Study from the HBF reveals uphill battle faced by FTBs

A report from the Home Builders Federation (HBF) has found that first time buyers face almost a decade of saving to afford a deposit for a home.

The findings, detailed in Broken Ladder, looks at house prices, earnings and mortgage costs in areas across England, and reveals that the average first time buyer would have to save half of their remaining income – after rent and bills – over nine years to gather enough money for a deposit.

The house price to average income ratio across England was 10, rising to 16 in London. The North East of England had the lowest ratio, at 6.

The HBF have called for a targeted home ownership scheme, stating that there is currently no “active” Government support for first time buyers following the close of Help to Buy.

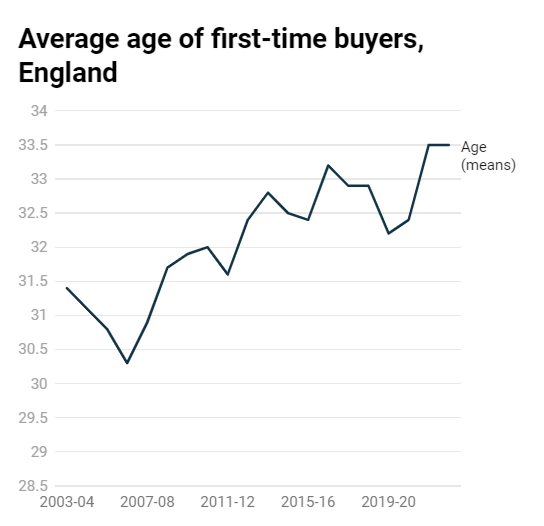

Neil Jefferson, CEO of HBF, said: “This latest analysis lays bare the reality of the affordability challenges facing younger generations struggling to access the housing market. The uncomfortable truth is that home ownership is being pushed out of reach of many – particularly those without the support of family wealth.

“Whilst government’s recent moves to tackle long-standing challenges within the planning system are welcome, action is needed to help people get a foot on to the property ladder. The lack of affordable mortgage availability is stifling the market and snuffing out home ownership aspirations.”

Save SMEs “from oblivion”, says Pocket Living

Developer Pocket Living has launched a campaign to save small and medium-sized housebuilders “from oblivion”.

The report – Get SMEs Building Again – sets out ten policy recommendations to boost the SME sector and support the Government’s target of building 1.5 million homes.

The recommendations include requiring at least 15% of homes to be built by SMEs, and a national public land portal for small sites.

The campaign has the backing of several large developers, including Barratt Developments and the Berkeley Group.

Marc Vlessing, Pocket Living’s founder and chair, said: “Ever since I co-founded and led Pocket 20 years ago, Labour has had a strong history of supporting small businesses in the UK. Their manifesto today promises to make small businesses ‘the beating heart of our economy.’

“So it’s time to use their substantial majority, heed the sector’s calls and implement these ten policy proposals, which are designed to be cost-neutral for the Treasury and should be low-hanging fruit for the chancellor.”

Vistry set to become UK’s largest developer

Three of the UK’s largest housebuilders published trading updates this week.

Barratt completed just over 14,000 homes in the year to 30 June 2024; at the upper end of its forecast but still -18.6% below the 17,206 homes built last year.

And, in a challenging year, Barratt saw pre-tax profit fall by -75.8% to £170.5m, at an operating margin of 4.2%. This was predominantly driven by costs associated with legacy properties and the recent acquisition of Redrow.

Meanwhile, Vistry looks set to become the UK’s largest housebuilder by volume, as it announced it was on track to deliver 18,000 homes this year.

Reporting its half-year results for the period ending 30 June, the partnerships developer also revealed that pre-tax profit was up 7% to £186.2m, on a turnover of £1,975m.

The Berkeley Group also announced it was on track to achieve pre-tax profit of £525m for the full year ending April 2025.

In a trading update covering 1 May to 31 August, the firm also said that it supports proposed changes to the planning system and “the Government’s aspiration to deliver 1.5 million new homes across this parliament as part of its mission for growth”.

Optimism in market to drive growth

The latest S&P Global Construction Purchasing Managers’ Index has found that many buyers believe the industry has “turned a corner”, as output remained positive for the sixth month running.

The index fell from 55.3 in July to 53.6 in August; any reading over 50.0 indicates sector growth.

Residential work gathered momentum, with growth accelerating at its fastest rate since September 2022, reaching 52.7.

Tim Moore, Economics Director at S&P Global Market Intelligence, said: “The UK construction sector appears to have turned a corner after a difficult start to 2024, with renewed vigour in the house building segment the most notable development in August.

“Residential work expanded at the fastest pace for almost two years as lower borrowing costs and a gradual recovery in market conditions helped to boost activity.”

Meanwhile, consulting firm PwC has forecast that the UK construction sector will return to growth of 2.9% in 2025, spurred by renewed annual housing targets and growth in repair, maintenance and improvement work.

It also expects the new build residential sector to grow by 7% next year.