DLUHC hands back money after struggling to spend it

A Guardian exclusive has revealed that the Department for Levelling Up, Housing and Communities (DLUHC) has handed back £1.9bn earmarked for combatting the housing crisis to the Treasury.

The funds – which were meant to be used to build new affordable housing and improve building safety – have been returned after DLUHC struggled to find projects to spend it on, thanks to rising interest rates and ongoing market uncertainty.

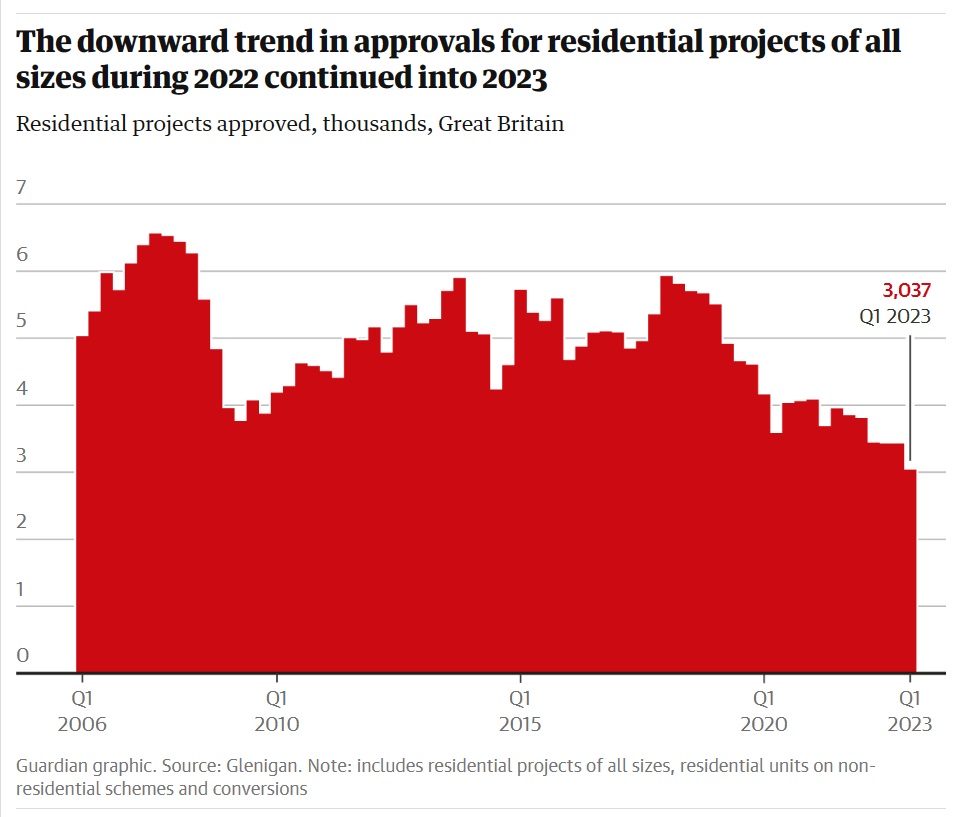

The move has sparked concern within the industry that the current housing crisis will be worsened, with analysis by consultancy Lichfields earlier this year projecting that housbuilding is expected to fall to its lowest level in decades.

A spokesman from DLUHC said: “Our target of delivering 300,000 homes a year remains and we are fully committed to funding and delivering the programmes that help us meet that target, including the £11.5bn affordable homes programme.”

But Lisa Nandy, the Shadow Housing Secretary, said: “The Conservatives have simply given up trying to solve the housing crisis that they helped create.”

Meanwhile, a cross-party committee of MPs has published a report following a review of the Government’s proposed planning reforms, stating that they could make meeting annual housebuilding targets “impossible”.

The Levelling Up, Housing and Communities Committee has been reviewing plans to scrap mandatory local housing targets, with the report highlighting the importance of building more affordable housing in order to meet the Government’s target of 300,000 new homes each year.

We reiterate our long-standing recommendation that the Government should set out the proportions of different types of tenure that will make up the 300,000 figure.

LUHCC Report, ‘Reforms to national planning policy’

90,000 of the new homes delivered annually should be designated for the most affordable housing tenure, Social Rent.

The report comes as Gove and Sunak work on plans for an amendment to the Levelling Up and Regeneration Bill, which would see the release of more than 100,000 homes currently blocked by the nutrient neutrality crisis.

The Prime Minister and Housing Secretary are believed to be in discussions over bringing forward regulations to allow homes to be built, even if water treatment facilities are not in place.

Barratt forecasts fall in new home completions

Barratt Developments have issued a trading update for the year to the end of June, in which they predict that new home completions will fall to between 13,250 and 14,250 in the next twelve months.

The projection would mean a -23% drop in completions when compared to the 17,206 homes built in the year to June 2023.

Also reporting a fall in private reservations per outlet per week to 0.55 (FY22: 0.81), the developer revealed an 8% increase in the asking sales price of a private unit, valued at around £368,000.

Whilst the trading backdrop has become more challenging in recent months, with many of our customers facing significant cost of living pressures, we have responded decisively – increasing our reservations into the private rental sector, using incentives for customers in a disciplined way, and flexing our build activity, land buying and operating costs to reflect market conditions.

DAvid THomas, Chief Executive, Barratts

The update comes as the average price of a two-year fixed-rate mortgage rises to the highest level in almost 15 years, according to financial data service Moneyfacts.

At a rate of 6.66%, the cost of an average mortgage rises slightly above the 6.65% seen in October 2022, after the mini-budget.

Private housebuilding output drops in May, as Forterra cuts jobs

Official data from the Office for National Statistics has revealed that private housebuilding output fell by -1.7% in May, bringing it to almost 15% below the level seen in May 2022.

Noting that the additional bank holiday for the coronation of King Charles III could have had an effect, the publication also recognised ongoing economic worries as being the main driver for a reduction in private housing output.

Construction output overall saw an increase of 0.2% in the three months to May 2023 – the ninth period of consecutive growth in the quarterly series, but the weakest growth since the three months to August 2022.

Meanwhile, brick manufacturer Forterra announced a redundancy consultation this week as it seeks to cut £13m of costs, amidst “significant uncertainty” in demand.

The news comes after the firm’s decision in May to close its Howley Park factory, following falling demand from developers.