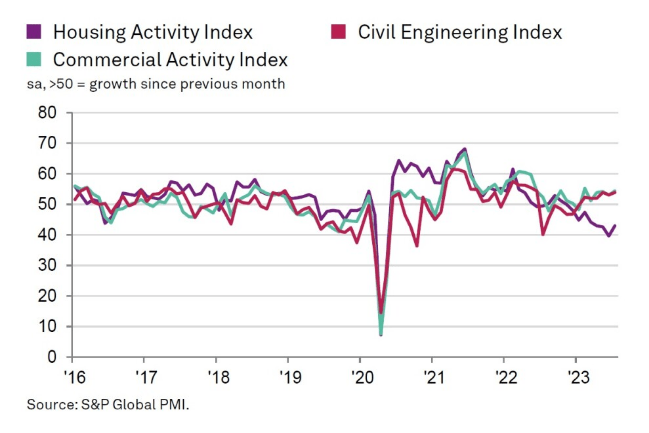

Boost in commercial construction and civil engineering offset housing downturn

A monthly survey of purchasing managers in the construction industry has seen an increase in output from 48.9 in June to 51.7 in July.

Any reading over 50.0 in the S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) signifies growth in output.

However, the increase was driven by a surge within the commercial construction and civil engineering sectors, with residential construction scoring 43.0; albeit still an improvement on June’s score of 39.6.

Survey respondents attributed the decline in residential output to rising interest rates and concerns about the economic outlook.

Meanwhile, another steep reduction in house building acted as a severe constraint on construction growth.

Tim Moore, Economics Director, S&P Global

Around 35% of the survey panel reported a decline in residential work during July, while only 18% signalled a rise.

Lower volumes of housing activity have been recorded in each month since December 2022, with construction companies widely reporting subdued sales due to rising interest rates and worries about the economic outlook.

Meanwhile, construction data monitoring firm Glenigan has noted a rise in housebuilding over the past three months, with residential construction starts increasing by 21% over the period.

Covering the quarter from May to July, the latest bulletin revealed a 40% increase in private housing; however, this was still 26% down on 2022 levels.

Social housing starts were 25% down over the three months, and 21% down when compared to last year.

And, in further gloomy news, the latest UK Construction Monitor from the Royal Institution of Chartered Surveyors (RICS) has revealed a slowdown in construction activity.

The report, which covers the second quarter of 2023, records the deteriorating credit environment and associated financial constraints as being the primary factor limiting construction work.

Survey respondents recorded a net balance of -12% for private housing, voicing concerns about money-tightening policies of the Bank of England.

However, the forecast for the housing industry remains broadly flat for the rest of the year.

Realistically, to deliver on housing targets, investment is needed to build up a diverse future pipeline of construction skills, in particular to embrace digital and green technologies.

Amit Patel, Head of Professional Practice – Construction, RICS

In the short term, however, there should be more flexibility for international recruitment.

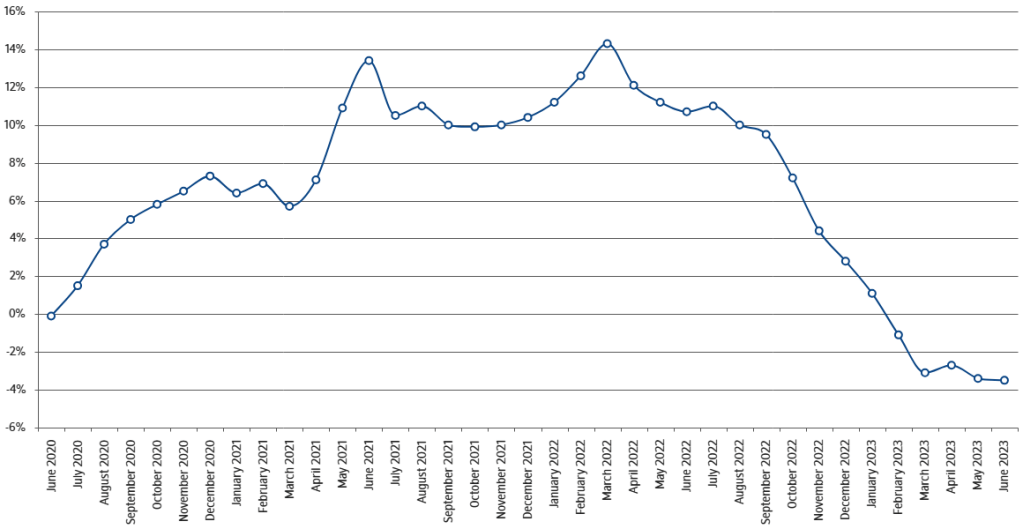

Annual house price growth falls further in July

Nationwide has published its house price index for July, revealing a -0.2% fall in monthly property values.

Valuing the average home at £260,828 (Jun: 262,239), the rate of annual house price growth remained negative at -3.8%, down from -3.5% in June.

Annual house price growth edged down to -3.8% in July. This was the weakest outturn since July 2009, although it is only modestly lower than the -3.5% recorded last month.

Robert Gardner, Chief Economist, Nationwide

There was a slight fall of 0.2% over the month, after taking account of seasonal effects. As a result, the price of a typical home is now 4.5% below the August 2022 peak.

Increased mortgage rates continue to present a challenge to affordability, with a prospective buyer earning the average wage and looking to buy the typical first-time buyer property with a 20% deposit spending around 43% of their take-home pay on monthly mortgage payments, assuming a 6% mortgage rate.

This represents an increase from 32% in 2022 and the long-run average of 29%.

Taylor Wimpey hails “resilient” six months, but profit falls

Housebuilder Taylor Wimpey has released its results for the first half of 2023, revealing an improvement in completions, but a -43% fall in profit.

Reporting on the six months ending 02 July, the volume developer achieved 5,082 completions – a fall of 25.2% on the first half of 2022.

Pre-tax profit fell to £237.7m from £414.5m in 2022, amidst a net private sales rate of 0.71 per week (H1 2022: 0.90).

The first half of the year has been characterised by variable market conditions including substantially higher mortgage rates.

Jennie Daly, Chief Executive Officer, Taylor Wimpey

While this has inevitably impacted our results, I am pleased that we have delivered a resilient performance with first half completions slightly ahead of our expectations.

Marshalls cuts jobs as slow housing market affects sales

Building products manufacturer Marshalls has announced that it is cutting 250 jobs and closing its factory in Lanarkshire.

In a trading update to the end of June, the firm warned that performance in the second half of the year will be below market expectations, with revenue falling by -13% in the first six months of 2023.

The gloomy outlook was echoed by Travis Perkins, who revealed that pre-tax profit fell by a third in the first half of the year.

Profit dropped 37% ton £86m in the six months to June, with the firm saying that the numbers “reflect weak market volumes in private domestic RMI and new build housing”.

However, demand for highly-skilled self-employed labour remained high in June, according to Hudson Contract.

The payroll consultancy found that average earnings rose by 3.2% to £982 per week, which is 6.6% higher than the same period last year.