Buyer demand and prices improve

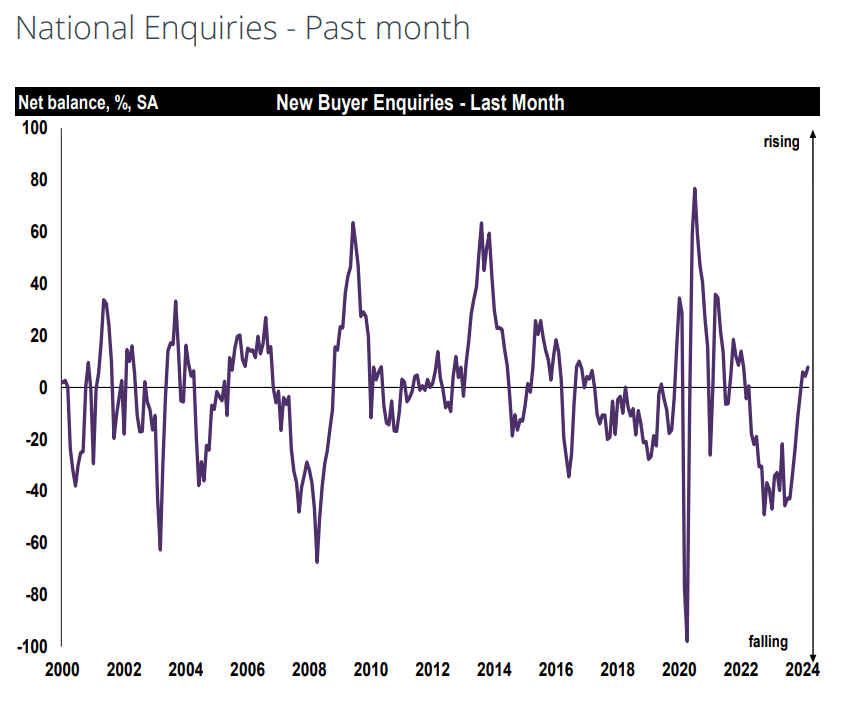

The RICS UK Residential Market Survey for March has posted a net score of +8% for new buyer enquiries in the month – the most positive result since February 2022.

The supply of new properties onto the market also increased for the fourth successive month, with a net score of +13%, and a net balance of +13% also forecasting rising sales volumes in the coming quarter.

And a net balance of +46% of respondents forecast a rise in sales activity over the next twelve months; an increase from +42% in February.

And, in further good news, it looks as though house prices have stabilised, with forward-looking metrics suggesting an upward trend may emerge later in the year.

With the inflation backdrop turning a little less difficult of late, this has led to expectations that the Bank of England will be able to start lowering interest rates later in the year.

This should continue to support the market to a certain degree going forward.

Tarrant Parsons, Senior Economist, RICS

Homes England should “take more risk”

A report commissioned by the Department for Levelling Up, Housing and Communities (DLUHC) has declared that Homes England should be allowed to “take more risk” to make its programmes easily accessible to SMEs.

The Homes England Public Bodies Review also stated that the body should be “even bolder” in its role as master developer on large regeneration and placemaking schemes.

The publication also said that Homes England had “very materially underdelivered and/or underspent against targets” since 2020, and that the scale of these shortfalls had caused “tension” between the agency and DLUHC.

But the overall conclusion was that “England and the government need Homes England. It has the right powers and form, and most of the capability and tools to delivery better housing and better places.”

Heavy rain in February leads to output fall

Construction output fell by -1.9% in February due to poor weather and heavy rainfall, according to latest figures from the Office for National Statistics.

New work fell by -2.3% in the month, with repair and maintenance slipping by -1.4%.

Construction output is estimated to have decreased by -1.0% in the three months to February 2024, driven predominantly by a -3.0% fall in new work.