Speech brings forward Planning and Infrastructure Bill

The housing sector has reacted positively to the King’s Speech, which saw the new Government commit to a Planning and Infrastructure Bill to unblock stalled developments.

The Bill aims to accelerate housing and infrastructure delivery by streamlining the planning process, enabling more effective land assembly, and “in doing so speeding up housebuilding and delivering more affordable housing”.

The Speech came after Deputy Prime Minister and Housing Secretary Angela Rayner urged council leaders in regions without devolved powers to “partner with the Government to deliver the most ambitious programme of devolution this country has ever seen”.

In a letter to local leaders, Rayner encouraged local councils to take power over areas including housing, to “make decisions that benefit their communities better, while boosting economic growth and opportunity”.

Neil Jefferson, Chief Executive Officer of the Home Builders Federation, described the contents of the King’s Speech as “positive and welcome”, adding that “planning has been the biggest constraint on housebuilding in recent years and the measures proposed will address the main areas of concern by bringing more land forward for development more quickly.”

Stephen Teagle, Chief Executive Officer of Countryside Partnerships, said that “the measures announced today will help lay the foundations needed for long-term housing delivery beyond this term of Government.”

Other industry leaders, as quoted in Housebuilder, described the King’s Speech as “a big step forward for housing”, with one noting that “we’ve heard more positivity about housebuilding from the new Labour cabinet over the past two weeks than we got from the Tories during the past two years.”

Industry raises warnings to Government over future challenges

The positive reception to the King’s Speech and Labour’s first few weeks in power has been tempered by a number of warnings about issues faced by the sector, which could hamper the targeted delivery of 1.5 million homes over the next five years.

Savills highlighted the “fundamental challenge” of land supply in their quarterly analysis of the housing market, but noted a high level of confidence in the residential land market.

The real estate firm also found that land sales in the first half of 2024 were -21% below the three-year average, but that UK greenfield and urban land values “maintained their resilience” in the second quarter of the year.

Meanwhile, the Economics Director at the Construction Products Association has warned that “there just won’t be the people” available to meet housing targets.

Writing on LinkedIn, Noble Francis said that the Government will likely be hoping to build over 380,000 homes a year by the fifth year of parliament – an increase of 60% on the 234,400 net additions in 2023.

Francis pointed to a need for “new investment in skills and capacity” to get back to the levels of housebuilding seen before Covid, and noted that there were 2.08m people employed in construction in the first quarter of 2024, an annual reduction of -1.4%.

Finally, the Climate Change Committee has published a list of ten recommendations to the new Government, including the removal of planning barriers for heat pumps and electric vehicle charge points.

The firm noted that approximately 10% of existing homes in the UK will need to be warmed by a heat pump by 2030, compared to just 1% today.

House prices increase to May

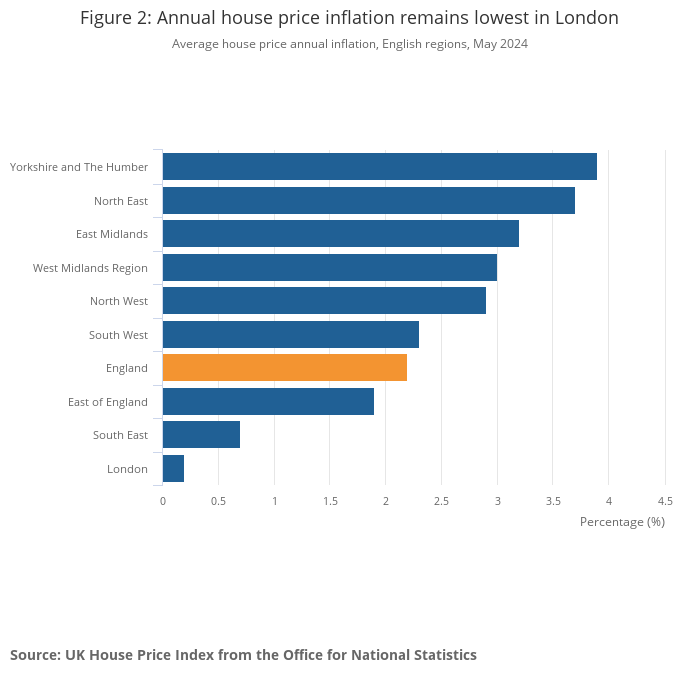

Latest figures from the Office for National Statistics have revealed that the average UK house price rose by 2.2% over the year to May 2024; an increase on the 1.3% rise seen in the twelve months to April.

The average house price in England is estimated at £302,000, whilst house prices in Wales have risen by 2.5% over the year. Scotland has enjoyed house price rises of 2.5%, and Northern Ireland at 4.0%.

Yorkshire and the Humber saw the largest annual house price inflation of all English regions, at 3.9%.

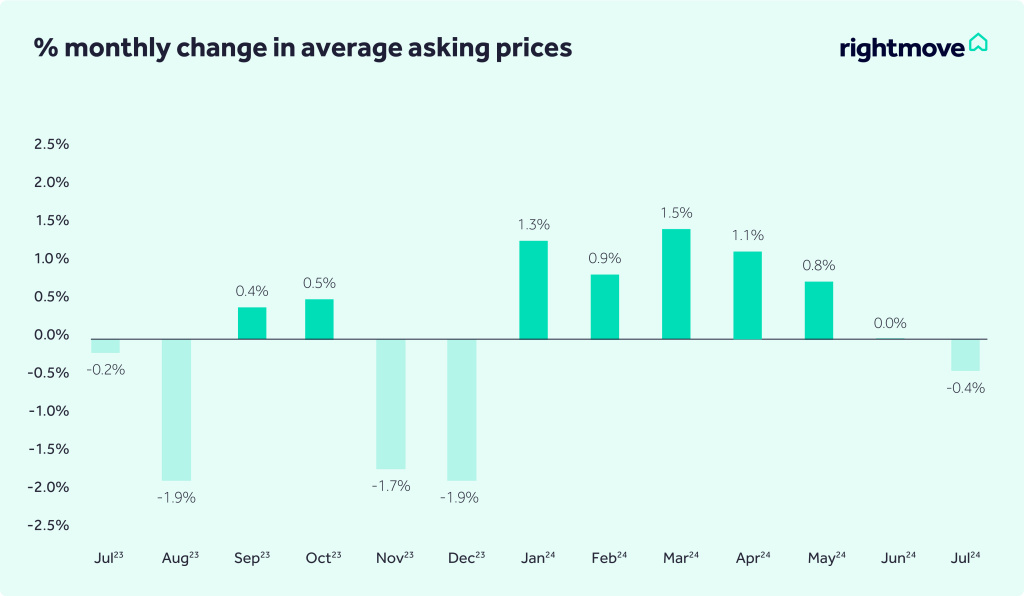

Meanwhile, Rightmove has reported a fall of -0.4% in asking prices during July, as sellers take action to tempt buyers distracted by the General Election and sporting events.

However, the number of new sellers to market remains at around 3% above levels seen in 2023, with the number of sales agreed reaching 15% above a year ago.

With many areas of the market that could be improved, we hope that the new government is able to get on with its plans and deliver sustainable housing policies that help the market in the medium to longer-term.

Tim Bannister, Director of Property Science, Rightmove

One area of the market in need of more support is first-time buyers, many of whom have been stretched to the limit by high mortgage rates, with some also facing higher stamp duty fees when the current thresholds are set to revert in March 2025.

Avant discovers balance sheet error

An annual report by Viva Midco Limited, Avant Homes’ parent company, has revealed that the firm overstated its assets by £43m when it was acquired by Berkely DeVeer and Elliot Advisers in 2021.

The new directors have “identified material errors” in the reporting period to 30 April 2021. The news comes just weeks after Avant Homes approached Crest Nicholson with a merger offer.