Combined housebuilder set to build over 20,000 homes a year

Barratt has reached a £2.5bn deal to buy rival Redrow, in a deal which could see the combined business deliver around 22,000 homes a year on a turnover of over £7bn.

The combined business, to be named Barratt Redrow, will see each Redrow shareholder receiving 1.4 Barratt shares, with Barratt shareholders holding approximately two-thirds of the combined group.

The deal is expected to achieve cost savings of at least £90m, but could also see the loss of around 800 jobs and the closure of some business units.

This is an exciting opportunity to bring together two highly complementary companies, creating an exceptional homebuilder in terms of quality, service and sustainability, able to build more of the high-quality homes this country needs.

David Thomas, Chief Executive Officer, Barratt Developments

Both businesses are a great fit and there are many exciting opportunities to innovate and share knowledge across a range of different areas.

Matthew Pratt, Chief Executive Officer, Redrow

Meanwhile, housebuilder Bellway completed around 4,000 homes in the six months to 31 January 2024; a -28% reduction on the 5,695 homes built in the same period last year.

In a trading update, the firm stated that they expect to complete around 7,500 homes in the full year, compared to 10,945 the previous year.

This chimes with NHBC figures released this week, which showed that 133,213 new homes were completed in 2023; a reduction of -12% on 2022, at 151,308 homes.

Private sector completions took the brunt of the fall, down -20%, whilst homes completed in the rent and affordable sector jumped by 10% when compared to 2022, recording the highest figure ever logged by NHBC.

The data also showed a fall in new home registrations in 2023, down from 189,009 in 2022 to 105,449.

Semi-detached homes saw the largest number of registrations by house type, reaching 31,363 units, followed by detached homes and apartments. The humble bungalow continued to decline, with 1,466 registrations in 2023 (2022: 2,819).

Homes England have also confirmed that their Affordable Homes Programme is set to fall short of delivery targets.

Originally expected to deliver 180,000 homes, a report by the National Audit Office in 2022 forecast that completions would be around 30,000 homes fewer.

However, according to Building magazine, the Director of Affordable Housing at Homes England has confirmed that actual completions would be “some way” lower than this revised 158,000 target.

House prices rise in January

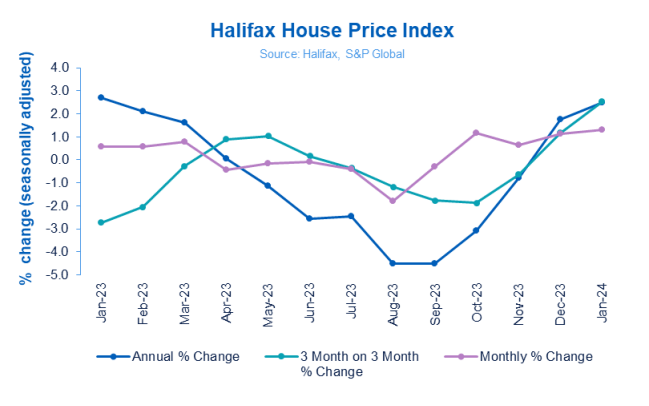

The Halifax has published its house price index for January, revealing a monthly increase of 1.3%, with the average property now valued at £291,029.

Property prices also grew annually by 2.5%; the highest annual growth since January 2023.

Northern Ireland recorded the strongest growth across all nations, with annual house prices rising by 5.3% to an average of £195,760. Scotland and Wales also enjoyed 4% growth.

While housing activity has increased over recent months, interest rates remain elevated compared to the historic lows seen in recent years and demand continues to exceed supply.

Kim Kinnaird, Director, Halifax Mortgages

For those looking to buy a first home, the average deposit raised is now £53,414, around 19% of the purchase price. It’s not surprising that almost two thirds (63%) of new buyers getting a foot on the ladder are now buying in joint names.

FMB reveals fall in enquiries

The Federation of Master Builders has reported that almost half of its members saw a fall in new enquiries in the last quarter of 2023.

The survey also found that 36% of members are still struggling to hire carpenters, with 34% experiencing challenges in sourcing bricklayers.

However, members did report an easing of material prices; but Chief Executive Brian Berry added: “As we head towards the general election, housing is increasingly becoming one of the major issues which will decide the outcome.

“With workloads and enquiries down, recruitment declining, and costs remaining high, the FMB survey is clear evidence that with the chancellor set to announce his latest budget in March, there is substantial need to reduce barriers to construction and provide financial support to SME construction firms facing tough economic conditions.”