Lee Rowley steps back into cabinet role

Lee Rowley has been appointed Housing Minister in the latest Government reshuffle, replacing Rachel Maclean, who held the post for nine months.

Rowley becomes the 16th Housing Minister since 2010, when the Conservative party came to power, and returns to the role after briefly serving in this position under Liz Truss.

Rowley has been a Conservative MP for North-East Derbyshire since 2017.

Stewart Baseley, Executive Chairman of the Home Builders Federation, said “the revolving door of Housing Ministers spins yet again”, describing the move as “disappointing” and adding that “clear policy direction” was needed.

CMA considers planning reform

The Competition and Markets Authority (CMA) has published two working papers on the planning system and land banking, as part of its ongoing study into the housing industry.

The CMA report on planning highlights areas of concern, including the cost, length and complexity of the planning process, and calls for more support and resource.

It is necessary to consider whether the design and operation of the planning system could be reformed in a way that would better support the aggregate level of housebuilding that policymakers are seeking to achieve whilst aligning with other societal goals.

Planning Working Paper, CMA

The CMA is proposing a number of planning reforms, such as introducing permitted development zones where full planning applications are not required, and allowing sites within local plans to be approved without needing to undergo the full planning process.

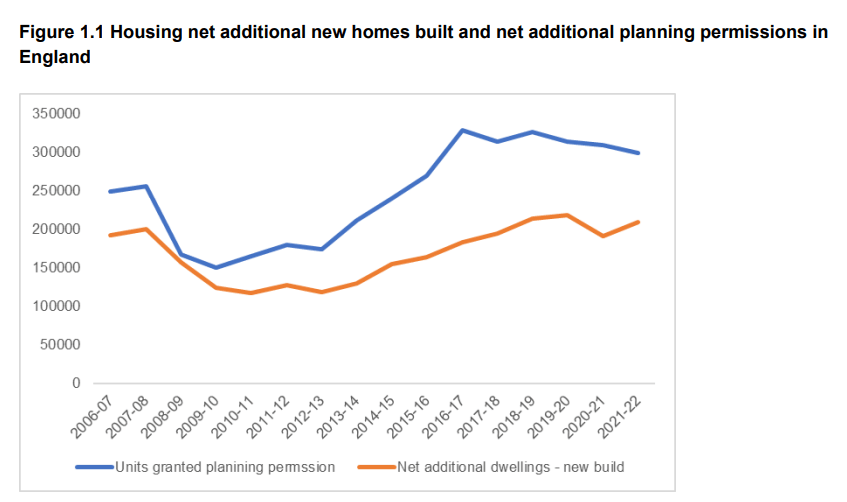

The paper also acknowledged that planning permissions must remain well above the construction target of 300,000 units per year, as some permissions will lapse or result in reapplications.

The CMA’s paper on land banking reveals that eleven housebuilders collectively own or control around 1.17 million plots across England, Scotland and Wales.

Around 658,000 of these homes are on land without planning permission, with 522,000 in short-term land banks which have some level of planning permission.

The CMA is requesting feedback on its land bank analysis, to understand whether competition in some areas is being constrained by a small number of developers owning the majority of land.

Rightmove forecasts ‘better-than-predicted’ year

Rightmove has published its house price index for November, revealing that 2023 may be a better year than many predicted.

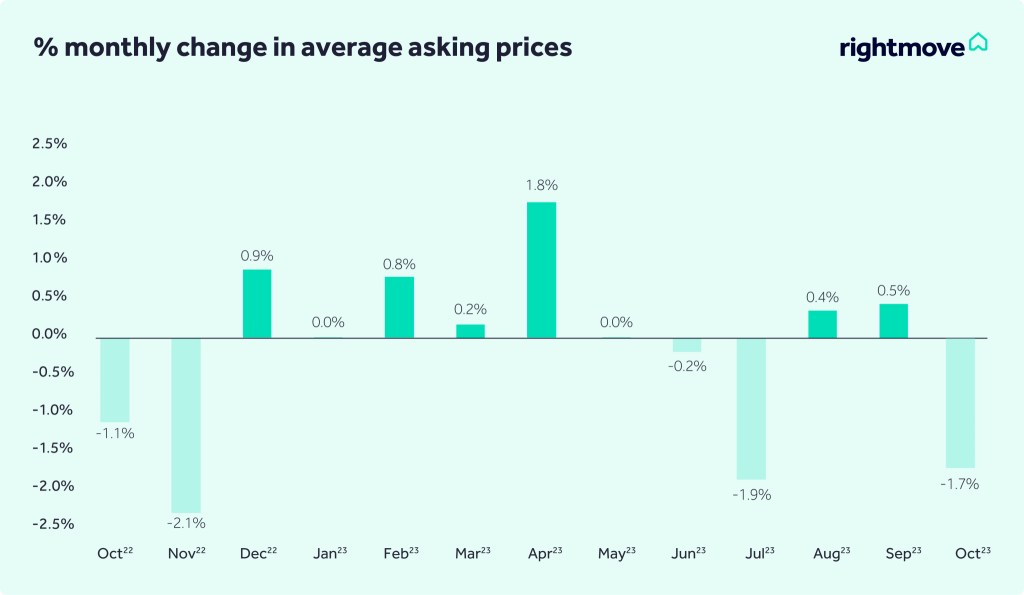

Despite a -1.7% fall in house prices in the month – the largest November fall in five years – property values are just -3% below May’s peak, and sales agreed are just -10% below 2019’s market level.

This is an improvement on October’s sales, which were -15% below 2019 level.

The average property is now valued at £362,143.

The larger than usual drop this month signals that among the usual pricing seasonality, we are starting to see more new sellers heed their agents’ advice and come to market with more enticing prices to stand out from their over-optimistic competition.

Tim Bannister, Director of PRoperty SCience, Rightmove

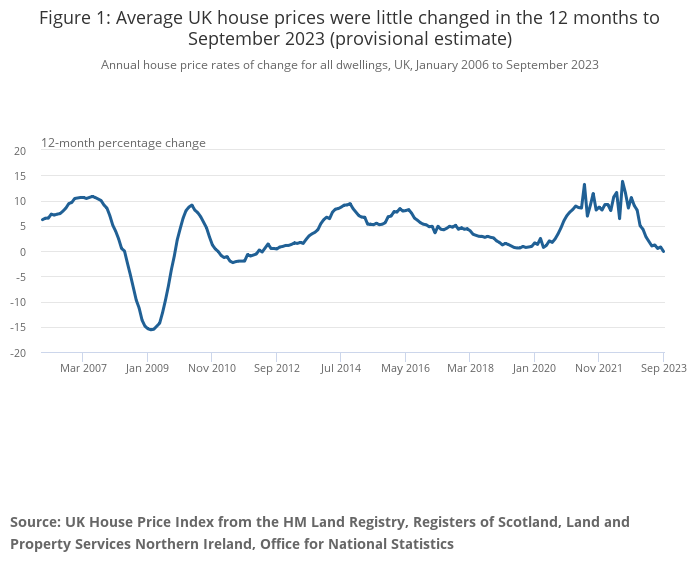

Meanwhile, official Office for National Statistics data for September has found that average UK house prices decreased by -0.1% over the year.

This is down from -0.8% over the twelve months to August 2023, and brings the average property value to £291,000.

Average house prices fell by -0.5% over the year in England and -2.7% in Wales, but rose by 2.5% in Scotland and 2.1% in Northern Ireland.

The North-East region enjoyed the largest annual house price increase, at 1.6%. The South West experienced the largest decrease, at -1.6%.

Crest Nicholson downgrades profit expectations

Housebuilder Crest Nicholson has published a trading update for the year ending 31 October 2023, revising its pre-tax profit to be in the range of £45m to £50m, down on the £50m quoted by the firm in August.

The developer also announced a ‘streamlining’ of operations, including moving its East Anglia division, established in 2022, into its Eastern division.

We expect the housing market will remain challenging as we head into 2024 with elevated interest rates remaining in place until inflation comes back down to its target level.

Peter Truscott, Chief Executive, Crest Nicholson

In addition, the absence of any Government support for first time buyers, coupled with higher borrowing costs continues to impact affordability.

Build-to-rent sector grows 11%

Research by the British Property Federation has found that the build-to-rent sector has grown by 11% in a year, despite challenging economic conditions.

The total number of homes completed and in the pipeline across the UK has increased to more than 263,000.

However, build and finance cost increases have impacted delivery in London, with just 434 units started in Q3 2023.

Meanwhile, the Regulator of Social Housing (RSH) has forecast a -25% decrease in the number of homes developed by social housing providers over the next five years.

The RSH’s annual risk profile for 2023 has warned providers to ensure they manage sales and development risks, as market decline continues.