Volume developer expecting “small reduction” in staff

Housebuilder Redrow announced plans this week to close the administrative offices of its Southern and Thames Valley divisions, as well as making “a small reduction in staffing across some of our other teams”.

A spokesperson for the business added that there would be no impact to customers, and none of its schemes would be affected.

We appreciate how difficult this is for those colleagues that are affected, and we are supporting them throughout this process.

REdrow Spokesperson

Meanwhile, home completions in Vistry’s housebuilding arm fell 22% in the period from 01 January to 30 June, as the business faces “more challenging market conditions”.

Coming a week after Barratt announced a forecasted drop in completions this year, the Vistry Group also revealed that completions in its partnerships business rose 6% during the same period, reaching 3,203.

Reporting an average weekly sales rate of 0.86 across all tenures (2022: 0.84), the volume housebuilder stated that it expected adjusted revenue for the half year to be around £930m (2022: £426m).

Partnerships is demonstrating its resilience and remains on track to deliver revenue growth in the full year.

Greg Fitzgerald, Chief Executive, Vistry Group

Housebuilding is maintaining a controlled and disciplined approach, taking the opportunity to deliver bulk sales to support overall sales rates and open market pricing.

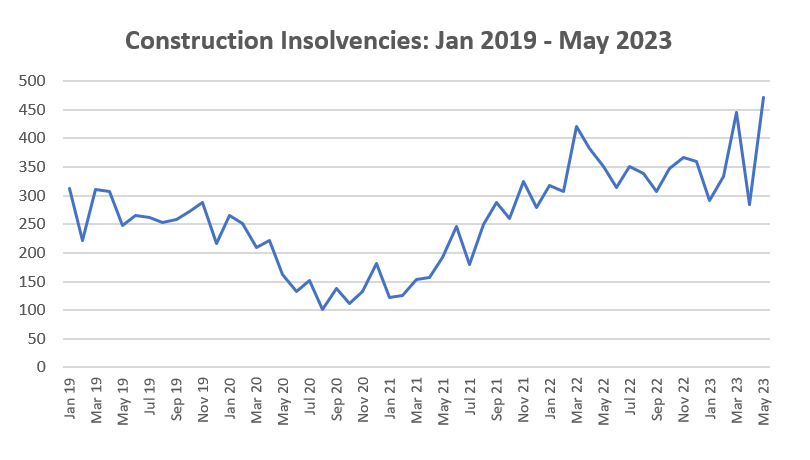

Construction insolvencies rise 34% in a year

The number of construction companies going bust as a result of inflation and high interest rates has risen by over a third in a year, according to the Insolvency Service.

Latest figures reveal that 471 construction firms went under in May, a 34% increase over twelve months and the highest number in recent years.

Data from firm Glenigan has revealed that detailed planning approvals fell by 29% in the second quarter of 2023 when compared to the previous quarter.

In addition, the construction monitoring firm also found that construction project starts were down 26% in the second quarter when compared to the first quarter, and down 43% compared to Q2 2022.

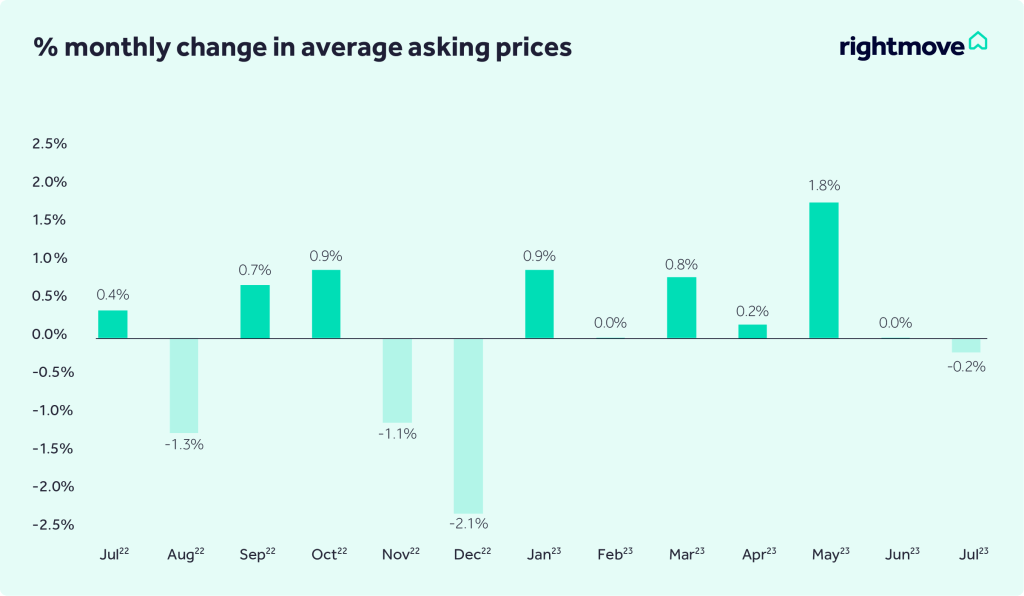

Rightmove reveals “resilient” demand, but house prices slip slightly in July

Property website Rightmove has published its house price index for July, revealing that the average property value decreased by -0.2% in the month.

The firm also found that the number of sales agreed is now 12% behind 2019, widely considered to be a more ‘normal’ market.

However, buyer demand remains resilient, being 3% higher than 2019, due to a shortage of properties for sale.

The interest-rate brakes being applied more strongly to slow the economy are now beginning to bite in the housing market. While prices and sales bounced back this year much more strongly than most expected, the unexpectedly stubborn inflation figures and the surprise of further mortgage rate rises when many felt that they had stabilised, have contributed to the fall in prices and number of sales agreed.

Tim Bannister, Director of Property Science, RIghtmove

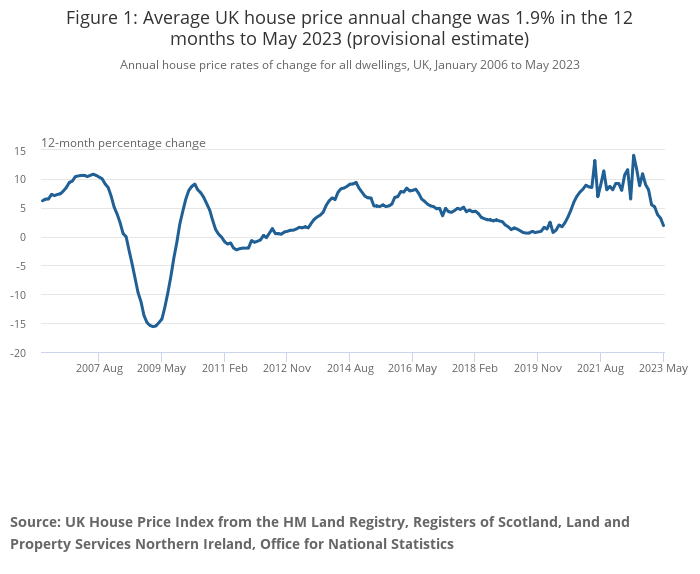

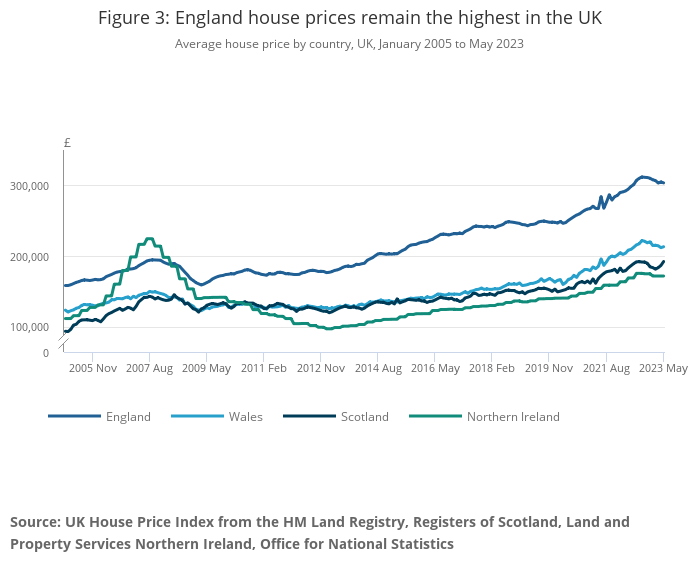

Meanwhile, official data from the Office for National Statistics (ONS) has found that average UK house prices increased by 1.9% in the year to May 2023, down from 3.2% in April.

The ONS has valued the average property at £286,000, which is £6,000 higher than May 2022, but £7,000 lower the peak in September 2022.

Northern Ireland enjoyed the highest annual property price rise at 5.0%, followed by Scotland (3.2%), Wales (1.8%) and England (1.7%).

Number of ‘for profit’ affordable homes to double by 2025

Property consultant JLL have forecast that the number of affordable homes owned by investors will double from the 26,400 recorded at the end of 2022 to 58,100 by the end of 2025.

However, this will account for only a small portion of the market, rising to 1.4% of all affordable homes.

Meanwhile, research by Savills and the British Property Federation has found that the number of build-to-rent homes completed and in the pipeline has increased by 12% year-on-year to more than 250,000.

The number of build-to-rent homes completed in the UK in the year to the end of June has increased by 13% to 88,100.

However, build cost inflation and wider economic uncertainty looks set to slow down delivery, with construction starts totalling 5,549 in the first half of the year, down 55% on the same period in 2022.

Build-to-rent is continuing to expand but the sector is not immune to the current economic uncertainty and cost inflation.

Ian Fletcher, Policy Director, British Property Federation

At the current time it is very challenging to deliver large-scale capital intensive schemes, particularly in London, but there are fewer obstacles to the delivery of smaller developments in regional cities and single-family housing both which continue to grow as a proportion of housing supply in UK cities.

Inquiry launched into developer contribution system

The All-Party Parliamentary Group on Housing and Planning launched an inquiry into England’s developer contribution system this week, calling upon local Government, housebuilders and others to submit evidence on the proposed Infrastructure Levy.

The Infrastructure Levy has been proposed by Government to replace the current Section 106 and Community Infrastructure Levy systems, but has caused concern within the industry that the proposals could reduce funding available for affordable homes.

The inquiry will also investigate the “current opportunities and challenges” facing the contributions system, and will make recommendations to Government.

The deadline for submissions to the inquiry is 05 September.

Meanwhile, bricklayers, roofers and joiners have been added to the Shortage Occupation List, meaning that visa rules can be relaxed to help businesses plug labour shortages using foreign workers.

The list was updated following a review of the immigration system by the Migration Advisory Committee earlier this year.