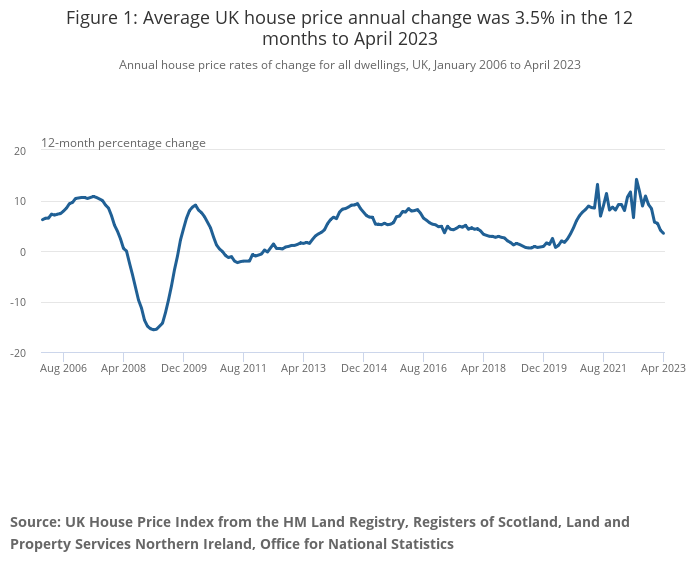

Official figures from the Office for National Statistics have revealed that the average UK house price increased by 3.5% in the twelve months to April 2023, down from 4.1% in March.

The average house price was £286,000 in April 2023, which is £9,000 higher than the same period last year, but £7,000 below the peak in September 2022.

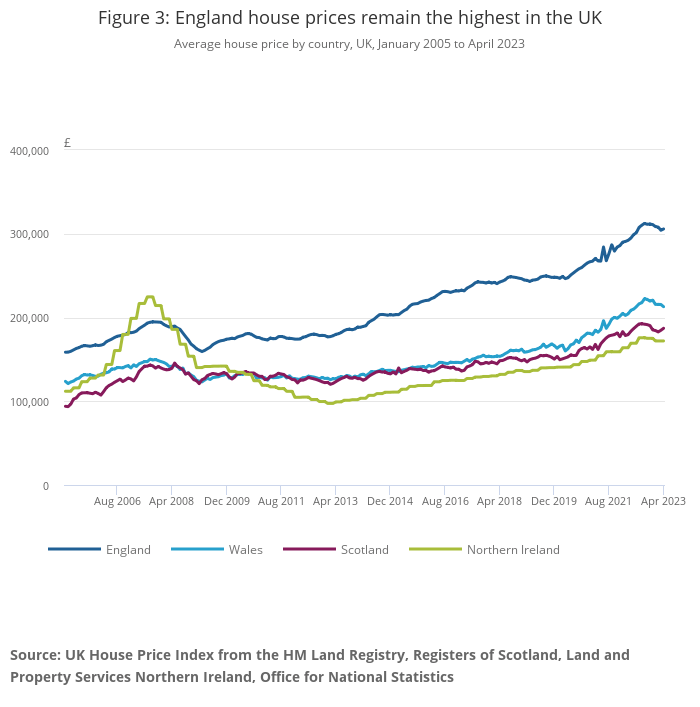

Average house prices increased by 5.0% in Northern Ireland over the year, followed by England (3.7%), Wales (2.0%) and Scotland (2.0%).

Planning permissions falling to “new record lows” due to nutrient neutrality

The Home Builders Federation (HBF) has blamed ongoing nutrient neutrality restrictions for blocking the delivery of more than 145,000 new homes.

The firm’s latest Housing Pipeline Report for Q1 2023, based on data from Glenigan, has revealed the lowest quarterly figure for permissions for housing projects on record at 3,037 projects; 20% down on the previous year and 11% lower than the final quarter of 2022.

The report also found that the number of units approved during Q1 2023 fell 24% against Q1 2022, and was 17% down on Q4 2022.

Despite the fact we face an acute housing crisis, the government’s policy approach continues to drive housing supply down. There is now clear evidence that planning permissions are plummeting, a direct result of the Governments capitulation to the NIMBY lobby on planning.

Stewart Baseley, Executive Chairman, HBF

Over the last four years ministers have failed to intervene on Natural England’s disproportionate ban on new homes, which disregards the findings of government’s own evidence and represents a major misdirection of effort and resources.

Homes England placed under Government review, as programme target missed

The Government has announced a “routine review” of Homes England as part of the Public Bodies Review programme.

The review, which will assess the function and form of the non-departmental public body, will seek to establish any inefficiencies between the Department for Levelling Up, Housing and Communities and Homes England.

The housing and regeneration agency has a portfolio of over 9,000 hectares of land and around £16bn of combined capital spend to deploy by 2027/28. It was last reviewed in 2016.

The news came as the Government announced an overhaul of the way it funds affordable housing in regeneration projects, amidst confirmation that Homes England had missed its build target for the 2016-2021 affordable homes programme.

Homes England has said that grant funding provided through the Government’s current affordable homes programme – from 2021 to 2026 – will be eligible for use to fund the replacement of outdated and not fit-for-purpose homes for the first time.

However, Labour leader Sir Kier Starmer has accused the Prime Minister of “crumbling” to backbenchers and claimed that housebuilding had “collapsed” under the Conservative Government.

Speaking at Prime Minister’s Questions on 28 June, Starmer said of his opponent: “One minute he says he’s for building new houses; the next he’s campaigning against them.”

In response, Sunak stated that Starmer had “never actually kept a promise he’s made,” and claimed that some Labour ministers disagreed with Starmer about housing development in their areas.

Meanwhile, Dandara is the latest developer to put pen to paper and sign a Government contract committing to remediating unsafe buildings.

The move means that just two firms are still yet to sign the contract: Rydon Homes and Abbey Developments.

ilke Homes enters administration

Troubled modular developer ilke Homes has entered administration after failing to find a buyer, triggering the loss of over 1,000 jobs.

Clare Kennedy, Catherine Williamson and Deborah King of consulting firm AlixPartners have been appointed as joint administrators.

In a statement, the company said it would “regrettably” close its manufacturing facility, with a small number of employees kept to assist the administrators in their duties.

This is an incredibly difficult time for all associated with ilke Homes, and in particular its employees, who have worked tirelessly alongside management over recent months to find a resolution.

Clare Kennedy, Managing Director, AlixPartners

Housing completions fall by 12% in Q1

Official figures from the Department for Levelling Up, Housing and Communities (DLUHC) have revealed a -12% fall in housing completions from January to March 2023 when compared to the previous quarter.

At 39,970, the seasonally adjusted number of completed dwellings was also -8% down on the same quarter last year.

However, DLUHC has also revealed that there were 232,820 net additional dwellings in 2021/22 – a 10% increase when compared to 2020/21.

There was also a slight uptick in the number of housing association units built in the year, rising from 38,672 in 2020/21 to 45,577 in 2021/22.

Construction workers secure pay increase, as builders’ merchants see sales revenues fall

An agreement between construction unions and contractors will see a pay increase of at least 6% for around half a million site workers from 10 July.

In a two-stage deal under the Construction Industry Joint Council agreement, workers will receive a further 1.5% rise from 01 January 2024.

Meanwhile, a report from the Builders Merchants Federation (BMF) sees sales revenues falling by -2.3% in the first quarter of 2023, and volumes decline by -16% compared to 2022.

The Spring 2023 Forecast Report cites the cost of living crisis and rising interest rates for the fall, along with the effects of the end of the Help to Buy scheme on 31 March.

The BMF now predicts negative growth of -1.4% in sales revenue this year, when compared to 2022.

Much depends on the effectiveness of the Bank of England’s strategy to bring down inflation.

Thomas Lowe, Economist, Builders Merchants Federation

If we start to see signs of economic stabilisation, we expect the market to pick up in the latter months of this year and continue to slowly improve into 2024.

We are, of course, keeping a watchful eye for any change in conditions that may affect the forecast for 2024.

In other news…

All nine members of the Royal Institution of Chartered Surveyors’ (RICS) standards and regulation board resigned this week, plunging the firm into crisis.

The walk-out came in protest over plans to oust its chairman, Dame Janet Pareskeva, after her whistle-blowing on alleged governance failures.

The NHBC has launched a publication to “shine a light” on the important role of housing associations.

The report, titled Built. On insight. A collection of industry insights from leaders in housing association development, brings together senior figures within the housing association world to share their thoughts on the sector.

It’s heartening to learn, despite a very challenging financial environment, our contributors have an optimistic outlook, albeit tempered with healthy realism.

Charlie Ash, Sector Lead for Housing associations, NHBC

New considerations such as the green agenda and decarbonisation are being enthusiastically embraced, and modern methods of construction being given serious thought – this forward-thinking attitude and a thirst to achieve shines through in our contributors’ words.