Rayner announces scheme designed to unlock new homes

Deputy Prime Minister Angela Rayner launched the Government’s New Homes Accelerator this week in an effort to release “hundreds of thousands of new homes stuck in the planning system”.

The scheme involves an “experienced team” from the Ministry of Housing, Communities and Local Government (MHCLG) and Homes England working with local authorities, housebuilders and planning departments to accelerate developments currently delayed by planning issues.

Government analysis has revealed that 200 large developments across England have outline or detailed plans, but have not begun construction, representing around 300,000 new homes.

The New Homes Accelerator, MHCLG said, would:

- Identify and address specific issues causing delays, such as regulatory obstacles, co-ordination failures and capacity constraints;

- Deploy expert teams to provide on-the-ground assistance and support to local authorities;

- Utilise its resources to accelerate delivery on sites facing delays;

- Inform future reforms to housing and planning policy.

MHCLG has invited developers, local authorities and landowners to submit details of blocked sites with planning issues.

Meanwhile, the independent think tank Institute for Government (IfG) has published a report calling on the Government to make housebuilding a “consistent political priority”, and not give in to local objections.

The report – From the ground up – How the government can build more homes – examines “why so many [Governments] have found it difficult to deliver on such ambitions”, including fixing the housing crisis.

The IfG has identified “persistent barriers” to solving the housing shortage, setting out ten principles to navigating them, including keeping housing ministers in post long enough to “develop a deep understanding of the policy area and build the stakeholder relationships needed to deliver”.

Annual house price growth edges higher

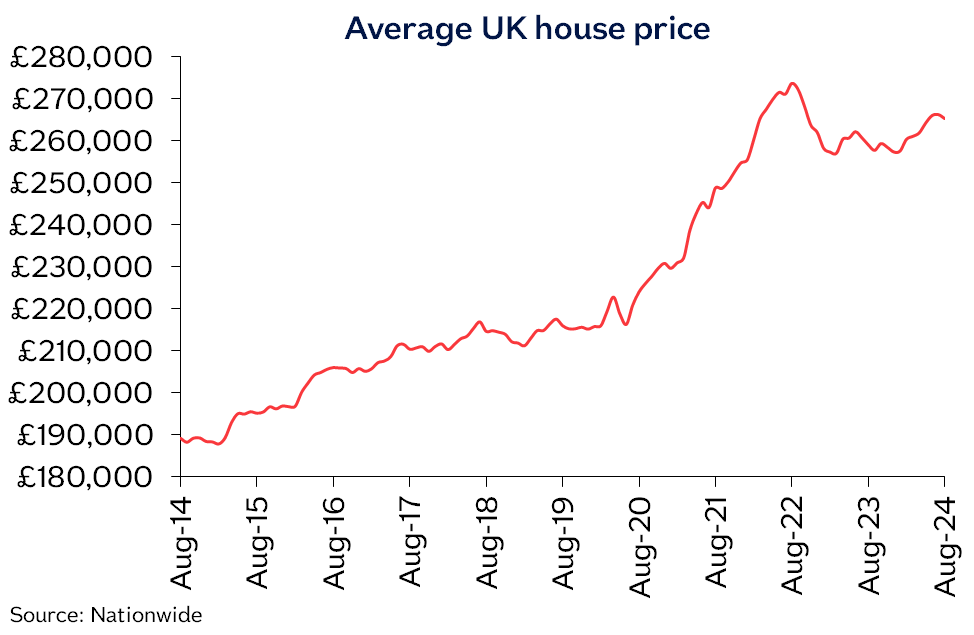

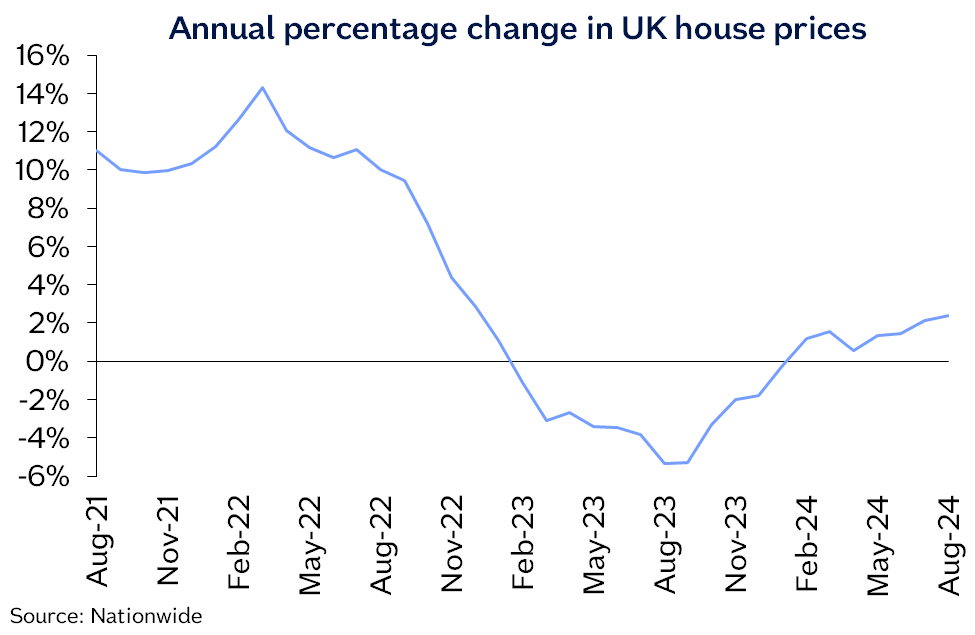

Nationwide has published its latest house price index, reporting that the annual change in growth has increased from 2.1% in July to 2.4% in August.

However, the monthly change fell slightly to -0.2%, with the average UK property valued at £265,375 (Jul: £266,334).

Robert Gardner, Nationwide’s Chief Economist, said: “Providing the economy continues to recover steadily, as we expect, housing market activity is likely to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.”

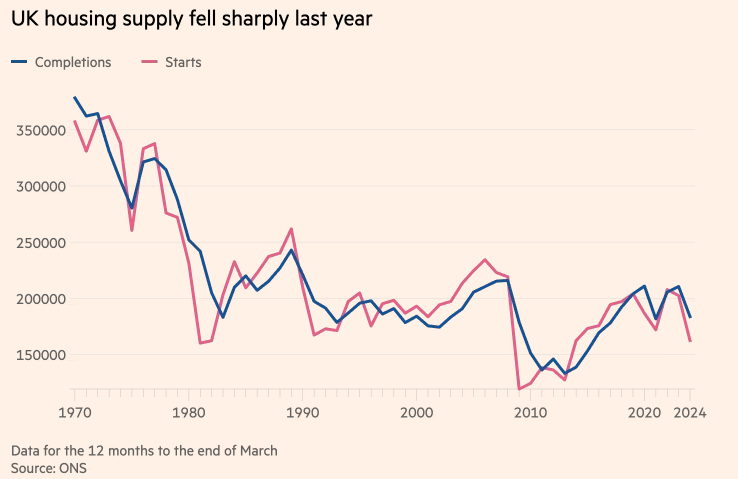

Housing starts fall in first quarter

Official data from the Office for National Statistics has revealed that housing starts across the UK slumped by -34% to just 29,820 in the first quarter of the year.

Similarly, new housing completions fell by -17% to 38,400 over the same period.

Melanie Leech, Chief Executive of the British Property Federation, said: “The housebuilding figures for the first quarter underline the scale of the challenge in delivering the Government’s target of 1.5m homes by 2029.

“We will not reach and sustain this level of house building nor meet the needs of individuals and families by focusing on homes for sale alone; we need to also supercharge the build-to-rent sector and look at how to unlock the delivery of affordable housing of all tenures.”