Latest Knight Frank survey reads industry pulse

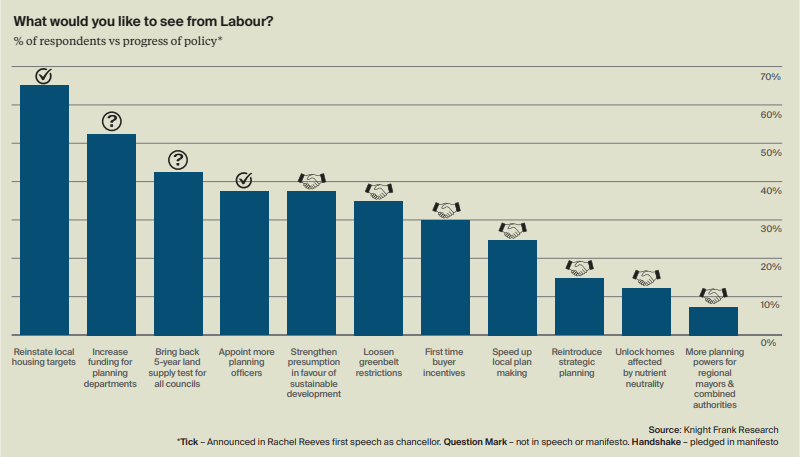

The latest quarterly survey by Knight Frank has revealed that over half of respondents want to see increased funding for planning departments in next week’s Budget, with over 40% wanting to see the return of the five-year land supply test for all councils and over 60% looking for Labour to reinstate local housing targets.

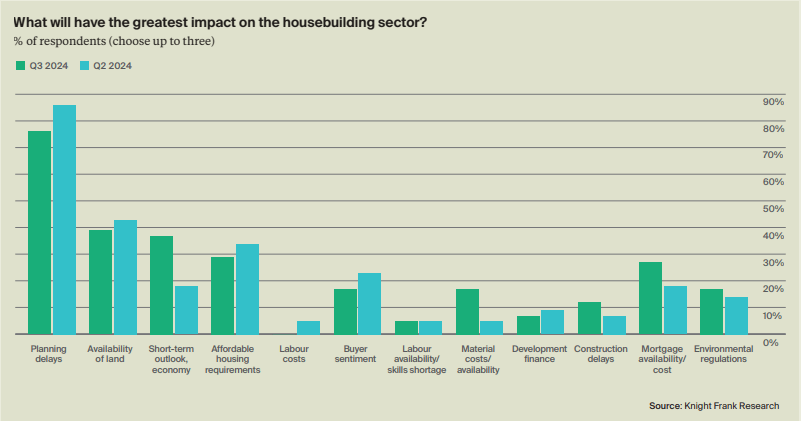

The survey, which covers around 50 SME and large housebuilders, also found that over 70% of respondents felt that planning delays would have the greatest impact on the housing sector.

Meanwhile, Angela Rayner is set to be handed almost £1bn in funding in a plan to double the amount of council homes built each year.

The payment, which will be released over the next 18 months, will be used to top up the Affordable Homes Programme ahead of the Budget.

This week also saw the publication of research by the Home Builders Federation (HBF) which found that local authorities and councils have more than £8bn of unspent developer contributions in their bank accounts.

More than £6bn has come from Section 106 agreements, with £2bn raised through the Community Infrastructure Levy. The report shows that, on average, councils are holding £19m in unspent Section 106 contributions, which are often earmarked for new schools, local enhancements and educational facilities.

The HBF is recommending, amongst other suggestions, that information on unspent contributions should be taken into account when council objections over new planning applications cite concerns over infrastructure pressures.

Government responds to CMA study

The Government has said that they will make the New Homes Ombudsman a legal requirement and introduce a single mandatory consumer code for developers, in response to a study into the housing market by the Competition and Markets Authority (CMA).

The Ministry of Housing, Communities and Local Government said this week that it agreed with the CMA’s comments that the housing market was not delivering well for consumers.

House prices rise at fastest rate for two years

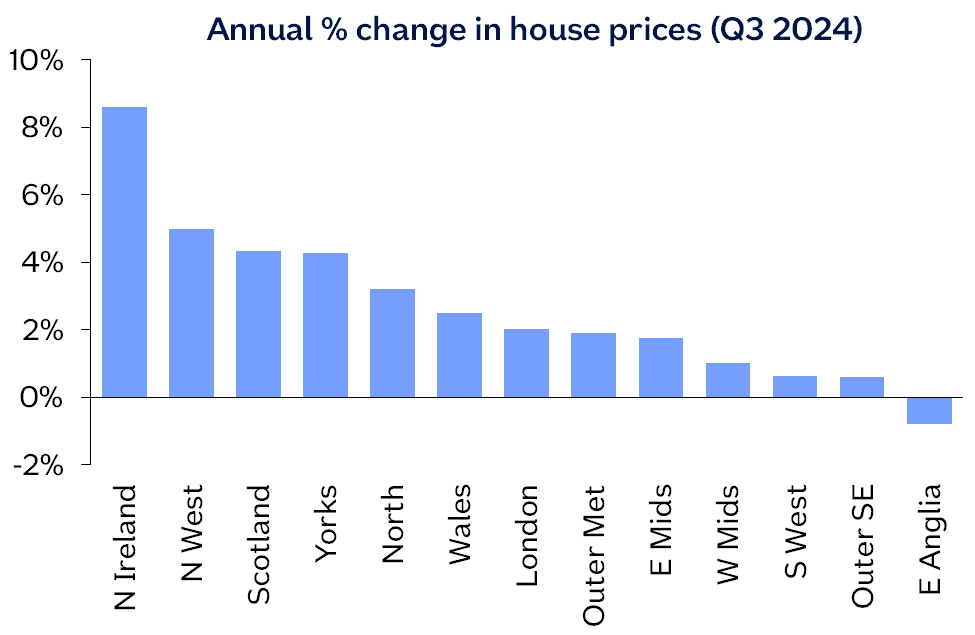

Nationwide published its house price index for September this week, revealing a 3.2% increase in property values over the past 12 months – the fastest pace since November 2022.

A 0.7% increase in the month sees a typical home valued at £266,094.

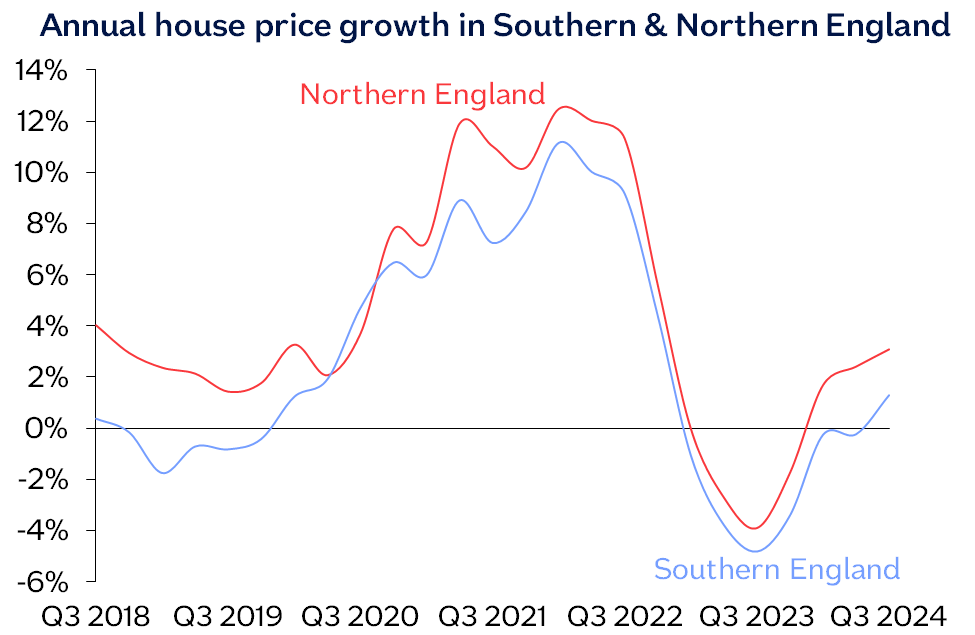

Northern England has continued to outperform southern England, with prices up 3.1% over the year. The North West was the best performing English region, with annual prices up by 5.0%.

Barratt Redrow closes offices in search of cost savings

The first trading update by Barratt Redrow as a combined group has announced a projected £90m of savings from the merger, with £33m coming from the closure of nine offices across the country.

The firm is also targeting £34m of procurement-related savings, stating: “Synergies will be centred on optimising procurement for Redrow’s business whilst working with our supply chain partners to unlock additional procurement savings.”

Meanwhile, volumetric offsite housebuilder TopHat has announced that it is winding down its factory operation; the latest in a series of modular business closures over recent years.

The firm’s accumulated losses stand at around £87m. A company statement said: “Unfortunately, due to the continued reduction in future pipeline, TopHat is in the process of making most of the factory staff redundant by following a statutory consultation process.

“This orderly wind-down of volumetric operations will put the business in a position to assess all future options.”