Derby-based developer latest modular firm to face challenges

Harworth Estates Residential Development has issued a winding up petition against TopHat Communities and parent company TopHat Enterprises.

The move comes during a difficult year for the modular developer, which has made staff redundant and paused opening a new 650,000 sq ft factory in Corby.

A winding up petition is a legal action that can be taken by a creditor against a company who owes £750 or more, and can lead to a company’s bank accounts being frozen.

TopHat has yet to be profitable and posted a £20.4m pre-tax loss for the year to 31 October 2022. Recently the UK has experienced several modular firms going out of business.

Meanwhile, Persimmon has written off the £25m it invested in TopHat last year, saying that the decision was due to “a reassessment of risks within the modular build sector”.

However, the developer did say that “we continue to work with TopHat as they reposition the business to focus on the façade product”.

The news comes as Persimmon reported increased revenue over the six months to 30 June 2024, but a lower profit than last year (£146.3m; 2023: £151m).

During the half year, the housebuilder’s completions rose by 5% to 4,445 new homes; the firm says it remains on track for its full year target of 10,500 new homes.

House prices rise in July

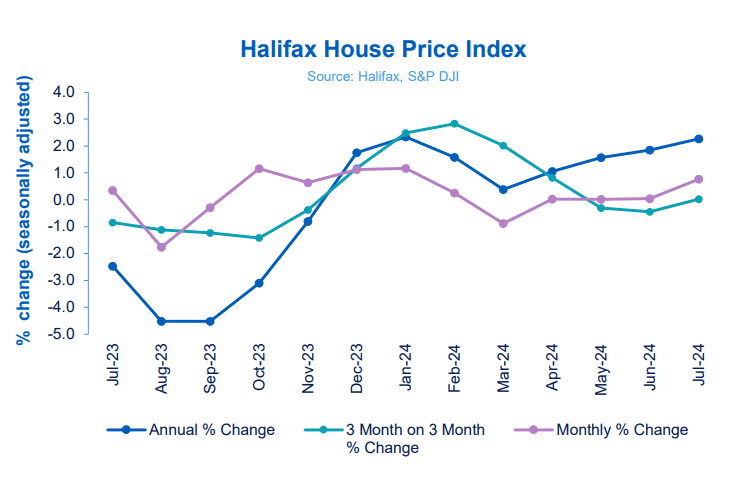

Mortgage lender Halifax has published its house price index for July, revealing a 0.8% increase in property values in the month.

The average UK home now costs £291,268, with an annual growth rate of 2.3% – the highest since January 2024.

Northern Ireland continues to record the strongest property price growth of any nation or region in the UK, with prices rising by 5.8% over the year to July. The North West also recorded strong growth, with values up by 4.1%.

Wales enjoyed annual growth of 3.4%, as property prices in Scotland rose by 2.1%.

The only region or nation to record a fall in annual growth was Eastern England, at -0.4%.

Against the backdrop of lower mortgage rates and potential further Base Rate reductions, we anticipate house prices to continue a modest upward trend throughout the remainder of this year.

Amanda Bryden, Head of Mortgages, Halifax

CMA spots concern in Barratt Redrow deal

The Competition and Markets Authority (CMA) has noted one area of competition concern in their review of the proposed Barratt Redrow merger.

The CMA’s Phase 1 investigation into the planned £2.5bn acquisition of Redrow by Barratt has highlighted an issue in Whitchurch, Shropshire, where there are four Barratt developments and one Redrow scheme.

The CMA have said that if the deal went ahead, “it could lead to higher prices and lower quality homes for buyers in this catchment area”.

Barratt and Redrow now have until 15 August to address the CMA’s concerns and avoid a more in-depth Phase 2 investigation. The deal is likely to go ahead, with the CMA finding that once the merger was complete the combined businesses would still encounter competition nationally.

We remain confident that the combination of Barratt and Redrow will be approved and that it is in the best interests of our customers and wider stakeholders.

David Thomas, CEO, Barratt Developments

Meanwhile, Bellway now has until 20 August to decide if it will make a firm offer to acquire Crest Nicholson, after the original deadline of 8 August was extended.

Both housebuilders have said that “good progress” has been made on due diligence, but that Crest requested the extension to grant further time for discussions.

The news comes as Bellway published a trading update, which saw the firm’s completions ahead of guidance, at 7,654 homes.

The developer’s previous guidance for its year ending 31 July 2024 was around 7,500 homes.

Construction buyers see surge in activity, but suppliers sound warnings

The S&P Global UK Construction Purchasing Managers’ Index rose at its fastest rate for 26 months In July, jumping from 52.2 in June to 55.3.

Any reading over 50.0 indicates growth in output.

All three construction categories enjoyed an increase in the month, as work on housing projects returned to growth after months of contraction.

However, brickmaker Ibstock has warned that ongoing falling demand in the new build housing sector has seen profit and revenue fall in the first six months of the year.

The firm, which closed two brick factories during a restructuring, said pre-tax profit fell by -60% to £12m in the six months to June, and that overall 2024 volumes would be lower than expected.

Travis Perkins has also warned on full-year numbers, stating that “weak demand” would result in full-year profit being lower than previous expectations.

In its half-year results, the firm said that reduced demand and price deflation has resulted in revenue being -4.4% below the previous year.