Competition and Markets Authority targets eight developers

The Competition and Markets Authority (CMA) has published its long-awaited investigation into the housebuilding market in Great Britain, finding that the planning system and private estate management is “responsible for the persistent under-delivery of new homes.”

Highlighting five areas of concern, the CMA also stated that it would be looking more closely at eight housebuilders for potential ‘anti-competitive behaviour’, and has launched an investigation under the Competition Act 1998 into Barratt, Bellway, Berkeley, Bloor Homes, Persimmon, Redrow, Taylor Wimpey and Vistry.

The fines could reach up to 10% of global revenue, which would result in a combined maximum penalty of £2.5bn if they are found guilty.

Elsewhere in the report, the five areas of concern were:

- Planning, which takes too long to navigate and is too onerous, with under-resourced departments wrestling with incomplete or missing local plans and targets.

- Speculative private development, whereby developers manage the rate at which houses are build to avoid reducing prices.

- Land banks, although the CMA found that this was not a primary reason for the shortage of new homes.

- Private estate management, with many developments containing privately owned public amenities, with several providing an unsatisfactory service and low levels of maintenance, with charges being unclear.

- Quality, with the CMA finding that there are few incentives for housebuilders to build to high levels of quality, and purchasers do not have clear routes of redress.

Our report – which follows a year-long study – is recommending a streamlining of the planning system and increased consumer protections. If implemented, we would expect to see many more homes built each year, helping make homes more affordable.

We would also expect to see fewer people paying estate management charges on new estates and the quality of new homes to increase.

Sarah Cardell, Chief Executive, CMA

The housebuilding industry broadly welcomed the report, with Stewart Baseley, Executive Chairman of the Home Builders Federation, stating: “We welcome recognition that the planning system is a fundamental barrier to delivery and adds unnecessary delay and cost into the development process, and the need for local authorities to have plans in place and properly resourced planning departments. We also welcome the CMA’s recognition that housebuilders do not land bank unnecessarily.

“We welcome recognition that quality of new build homes has improved in recent years and fully support moves to protect consumers with a single consumer code and New Homes Ombudsman, something the majority of the industry has already signed up for voluntarily.”

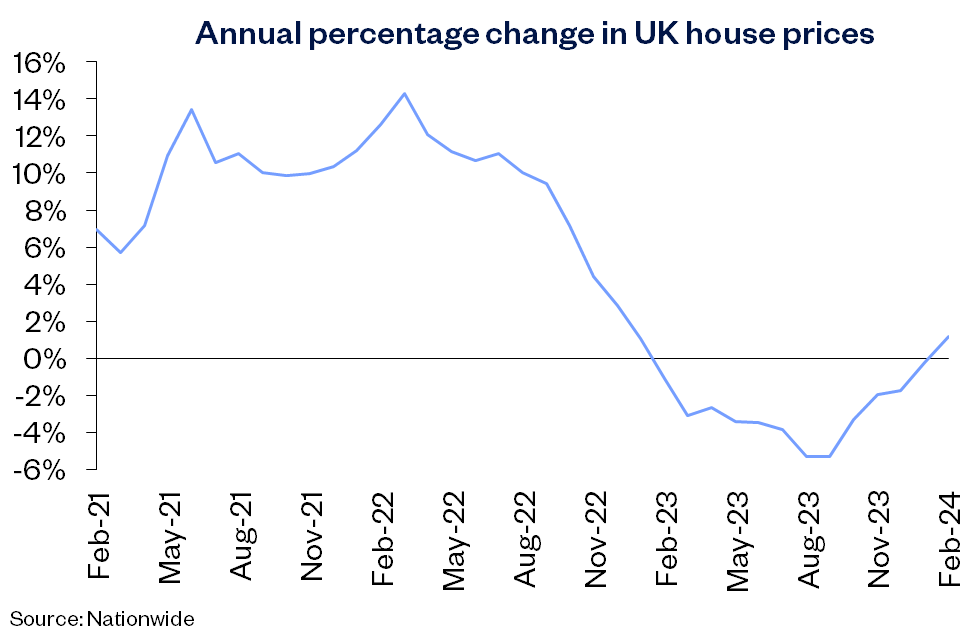

Annual house price growth finally turns positive

The latest house price index from Nationwide has revealed that annual house prices in February entered positive territory for over a year, reaching 1.2%.

A 0.7% increase in the month sees the average property valued at £260,420 (Jan: £257,656).

Robert Gardner, Chief Economist for Nationwide, noted signs of easing in affordability pressures, commenting: “The decline in borrowing costs around the turn of the year appears to have prompted an uptick in the housing market.

“Indeed, industry data sources point to a noticeable increase in mortgage applications at the start of the year, while surveyors also reported a rise in new buyer enquiries.”

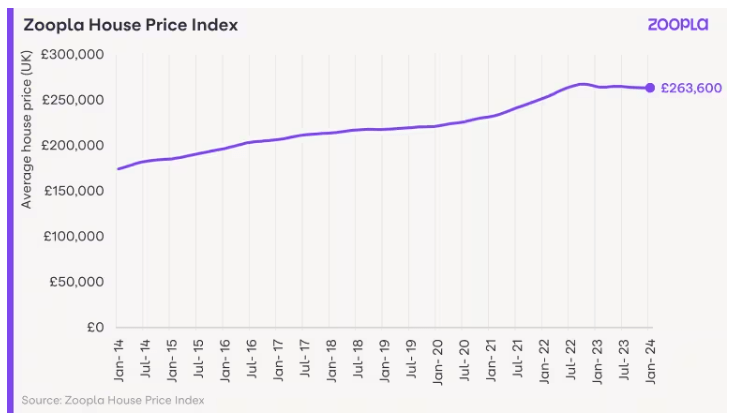

Meanwhile, property website Zoopla have reported no change in house prices, with the average UK property price remaining at £263,600 in January – a slight fall of -0.5% over the year.

Five regions in the south of England are experiencing house prices fall over the year, led by the East of England (-2.1%), followed by South East, South West, London and the East Midlands.

Seven regions are enjoying annual property price growth, led by Northern Ireland (4.3%), with Wales, the West Midlands and Yorkshire and Humber with the lowest growth, at 0.3%.

Building more social housing could boost British economy

A report commissioned by the National Housing Federation (NHF) and homelessness charity Shelter has found that building 90,000 new social homes a year could benefit the economy by over £50bn.

The report also states that building this amount of new social homes would yield a combined socioeconomic value of £86.5bn over 30 years, and support over 139,000 jobs in the first year alone.

This research shows not only that the housing crisis can be solved, but that this can be done in a way that will save the taxpayer money, boost jobs and bring huge benefits to the wider economy.

Kate Henderson, Chief Executive, National Housing Federation

Taylor Wimpey operating profit almost halved

Housebuilder Taylor Wimpey published its final results for 2023 this week, revealing a -49% fall in operating profit when compared to the previous year.

However, this was at the top end of the developer’s expectations, with the firm reporting “encouraging signs of improvement” in the housing market.

Full-year operating profit was £470m (2022: £923m), with 10,438 homes completed in the year.

Meanwhile, construction materials distributor Brickability has warned that falling sales will take longer than expected to recover, amidst a faltering housing market.

In a trading update, the firm said it would “assume a more conservative profile for the Group’s recovery over the next twelve months”, with market volumes for bricks in the UK down by around -30% in 2023 than the previous year.