Long-awaited NPPF revision confirms target removal fears

Levelling Up Secretary Michael Gove has confirmed that housing targets for local authorities will be scrapped.

Unveiling the revisions to the National Planning Policy Framework at the Royal Institute of British Architects this week, Gove stated that the standard method for calculating housing need had always been advisory.

At the same time, Gove emphasised that he would crack down on local authorities which fell behind local plans, stating that there would be “no excuse” for councils not to have plans in place.

Gove also announced plans to publish league tables to reveal the actual performance of local authorities.

And because we have listened to thoughtful and measured concerns about how the planning system has worked, and made sensitive, practical, improvements, there is now no excuse for any local authority not to have a plan in place, no excuse not to ensure that homes are delivered swiftly and efficiently through that plan, and no excuse for leaving communities – and the next generation – without the homes they need.

Michael Gove, Secretary of State for Levelling Up, Housing and Communities

The news was met with dismay from the housing industry, with the Home Builders Federation calling the move “extremely damaging.”

They said: “Already we are seeing housebuilding and planning permission levels tumble as a direct result of the government’s approach and further falls are now inevitable.

While the announcement today does include some modest improvements to the planning process, most are simply threats that will not make a difference in the short term.”

Other organisations, such as the Royal Town Planning Institute (RTPI), were more positive.

It was encouraging to see the Minister stand up not just for the important roles planners play in Local Authorities, but call for greater respect and status of planners generally.

Victoria Hills, Chief Executive, RTPI

We believe a robust and transparent planning framework is essential to address the climate emergency and housing shortages and create sustainable, thriving environments for current and future generations.

The government also confirmed this week that it will not pursue legislative routes to tackle nutrient neutrality.

The Department for Levelling Up, Housing and Communities (DLUHC) admitted that current and planned measures may not be enough to release all the homes locked by nutrient neutrality measures.

Instead, it said that it would “now focus on making rapid progress in unlocking homes. In the immediate term, Natural England will continue to deliver the £30m Nutrient Mitigation Scheme.”

Meanwhile, Labour announced that it would reverse planned changes to the NPPF on its first day in government.

Planning permissions reach new low

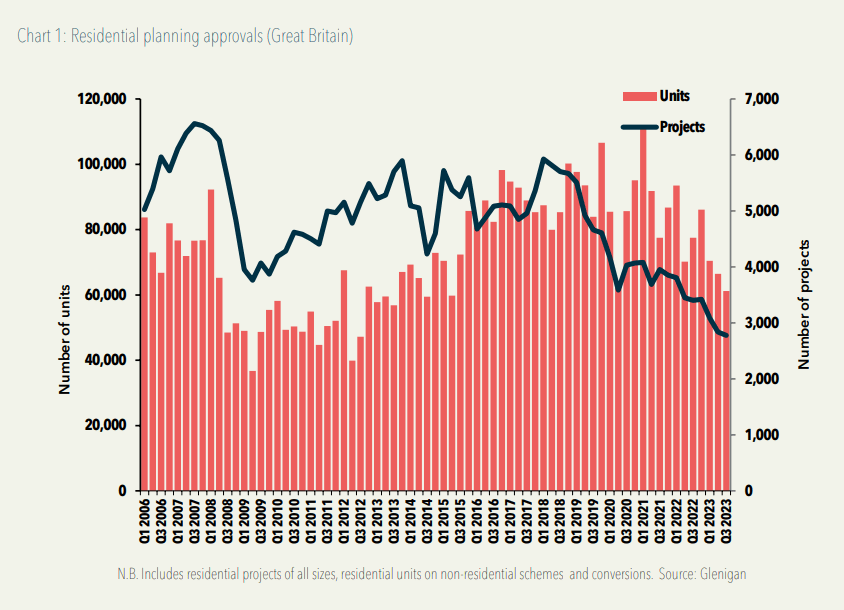

The Home Builders Federation has revealed that the number of planning permissions granted in the past twelve months has dropped to the lowest quarterly figure since their reports began.

The Housing Pipeline Report for Q3 2023 has found that 2,778 developments were granted planning permission – a reduction of -2% on the previous quarter, and -18% down on the same period last year.

Around 50,000 homes were granted permission in England during the third quarter of 2023; a reduction of -12% on the previous quarter, and -28% lower than Q3 in 2022.

This is the inevitable outcome of several years of anti-growth policy and rhetoric.

Stewart Baseley, Executive Chairman, Home Builders FEderation

Businesses have warned for some time that the impact of Government action would be severe but now there is now a mounting body of evidence.

If ministers continue with the proposals to rid the planning system of targets and consequences, no matter how it is packaged, it will result in fewer new homes and represents another victory for NIMBY backbenchers.

Home sales increase compared to last year

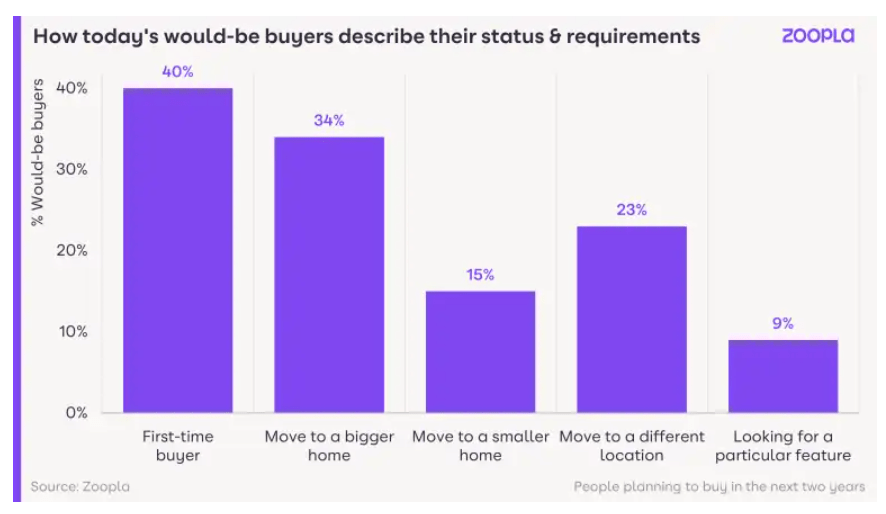

Zoopla has found that new sales are running 17% higher than a year ago, with demand also 19% higher.

The figures reflect improving buyer sentiment, with house price falls beginning to moderate as sales volumes improve.

The property website also predicted that – despite affordability challenges – first-time buyers will be the largest group of buyers in the next two years.

Zoopla also forecast the “steady momentum in new sales” to continue into early 2024, with house prices ending the year around -2% lower than in December 2023.

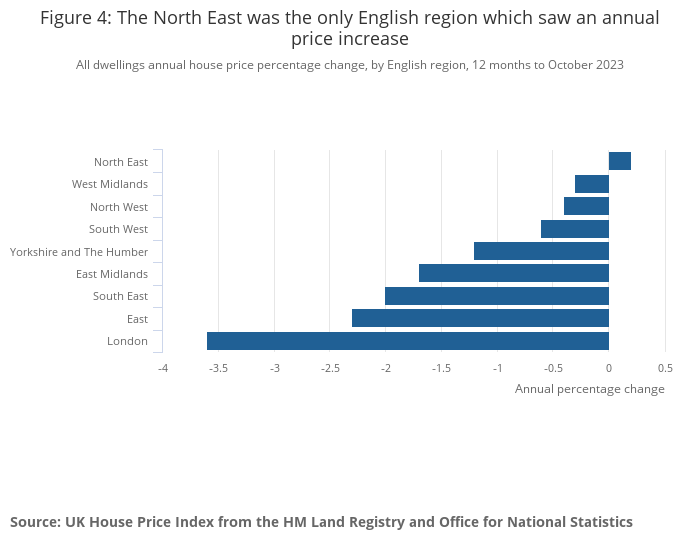

Meanwhile, the Office for National Statistics has reported that the average UK house price has fallen by -1.2% in the twelve months to October 2023.

The house price index, which uses data from the Land Registry, values the average property at £288,000; around £3,000 lower than a year ago.

House prices increased over the year by 0.2% in Scotland, but decreased in England (-1.4%) and Wales (-3.0%).

The North East was the only region which saw an annual price increase, posting a modest 0.2% increase.

London experienced the highest falls, at -3.6% over the year.

From April to September 2023 there were 11,530 housing starts and 11,297 completions delivered through programmes managed by Homes England.

In the same period last year, there were 14,899 housing starts and 12,377 completions.

Homes England have attributed the fall to “the ongoing effects of the economic downturn on the housebuilding industry.”

Mace predicts tender prices to ease in 2024

Cost consultancy Mace has said that tender price inflation will ease in 2024, with contractors becoming more selective over projects they bid for.

Mace have forecast national tender inflation of 2.5% in 2024, with 3.0% in 2025 and 2026.

Inflation reached 3.5% across the nation in 2023.

The firm’s Q4 Market View also reported that private housing output had decreased by -13.4% when compared to the third quarter of 2022.

There was also a warning of a rising number of insolvencies reducing the number of available subcontractors.

By making it harder to secure credit, the Bank of England has contributed to one of this year’s biggest problems for construction, which has been the high number of insolvencies.

Andy Beard, Global Head of COst and Commercial Management, MAce

Similarly, as the Monetary Policy Committee is unlikely to start easing interest rates anytime soon, we expect insolvencies to remain a problem for projects.