As we come to the end of a year fraught with difficulty, Housing View takes a look back at the last twelve months, and offers a prediction for the year ahead

It’s been a strange few years for the housing industry. The word ‘unprecedented’ has been tossed about, tagged to rampant cost inflation and a housing boom at a time when – if you adhere to the general rule that the housing market peaks and troughs every ten years – the industry should have been experiencing a slump.

In 2022 the industry was on the crest of an unexpected wave, a whirlwind of rising material and labour costs amidst booming sales rates and rising house prices; but then the now-infamous mini-Budget came in September, and the wave crashed dramatically back down to earth.

2023 therefore became a year of correction; some might say a welcome reset. A much-anticipated recession has thankfully been avoided, but a dramatic fall in private sales rates has seen housebuilders and developers circle the wagons and dust off the playbook from 2008: putting the brakes on buying new land; reducing costs wherever possible; switching private units into housing association or rental sector homes; and, of course, scything headcount in vast swathes of redundancies and organisational restructuring.

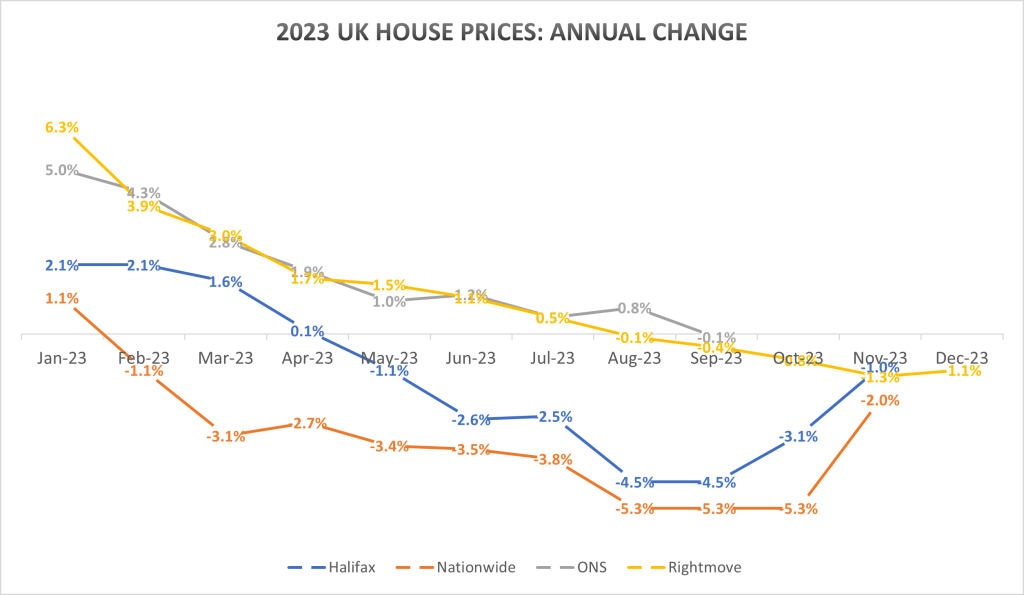

Amidst all this, house prices have held up remarkably well, ending the year around -1% to -2% lower than December 2022, when many expected double-digit falls.

However, whilst house prices remain fairly buoyant, the wider political environment has done little to support an industry facing swelling challenges. The King’s Speech offered barely anything; the Autumn Budget fell short of expectations. Housing bodies such as the Home Builders Federation have railed against a directionless Government characterised by U-turns which saw nutrient neutrality unlocked, and then locked again; back-benchers keen to appease a minority of NIMBYs thwarted any policies designed to release the red tape currently choking the sector.

A planning system already on its knees continued to buckle under the weight of applications; new labour drips instead of flows into the construction industry, with graduates and school leavers continuing to shy away from a glamourless sector which still hasn’t managed to shake its poor image.

But there are some chinks of light. Housing is fast-becoming the latest political gem, ahead of a much-anticipated General election next year, with the Labour party promising to ‘bulldoze’ restrictive planning rules. The need for somewhere to live continues to feature in the spotlight, with poor quality of existing stock and awful housing conditions regularly taking up column inches and forcing developers and associations to think more carefully about the quality of their build.

So, what will 2024 bring for the industry?

As far as house prices are concerned: not a lot, probably. Mortgage lenders and property websites are anticipating slight falls by the end of next year. Nationwide says that house prices will see “low single digit decline or remain broadly flat” in 2024; Halifax reckons a fall of around -2% to -4% by December.

It is anticipated that mortgage rates will continue to edge downwards, which may translate into some improvement in sales rates. Whilst this will be welcomed, developers will continue to monitor every penny in a suppressed market and contractors will trim prices to the bone in order to win new work, running the risk of financial distress at a time when insolvency levels are at a high.

The Conservative party is unlikely to introduce any significant policy to stimulate the housing market whilst in the shadow of a looming General election, and potential buyers may decide to bide their time while they wait to see who will occupy Number 10 in the coming months.

And, even if there are any stimuli to boost housing next year, the fundamental issues facing the industry still remain: a lack of housing stock is pushing house prices to even more unaffordable levels as the queue for housing waiting lists grows ever longer; planning decisions will continue to take too long, with small and medium-sized developers struggling with the exorbitant cost of submitting a planning application; the labour pool, vastly reduced due to Brexit, continues to age without enough new entrants. Whilst these challenges remain, we cannot expect to see any significant long-term improvement in the industry.

We should, then, expect 2024 to be a quiet year – verging on stagnation – as the industry holds its breath and hopes for meaningful change under a new Government, whilst still battling with challenges it has faced for most of the last decade.

It’ll be a case of ‘head down and carry on’, with the hopes that, now the powers that be are beginning to realise the importance of high-quality housing, there may be – just maybe – light at the end of the tunnel.