HBF report reveals £50m spend by local authorities

A freedom of information request by the Home Builders Federation (HBF) has revealed that local authorities have spent more than £50m of taxpayers’ money in the last three years on opposing new developments.

The money comprises spending by councils and the Planning Inspectorate, a DLUHC agency which is responsible for dealing with appeals.

The news comes amidst a steep drop in housing supply, with planning permission numbers plummeting and over 60 local authorities withdrawing plans for new housing.

Nine of the ten biggest spenders are in Southern England, with Medway Council spending a total of £680,000 over three years.

Local Authorities should be putting plans in place that provide the number of homes their communities need. Doing so provides certainty for builders and residents alike and would avoid Local Authorities wasting council taxpayers’ money on spurious, politically-motivated legal challenges to new developments.

Stewart Baseley, Executive Chairman, Home Builders Federation

Meanwhile, housing delivery in England is set to fall to its lowest in ten years, according to real estate agency Savills.

A combination of lower demand for new homes, a reduction in planning consents and a reduced ability to deliver affordable housing means that new homes delivery from 2024/25 could lead to an average of 170,000 homes being built per year.

And, due to a “poorly performing” planning system and the discontinuation of Help to Buy, new private home sales would only generate around 100,000 new homes a year during the second half of this decade.

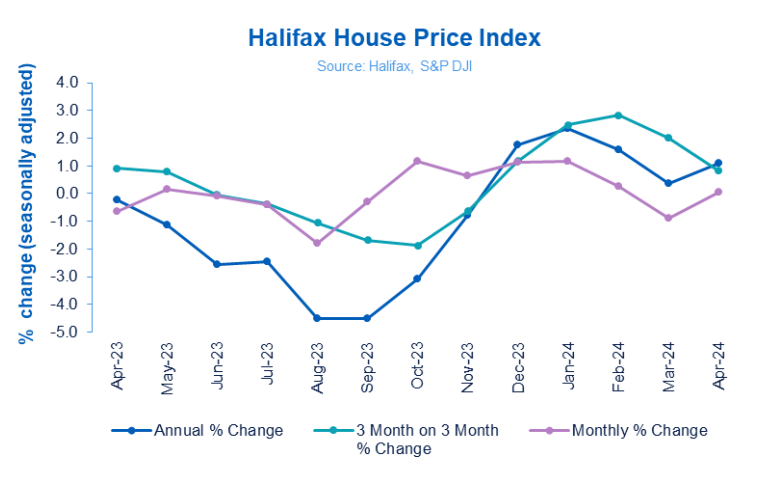

House prices hold steady in April

House prices rose by 0.1% in April according to mortgage lender Halifax, with annual property values rising by 1.1% over the year.

The typical UK home now costs £288,949 in April, compared to £288,781 in March.

Northern Ireland remains the strongest performing nation or region in the UK, with house prices rising by 3.4% on an annual basis in April.

Prices in Wales grew by 1.1% over the year, with Scottish house prices rising by 1.5% in twelve months.

This reflects a housing market finding its feet in an era of higher interest rates. While borrowing costs remain more expensive than a few years ago, homebuyers are gaining confidence from a period of

Amanda Bryden, Head of Mortgages, Halifax

relative stability.

Activity and demand is improving, evidenced by greater numbers of mortgage applications so far this year, while at an industry level mortgage approvals have reached their highest

point in 18 months.

Decline in new work drives falling construction output

Construction output in Great Britain fell by -0.9% in the first three months of 2024, according to official Office for National Statistics figures.

The fall was primarily driven by a reduction in new work (-1.8%), with anecdotal evidence suggesting that heavy rain decreased output and delayed production.

This first-quarter drop of -0.9% matched the final quarter of 2023, which saw the same reduction when compared to Q3 2023.