Sunak and Gove set out a suite of measures amidst industry scepticism

Housing Secretary Michael Gove unveiled a series of measures this week, aimed at unlocking housing supply and clearing planning backlogs.

Gove also confirmed that the 300,000 new homes a year target remains in place, whilst launching a £24m fund to “scale up local planning capacity”, along with £13.5m to create a new “super-squad” of experts to support large-scale development projects.

The report – which commits to “a new era of regeneration, inner-city densification and housing delivery across England” – also sets out plans to create “transformational change” in Cambridge, central London and central Leeds.

The Housing Secretary also announced a reformation of local plans, as well as relaxing permitted development rules to help convert shops and commercial premises into homes.

However, industry reaction has been lukewarm, with Housebuilder quoting Lawrence Turner, Director at planning consultant Boyer, as saying: “Regrettably, the current policy announcement falls significantly short of addressing the UK’s housing crisis.

“Offering a complete solution demands a balanced strategy, encompassing both brownfield and greenfield development, and a proper review of the green belt. Unfortunately, the present government announcements sidestep any commitment to development on greenfield land.”

In addition, the Home Builders Federation criticised the Government for launching several consultations at once, but added that it tentatively supported the “super-squad” of planning specialists.

This is best done though by building capacity and capability through shared services and should not mean a further hollowing out of LPAs.

Home Builders Federation

It should also serve to highlight the dire state that many are in and that the government has manifestly not progressed the skills strategy for the sector promised in 2020.

Housing charity Shelter has labelled the proposed measures as a “real mixed bag”, stating that the sector needs “proper investment to build much-needed genuinely affordable homes, not more piecemeal reform.”

Converting takeaways and shops into homes and restricting building to city centres won’t help. It could risk creating poor quality, unsafe homes that cause more harm than good.

Polly Neate, Chief Executive, Shelter

When we are losing more social housing than we build, the government must work with councils to deliver the quality homes local communities across the country need.

Gove’s announcement comes as Homes England accounts confirm that delivery targets have been missed for the second year in a row.

The Government agency revealed that it funded or supported 33,713 completed homes in the 2022/23 financial year; 86% of its completions target of 39,008 homes.

Homes England also missed its goal for homes started in the same period, with work beginning on 37,175 homes against a target of 52,967.

Planning survey reveals extent of system “set up to fail”

A census of 311 planning committee members by SEC Newgate has revealed that the current planning system is “riven with internal systemic issues”.

The National Planning Barometer, which has been conducted for the first time since before the pandemic, lists these internal issues – along with “external pressure from frequent changes to national planning policy” – as the core drivers for a “planning system set up to fail”.

The report also reveals that 67% of councillors think the housing crisis is getting worse (2020: 27%) and 69% believe housing supply is somewhat or severely lacking in their local authority areas (2020: 53%).

Providing affordable homes for future generations is viewed as the top priority for local authorities, with 68% of respondents agreeing.

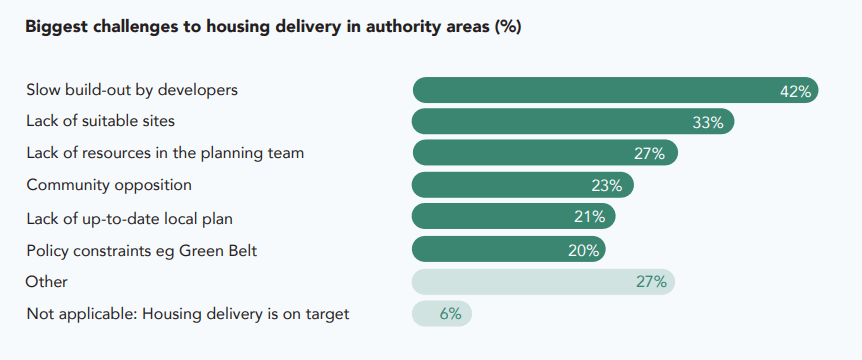

Meanwhile, the primary challenge for housing delivery is cited as slow build-out by developers – highlighting fractures within the housing industry as a whole – and a lack of suitable sites.

A lack of planning resource came third, ahead of community opposition.

The news comes as the National House Building Council (NHBC) revealed that registrations in Q2 2023 were down by 42% when compared to the same quarter last year.

A total of 38,044 new homes were registered in the three months from April to June, compared to 65,645 in the same time period in 2022.

Steve Wood, Chief Executive of the NHBC, said: “It is hardly surprising that consumer demand for new homes began easing in the second quarter. With mortgage rates at a 15-year high, volumes of homes built for private sales have weakened, although this is partly offset by bulk sales into affordable housing markets.”

Rising mortgage rates see annual house price inflation slow

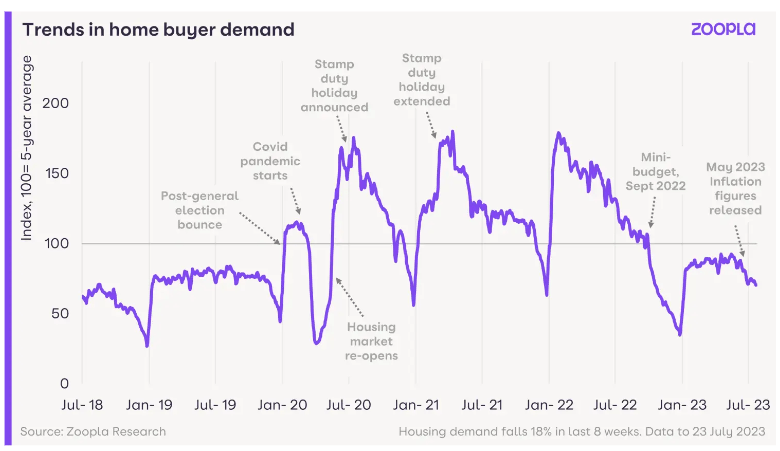

Zoopla has reported a slowdown in annual property value inflation, reaching 0.6% in July (June: 9.6%).

The property website also reported that “affordable markets in economically active areas” are still registering an annual house price inflation of over 3.5%, whilst higher mortgage rates have reduced demand by 18% over the last two months.

The report also found a “clear split” between trends in southern England and the rest of the country, with house prices falling by up to -0.6% over the year in all four regions in southern England.

In contrast, house prices continue to register annual price growth of over 1.0% in the other seven regions of the UK.

CPA forecasts “acute recession” this year

The Construction Products Association (CPA) has published their Construction Industry Forecast Summer 2023, predicting that the industry will experience an “acute recession” in 2023, driven by large falls in private housing new build and private housing repair, maintenance and improvement.

As a result, the CPA has forecast a -7.0% fall in output, recovering slightly in 2024 with growth of just 0.7%.

The report cites a “flatlining UK economy, falling real wages, and mortgage rates” as being the main reasons behind the solemn forecast.

Twelve months ago, the CPA forecast that construction output would grow by 1.6% in 2023 and 2.5% in 2024 – albeit this came before September’s mini-budget.

The government’s previously stated ambitions – building 300,000 net additional homes per year, investing £600 billion in an infrastructure pipeline, delivering Levelling Up, and transitioning to Net Zero – all sound like hollow soundbites now given its lack of commitment and investment.

Professor Noble Francis, Economics Director, Construction Products Association

It is essential that government uses its Autumn Statement later this year to invest in UK construction – an industry which employs more than three million people across its supply chain and provides the homes and infrastructure that are so vital for the country’s near-term needs and long-term productivity growth.

Meanwhile, the latest Builders Merchant Building Index has revealed that the value of merchant sales was down by -6.0% in May 2023, compared to May 2022.

Sales volumes also fell by -15.1% over the same period; however, they were up by 14.1% in the month.