Market slowdown pushes companies into critical status

A new report has found that the ongoing housing slump, along with rising mortgage rates and cost of living, has pushed almost 6,000 construction companies to the edge of going bust.

The paper, by business recovery specialist Begbies Traynor, has revealed a marked increase in the number of businesses in ‘critical’ financial distress since the second quarter of the year, with an increase of almost 25% to 37,722 businesses in Q3.

The number of construction firms marked as being in critical financial distress has increased by 46% over the same period, with over 70,000 companies listed as being in ‘significant’ financial distress.

The construction industry, which has long been a bellwether for the health of the economy, looks particularly vulnerable with over 70,000 firms now in significant financial distress and circa 6,000 in much more serious critical financial distress – often a precursor to formal insolvency.

Julie Palmer, Partner, Begbies Traynor

These businesses must now struggle through a period of inflation-eroded margins, weak demand and a looming recession. It is likely to be an insurmountable task for many.

Meanwhile, a similar report by EY-Parthenon has found that UK-listed home construction and household goods companies, which include housebuilders, have issued ten profit warnings in the past year.

A fifth of the 76 companies across all sectors who issued a profit warning in Q3 2023 cited the weaker housing market as being a key contributor.

House prices rise in October, but fall over the year

Nationwide and Zoopla both published their house price index for October this week.

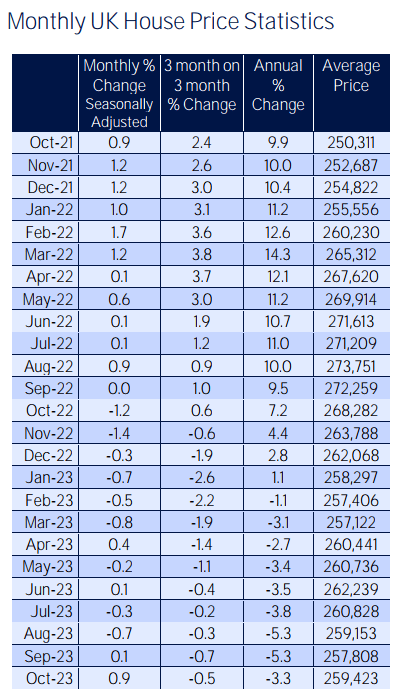

First, Nationwide cited a 0.9% rise in property values in the month, with the average home valued at £259,423. However, house prices fell by -3.3% over the year; a slight improvement from -5.3% in September.

The uptick in house prices in October most likely reflects the fact that the supply of properties on the market is constrained. There is little sign of forced selling, which would exert downward pressure on prices, as labour market conditions are solid and mortgage arrears are at historically low levels.

Robert Gardner, Chief Economist, Nationwide

Activity and house prices are likely to remain subdued in the coming quarters.

Meanwhile, Zoopla has revealed that house prices declined by -1.1% in the year to October, down from 9.6% in October 2022.

The property firm also found that buyer demand is a fifth lower than at this time last year, and 25% below the five-year average for October, as buyers bide their time and wait for a clearer market outlook.

Zoopla have predicted a -2% fall in house prices during 2024, but rising incomes will improve affordability.

Surveyors report worst result since pandemic

The latest economic bulletin from the Royal Institution of Chartered Surveyors (RICS) has shown a net balance of -10% of respondents reporting a decrease in housing activity in Q3 2023 – the worst result since the early months of the Covid-19 pandemic.

A drop in housebuilding and current financial challenges have seen UK construction workloads turn negative in July to September of this year.

The net balance for the housebuilding sector has fallen from -12% in Q2 2023 to -26% in the third quarter.

In addition, just over half of the contributors to the survey cited labour supply as an issue, with trades such as bricklayers, carpenters, plumbers and electricians presenting the greatest issues.

Only one-third of respondents anticipate an increase in productivity over the course of next year.

The latest reported drop in housebuilding highlights the urgency to launch a structured, holistic plan for tackling the housing crisis.

Sam Rees, Senior Policy Officer, RICS

While the government’s recently announced intention to meet its target of one million new homes before the end of this parliament is laudable, detail on how this will be achieved is still missing.

Meanwhile, housing transactions have fallen by -19% over the year, according to latest data from HM Revenue and Customs.

Figures published estimate 92,600 transactions (non-seasonally adjusted) for September; a -2% fall in the month. Bank of England figures also showed mortgage approvals falling in September to their lowest level since January 2023.

Construction material prices continue to fall

Latest figures from the Department for Business and Trade have found that construction material prices fell by -1.8% in September when compared to the same month in 2022.

The decrease was driven by falls in imported sawn or planed wood (-16.7%), concrete reinforcing bars (-29.0%) and fabricated structural steel (-28.4%).

However, doors and windows increased by 19.0% over the year, with ready-mixed concrete costs rising by 14.4%.