Housebuilding industry welcomes Government plan to amend bill

Housing Secretary Michael Gove has announced that the Government will scrap nutrient neutrality rules as part of an amendment to the Levelling Up and Regeneration Bill.

Describing the proposed rules as “defective”, Gove stated: “We are committed to building the homes this country needs and to enhancing our environment. The way EU rules have been applied has held us back. These changes will provide a multi-billion pound boost for the UK economy and see us build more than 100,000 new homes.”

The Government also announced that it expects developers to contribute to Natural England’s Nutrient Mitigation Scheme, and is “discussing the right structure and approach with the Home Builders Federation (HBF)”. It also doubled its investment in the scheme to £280m.

Local planning authorities will no longer have to consider the impact of nutrient pollution when determining applications, the Government added.

The move has been welcomed by the industry, with HBF Executive Chairman Stewart Baseley commenting that the announcement “has the potential to unlock housing delivery across the country, from Cornwall to the Tees Valley.”

Meanwhile, Barratt CEO David Thomas “welcomed the Government’s commitment to tackle the disproportionate rules”.

This will help deliver the country’s much needed new homes, which make a significant contribution to the wider economy.

Jennie Daly, CEO, TAylor Wimpey

Allison Homes’ CEO, John Anderson, praised the amendment, but cautioned: “While this announcement is welcome, it only fixes part of a broken system. The government now needs to provide more clarity to local authorities regarding the National Planning Policy Framework and allow local plans to be completed, helping provide homes that people need in other areas of the country.”

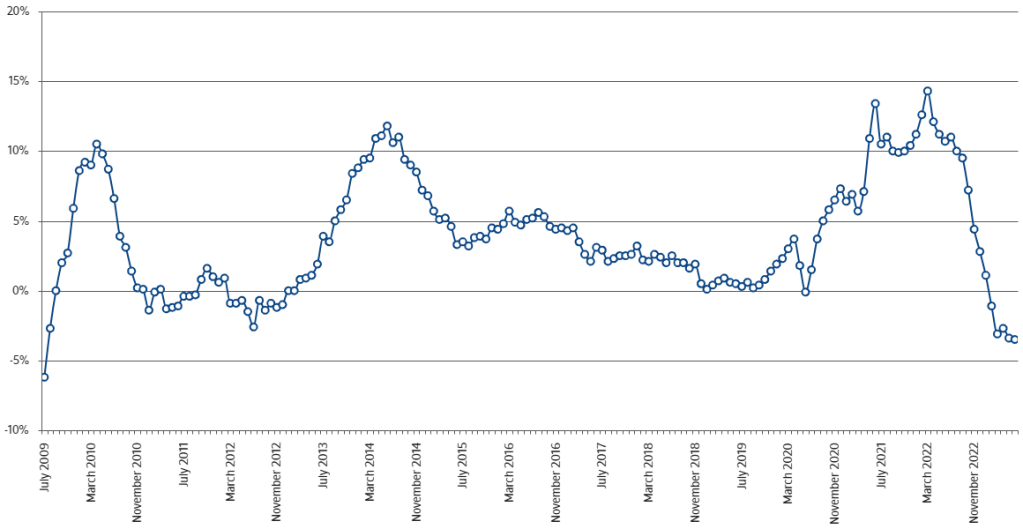

Nationwide reports biggest annual house price fall since 2009

Mortgage lender Nationwide has reported a stark drop in property prices, with the cost of an average home now -5.3% lower in August than last year.

The fall represents the weakest rate of annual house price growth since July 2009.

Prices fell slightly in the month, with a -0.8% reduction meaning that the average home is worth £259,153 (July: £260,828). Mortgage approvals are around -20% below pre-pandemic levels.

While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks.

Robert Gardner, Chief Economist, Nationwide

Meanwhile, Zoopla’s house price index for August has predicted that sales in 2023 will fall to their lowest level in eleven years, and -20% lower than last year.

Reporting a 0.1% increase in house prices in twelve months, the property website blamed higher mortgage rates and cost-of-living pressures for weaker buyer demand and fewer sales.

Annual house price falls were concentrated in Southern England, with London experiencing the biggest fall at -1.0%, along with the Eastern region. Scotland and the North West enjoyed the highest annual growth, at 1.7% and 1.2% respectively.

Housing associations cut home delivery to focus on existing stock

A report by specialist real estate lender Octopus Real Estate has found that affordable housing providers are reining in programmes due to rising build and finance costs, with a third of housing associations reporting a deficit of 11% to 25% on individual schemes.

The study, which took six months to complete, also revealed that many affordable providers are focussing on improving current housing stock, with spend on repairs and maintenance leaping from £5bn in 2018 to £6.5bn in 2022.

When considering the competing pressures in the affordable housing sector, it’s clear that a crucial decision needs to be made.

Jack Burnham, Head of Affordable Housing, Octopus Real Estate

Registered providers can continue business as usual and hope for increased grant rates from government, or they can look for innovative solutions — as they have done in the past — which can help deliver the homes the country needs.

Consensus suggests that registered providers are now looking towards equity partnerships as a solution.