Index shows month-on-month price increase

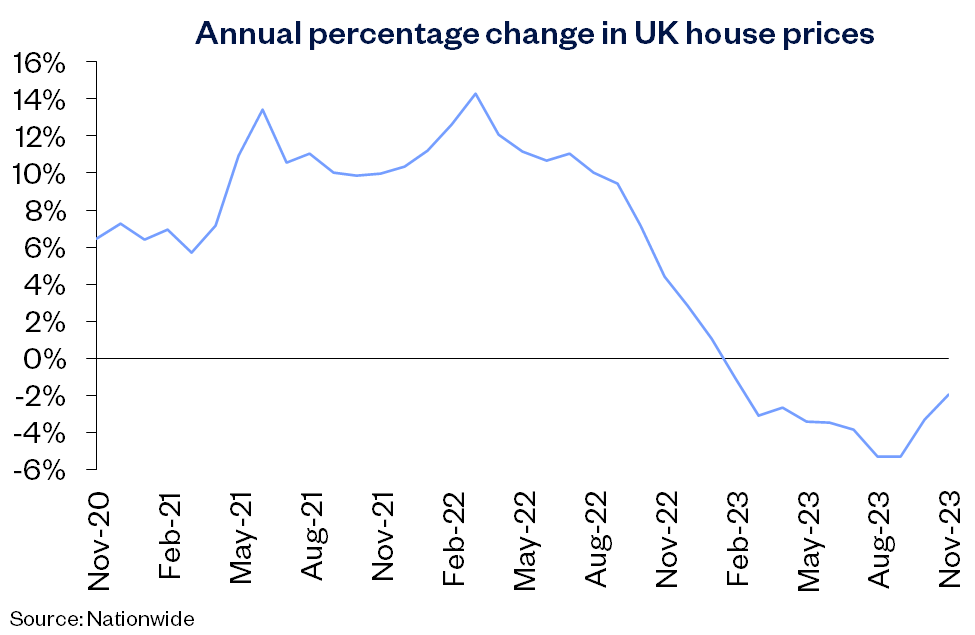

Nationwide has published its house price for November, revealing a modest 0.2% month-on-month rise in November; the third successive monthly increase.

And, whilst growth over the year remained weak at -2.0%, it marks the strongest annual reading since February 2023.

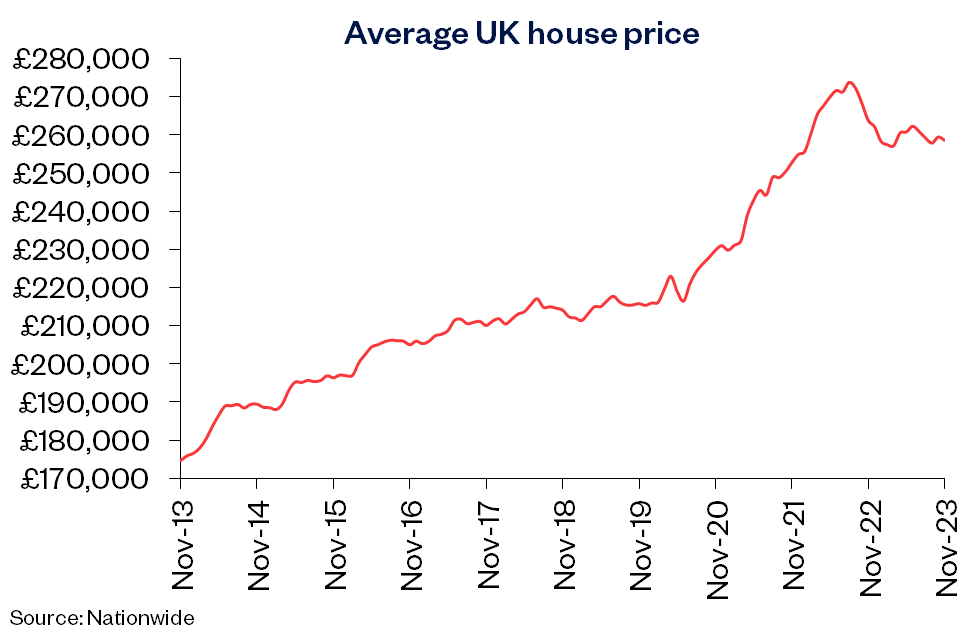

The average UK property is now valued at £258,557.

Robert Gardner, Chief Economist at Nationwide, is cautiously optimistic about the coming months.

While mortgage rates are unlikely to return to the lows prevailing in the aftermath of the pandemic, modestly lower borrowing costs, together with solid rates of income growth and weak/negative house price growth, should help underpin a modest rise in activity in the quarters ahead.

Nevertheless, a rapid rebound still appears unlikely. Cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, but consumer confidence remains weak, and surveyors continue to report subdued levels of new buyer enquiries.

Robert Gardner, Chief Economist, Nationwide

Meanwhile, Zoopla has revealed that the average house price in the UK is £264,400, with property prices falling by -1.2% compared to a year ago.

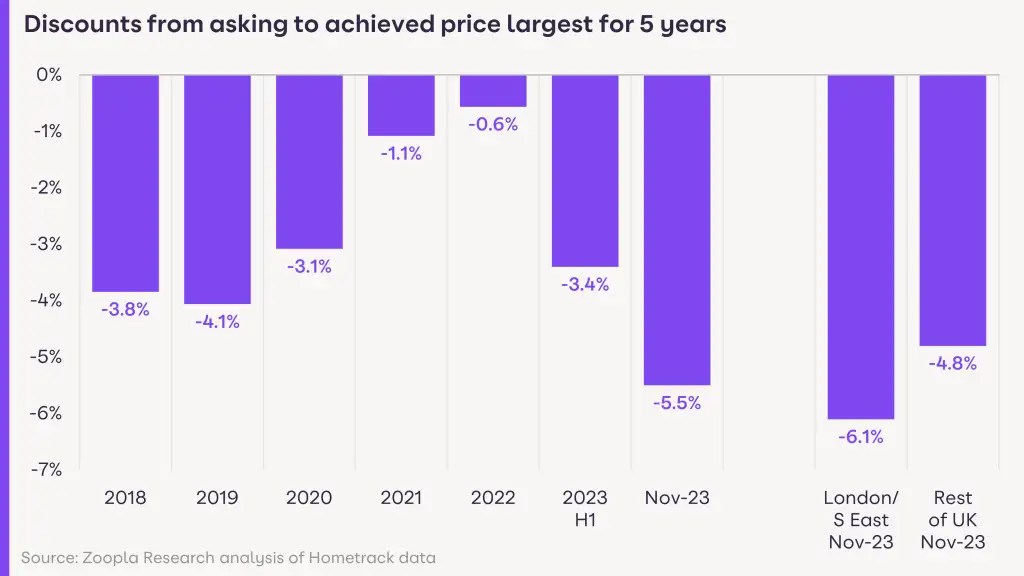

The property website also reported that the average discount is 5.5%, or £18,000 – the highest in five years.

The number of homes for sale per estate agent is now at its highest for six years, giving buyers more negotiating power.

The firm also forecasted continued house price falls in 2024, despite an anticipated reduction in mortgage rates.

More than 212,000 new homes built last year

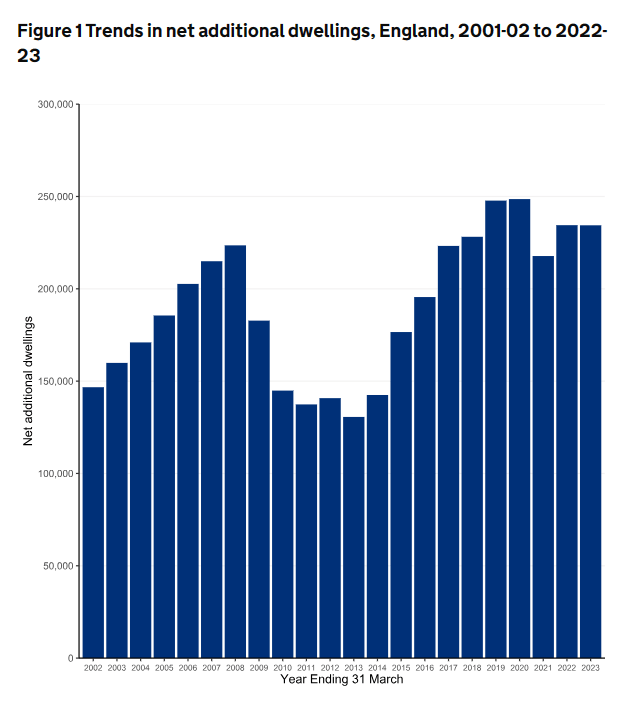

Official Government figures have revealed that 212,570 new homes were built in 2022/23 – an increase of 900 on the previous year but still significantly below the 300,000 per year target.

Net additional dwellings, which include changes of use and other conversions, totalled 234,400, marking a 0.9% increase on the previous dwelling stock estimate of 25.2 million homes in March 2022.

Meanwhile, Homes England has launched an awareness campaign to support small and medium-sized developers to access funding.

‘We fund it, you build it’ provides development loans from £250,000 to over £10m.

Construction boomed in 2022, but insolvencies rose

Official data from the Office for National Statistics has revealed that the value of construction new work in Great Britain increased to a record high of £133,989m in 2022, driven by growth in both the public and private sectors.

However, the construction industry saw a 59.4% annual increase in the number of recorded company insolvencies in 2022.

This was the highest of any industry, with construction firms contributed 18.8% of all insolvencies.

Builders’ merchant sales down in third quarter

Sales of building materials have continued to decline in the third quarter of 2023, according to the Builders Merchant Building Index (BMBI).

The amount of revenue taken was -3.3% lower in July to September 2023 than the same period a year ago, despite prices rising by 8%.

It has been another challenging quarter for the construction industry, particularly for the housebuilding sector and we can see this reflected in the Q3 BMBI results.

John Newcomb, Chief Executive, Builders Merchants Federation

Domestic RMI work has held up over the year providing some good news, but with higher interest rates set to remain the norm, it may be some time before the market returns to volume growth.