Developer on track to build 9,000 homes this year

Housebuilder Persimmon has stated that it remains on course to deliver around 9,000 homes in 2023, but has revealed plans to “share the cost pressures” with subcontractors in this “new challenging environment”.

The firm completed 4,249 homes in the first half of the year, compared to 6,652 in the first six months of 2022, generating £1.19bn of revenue and £151m of pre-tax profit.

Against a backdrop of higher mortgage rates, the removal of Help to Buy and significant market uncertainty, Persimmon has delivered a robust sales rate excluding bulk sales whilst growing the private average selling price in our forward order book and also securing cost savings.

Dean Finch, Chief Executive Officer, Persimmon

We are on track to deliver profit expectations for the year and are building a platform for future growth.

The group also set out the need for cost control, highlighting four focus areas for ‘smart’ savings: value engineering, reduced specifications, an overheads review (targeting £25m saving this year) and a review of subcontractor pricing.

We are actively retendering sites to identify savings. Just as we absorbed many price increases from sub-contractors in recent years, so we need to share the cost pressures in this new challenging environment.

Persimmon Half-Year Trading Update

Meanwhile, housebuilder Bellway completed 10,945 homes in the year to the end of July; a slight reduction on the 11,198 homes built in the same period last year.

In a trading update issued this week, the firm warned that “prevailing low reservation rates” would mean a “material” fall in legal completions by the end of its present financial year ending on 31 July 2024.

The backdrop of macroeconomic uncertainty and cost of living pressures affected consumer demand during the year and, given affordability remains constrained by higher mortgage interest rates, underlying trading conditions are likely to remain challenging in the near term.

Jason Honeyman, Group CEO, Bellway

Bellway highlighted that overall reservation rate so far this year reduced by 28.4% to 156 per week (2022: 218), with the overall cancellation rate trending upwards and averaging at 18% (2022: 13%).

The company also announced plans to consult on closing two divisions – South Midlands and London Partnerships – as well as reducing capacity in a third division in Durham.

And, following upheaval in the modular market with ilke Homes entering administration and Legal & General ceasing production, TopHat Communities – a subsidiary of modular housebuilder TopHat – posted a £5.1m loss for the business in 2022.

However, turnover almost doubled to £13.4m (2021: £7.1m) and the firm is pressing on with its 650,000 sq ft facility in Corby, Northamptonshire.

The business said: “TopHat is a young, ambitious company that is still in its growth phase. The group continues to invest ahead of revenue, both in growing its capacity and developing its product offering.”

Property prices decrease for fourth consecutive month amid signs of “resilience”

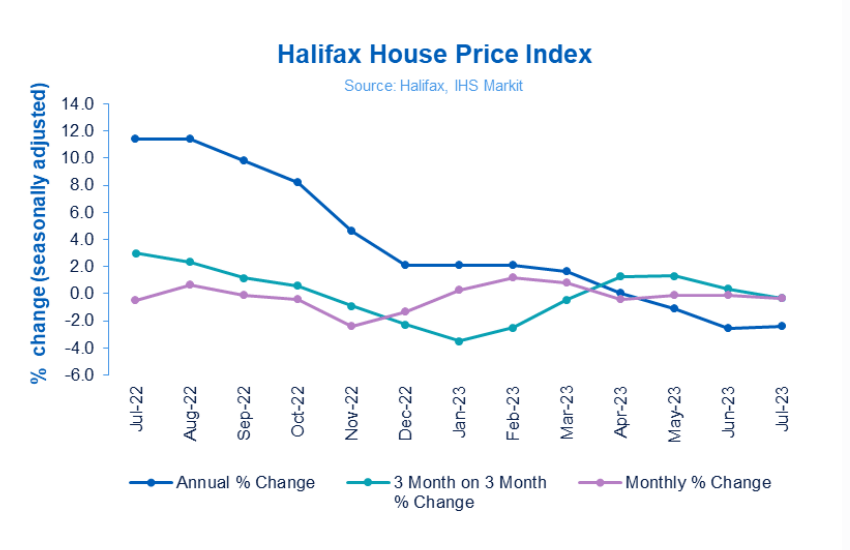

Halifax has published its house price index for July, revealing a -0.3% decrease in property prices in the month, for the fourth month in a row.

However, the value of an average home fell by -2.4% on an annual basis, easing from -2.6% in June, and is valued at £285,044 (August 2022 peak: £293,992).

The mortgage lender also said that the market was displaying “some resilience”, with industry data showing increased activity – specifically among first-time buyers, who are searching for smaller homes to offset higher borrowing costs.

Several factors are providing support, notably strong wage growth, running at around +7% annually.

Kim Kinnaird, Director, Halifax Mortgages

And, while the uptick in unemployment is likely to restrain that somewhat, it seems unlikely to reach levels that would trigger a sharp deterioration in conditions.

Halifax also found that average house prices fell over the year in almost all regions of the UK in July, with the exception of the West Midlands, which saw no change.

The South East remains the area with the most downward pressure, with prices down -3.9% over the year; a reduction of around £15,000 off the value of a typical property.

Meanwhile, the latest Residential Market Survey from the Royal Institution of Chartered Surveyors (RICS) has suggested that high mortgage rates are impacting on buyer activity, with the number of house sales dropping at the fastest rate in July since the early stages of the pandemic.

New buyer enquiries posted a net balance of -45% in July, similar to -46% in June.

Construction inflation continues to soften

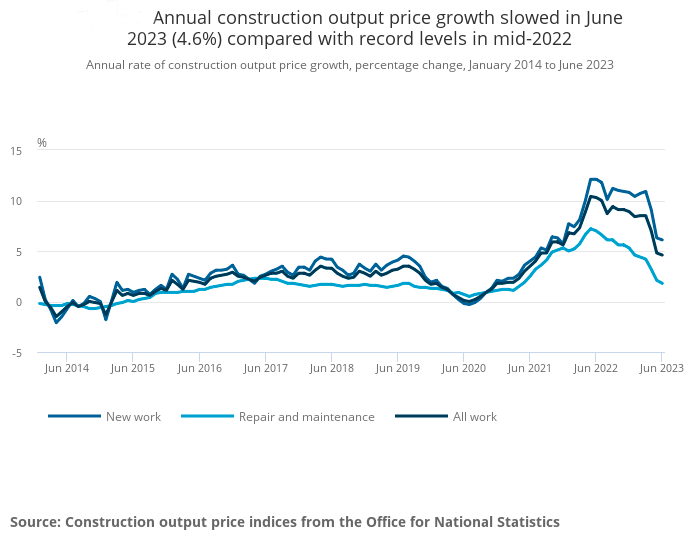

Official figures from the Office for National Statistics (ONS) have revealed that the annual rate of construction inflation was 4.6% in the year to June 2023.

This has slowed from the record rate of 10.4% experienced in May 2022.

The ONS has also published its estimates for construction output in June, showing an overall rise in volume of 1.6%, driven by a 2.0% rise in new work and a 1.1% increase in repair and maintenance.

And, finally…

The Home Builders Federation (HBF) has launched its 2023 SME Housebuilder Survey, which will inform its next State of Play report. The survey is open for responses until 29 August.

The last report revealed that 92% of SME respondents were unhappy with the Government’s current approach to housing.

Meanwhile, a study by the National Federation of Builders (NFB) has found that the construction industry has a higher than average number of neurodiverse workers.

The survey of 1,000 adults in the UK also found that being neurodiverse is actually encouraging people to pursue a career in construction, with ADHD being the most prevalent condition.

80% of respondents who informed their employer that they had a neurodiverse condition reported that the employer had made reasonable adjustments to accommodate their needs.