Starmer’s party supported by 70% of housebuilders

A survey by Knight Frank has revealed that 70% of housebuilders want to see the Labour party win the general election, believing that they would enhance the land and development market.

The remaining 30% of those surveyed backed the Conservatives, with none supporting the Liberal Democrats.

The quarterly report surveys fifty volume and SME housing developers, which build a combined total of 70,000 homes per year in England.

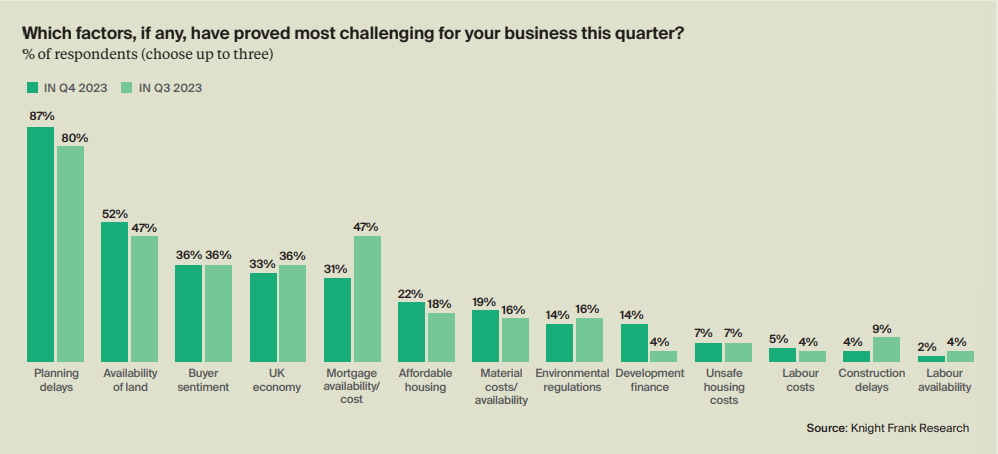

The firm’s Residential Development Land Index for Q4 2023 also found that a third of survey respondents believed that nutrient neutrality had affected the progress of their housing schemes, and 87% felt that planning delay was the biggest challenge to their business – up from 80% in Q3.

Meanwhile, Nationwide have sounded an “upbeat note”, revealing that house prices rose by 0.7% in the month of January, with annual house prices down by just -0.2%.

The mortgage lender values the average UK property at £257,656, and commented on signs of easing in affordability pressures.

There have been some encouraging signs for potential buyers recently with mortgage rates continuing to trend down.

Robert Gardner, Chief Economist, Nationwide

This follows a shift in view amongst investors around the future path of Bank Rate, with investors becoming more optimistic that the Bank of England will lower rates in the years ahead.

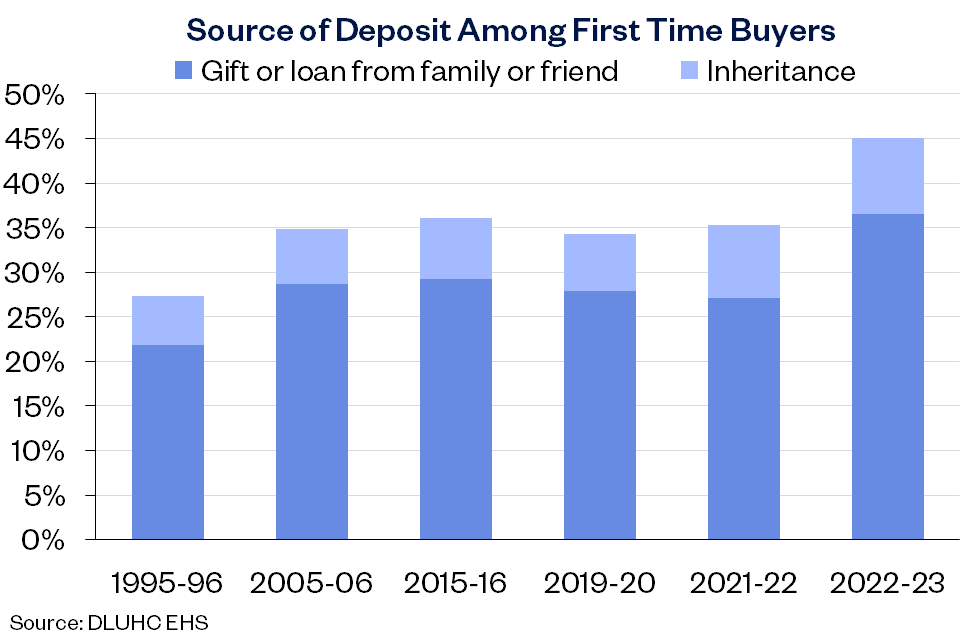

However, Nationwide did highlight the continued challenges around raising a deposit, with a 20% deposit on a typical first-time buyer home equating to around 105% of average annual gross income.

The house price to earnings ratio stood at 5.2 at the end of 2023; well above the long-run average of 3.9.

This is supported by research by mortgage firm Tembo, which has analysed Financial Conduct Authority data to reveal a 29% rise in the number of over-50s buying their first home between 2018 and 2022.

The number of 18 to 25-year-olds taking their first step on the property ladder fell by -8% over the same period.

A perfect storm of factors impacting first time buyer affordability means we’re now seeing a sharp rise in the number of people waiting until they’re aged 50 or over before they buy their first home.

Richard Dana, Chief Executive, Tembo

This is presenting a challenge to both the financial services industry and would-be home buyers, with many traditional high-street lenders not offering extended mortgage loan terms beyond the age of 75.

Meanwhile, mortgage approvals have risen for the third month in a row, according to Bank of England data.

The figures reveal a 2.3% increase in approvals during December, reaching 50,459 from 49,313 a month before.

Zoopla published their house price index for December 2023 this week, reporting a slowdown in the pace of annual house price falls.

The property website now values the average home at £264,400, with annual house prices falling by -0.8% over the year, compared to a -1.4% annual fall to October 2023.

The largest house price falls are in the East of England (-2.5%) and the South West (-2.2%).

CPA forecasts fall in housing output this year

The Construction Products Association (CPA) is predicting construction output to fall by -2.1% in 2024, dragged down by a -4% reduction in new-build private housing and repair, maintenance and improvement works.

However, the CPA forecasts a rise of 2% in construction output during 2025, amidst an expected recovery in the general economic climate.

The report references a 25% to 35% fall in demand last year, as reported by many housing developers, due to rising mortgage rates and regulatory issues around planning and nutrient neutrality.

Barratt CEO joins Business Council

David Thomas, Chief Executive of Barratt Developments, has joined the government’s newly-appointed 2024 Business Council.

The council of UK businesses will meet regularly with the Prime Minister to “share intelligence directly from the shop floor to help boost the UK economy and create jobs.”

Thomas commented: ““I welcome the chance to join the Prime Minister’s 2024 Business Council, the opportunity to share the challenges faced by all housebuilders and discuss solutions for a vital sector which provides the new sustainable homes the country needs and is a powerful driver of economic growth across the UK.”