Construction output grows for third consecutive month

A leading construction index has revealed that growth in the UK construction sector gained momentum during May, with all three monitored categories – housing activity, commercial activity and civil engineering – returning to growth.

The S&P Global UK Construction Purchasing Managers’ Index registered at 54.7 in the month, up from 53.0 in April, with any value over 50.0 indicating growth in output.

Construction firms also signalled a marked improvement in the availability of subcontractors in May, amidst improving supply chain conditions.

The UK construction sector looks to be building good momentum as we approach the middle of 2024, highlighted by activity increasing at the fastest pace in two years during May.

Andrew Harker, Economics Director, S&P Global

Particularly pleasing was the broad-based nature of the rise in activity as work on housing projects increased for the first time in more than a year and a half.

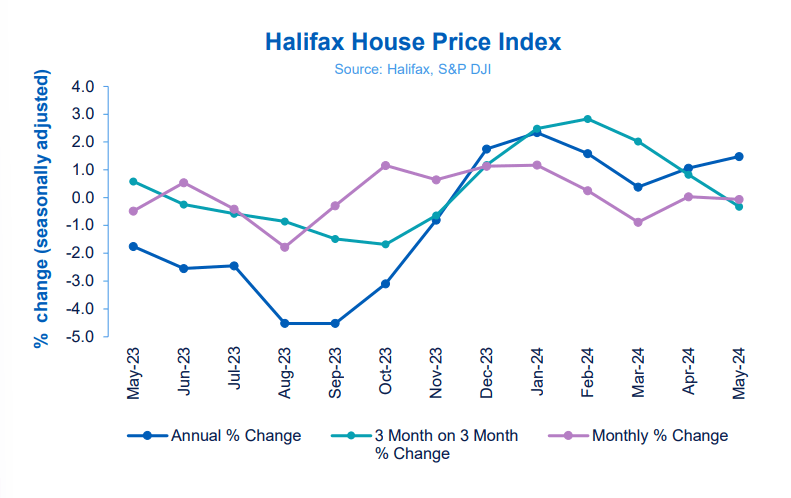

House prices remain stable in May

Data from mortgage lender Halifax has found that the average UK property value slipped slightly in May, down -0.1% from the previous month.

However, the annual rate of house price growth rose from 1.1% in April to 1.5% last month.

The typical UK home now costs £288,688, with the North West enjoying the strongest price growth of any nation or region, at 3.8% over the year.

Prices in Northern Ireland also rose by 3.2%, with Scotland (1.9%) and Wales (0.7%) also registering annual growth.

A period of relative stability in both house prices and interest rates should give a degree of confidence to both buyers and sellers.

Amanda Bryden, Head of Mortgages, Halifax

While homebuyers and those remortgaging will continue to respond to changes in borrowing costs, set against a backdrop of a limited supply of available properties, the market is unlikely to see huge fluctuations in the near term.

Bellway enjoys “robust” spring selling season

Developer Bellway has issued a trading update, reporting that during the period from 01 February to 02 June 2024, its private reservation rate per outlet per week rose to 0.62 – a 6.9% increase against the equivalent period in 2023.

The housebuilder also experienced “robust” spring trading, with customer demand strengthening due to mortgage interest rates and inflation stabilising.

The firm is on track to deliver 7,500 homes in the full year, and is poised to return to growth in its 2025 financial year.